Bitcoin surges past $120K: What’s fueling the rise?

Bitcoin smashes all the previous records: Here's why

Bitcoin has reached a new all-time high, surpassing $120,000 on Monday, July 14 and marking a milestone for the world’s largest cryptocurrency.

This record-shattering event came on the heels of investors’ efforts to secure the long-sought policy for the industry this week.

Bitcoin scaled a record high of $123,153.22 in the Asian session before dipping slightly to trade around $122,000, still up 2.4%.

The recent surge in prices occurs against a backdrop of falling US equities as President Trump has threatened to impose a 30% tariff on European Union and Mexican imports, underscoring Bitcoin’s growing appeal as an alternative asset.

The unprecedented climb of bitcoin has taken the internet by the storm, leading to discussions on possible factors behind this upward growth.

According to IG market analyst Tony Sycamore: “It’s riding a number of tailwinds at the moment,” as he cited strong institutional demand, expectations of further gains and support from Trump as the reasons for the bullishness.

Macroeconomic factors

The steady ascent of bitcoin relies on favorable macroeconomic factors. The declining US Treasury yields and expected interest rate cuts prospects by the Federal Reserve have boosted risk appetite. Consequently, this shift has turned bitcoin into an asset that is considered a hedge against inflation driven by rate cuts.

Weak US dollar

Moreover, the weak US dollar has made dollar-denominated assets less attractive. In the backdrop of the central bank’s expansionary monetary policies, bitcoin’s fixed rate supply makes it highly attractive to investors as it’s seen as a better store of value.

Owing to prevalent economic uncertainty, the US Dollar Index has declined 10% on the year. If the Fed decides to cut interest rates further, bitcoin prices could go higher on the back of the weak US dollar.

High institutional investment

A significant driver of this surge has been the increased institutional investment. Bitcoin became more accessible to institutional and retail investors when the first Bitcoin exchange-traded funds (ETFs) received SEC approval in January 2024. Until July 10, ETFs have attracted more than $50 billion in net flows, according to data from Farside Investors . The influx of capital not only exhibits improved investor confidence but also bolsters the position of bitcoin.

Besides ETFs, the institutional embrace of bitcoin by corporations and insurance companies also marked the rising popularity of bitcoin.

Equity market volatility

Turbulence in the traditional market has also steered some capital towards cryptocurrency. IG reports that US equities declined amid President Trump’s tariff threats, leading to bitcoin as an alternative asset. Moreover, it has recently outperformed gold and stocks, reflecting its role as a hedge when conventional markets experience dynamic change.

Favorable regulatory developments

On the regulatory front, certain promising developments have strengthened bitcoin dominance. In March 2025, US administration reportedly signed an executive order to create a Strategic Bitcoin Reserve, officially recognising it as a national reserve asset alongside gold.

Earlier this month, Washington declared July 14 week as “Crypto Week,” during which congressional members will vote on the series of crypto bills. These include the Genius Act, the Clarity Act, and the Anti-CBDC Surveillance State Act. According to Reuters, “the optics of legislative engagement are bullish.”

Moreover, the inclination of President Trump, who called himself the “crypto president,” to crypto has further enhanced prospects in the favor of industry.

As the regulatory landscape continues to evolve, these trends will provide confidence to institutional investors, leading to high bitcoin prices.

Collectively, all these factors can be responsible for record-breaking bitcoin prices. However, cryptocurrencies are unregulated, uncertainty associated with prices will remain.

-

Timothee Chalamet rejects fame linked to Kardashian reality TV world while dating Kylie Jenner

-

Sarah Chalke recalls backlash to 'Roseanne' casting

-

Willie Colón, salsa legend, dies at 75

-

Touching Eric Dane moment with daughter emerges after viral final words

-

Ryan Coogler explains why his latest project 'Sinners' is so close to his heart

-

Who is Punch? Here’s everything to know about the viral sensation winning over internet

-

Matty Healy sets summer wedding date close to ex Taylor Swift's nuptials

-

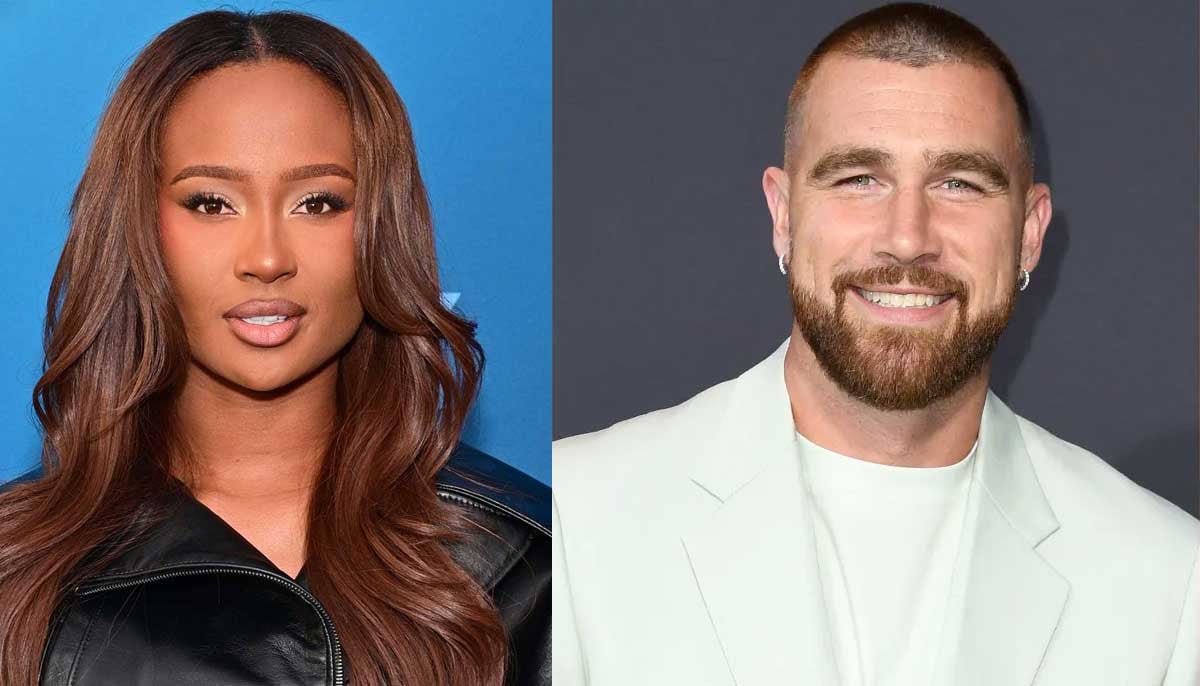

Kayla Nicole reveals surprising reason behind separation from Travis Kelce