Google Play introduces new screening policy for digital lending apps in Pakistan

Google's Pakistan director says tech company is setting stringent requirements for Digital Lending Apps

Google Tuesday introduced a new policy for personal loan applications with the commitment of protecting consumers across Pakistan from fake and unregistered loan apps.

The new requirements, which will come into effect from May 31, will allow the Non-Banking Finance Company (NBFC) lender to publish only a single Digital Lending App (DLA). Those who attempt to publish more than one DLA will be terminated from their developer account and any other associated accounts.

The development comes days after the Federal Investigation Agency (FIA) initiated action against illegal finance companies involved in short-term online loaning following the death of an unemployed man in Rawalpindi, who died by suicide due to his inability to repay the loan.

Developers with personal loan apps targeting users in Pakistan must complete the Personal Loan App Declaration form and submit the necessary documentation before publishing their app.

They must submit proof of approval from the Securities and Exchange Commission of Pakistan (SECP) to offer or facilitate digital lending services in Pakistan.

Google Play will also request additional information or documents relating to loan app compliance with the applicable regulatory and licensing requirements.

Personal loan apps operating in Pakistan without proper declaration and license attribution will be removed from the Play Store. The developers must remove the app from the Google Play Store immediately if the submitted license, registration, or declaration is no longer valid under the applicable laws.

"Google is taking preventative measures by setting stringent requirements for Digital Lending Apps in order to reduce financial risk and ensure data privacy. We strongly believe that the new requirements imposed on developers of personal loan apps will provide an extra layer of protection for the users," said Farhan S Qureshi, Google's Pakistan director.

Under the new set of rules, a DLA is prohibited from accessing sensitive data, such as external storage, media images, contacts and fine location. Whereas apps offering short-term personal loans, requiring repayment in full within 60 days from the loan issue date, are not allowed.

Pakistan is one of a small group of countries where Google has implemented additional requirements for DLAs. The new policy update is a significant step towards safeguarding consumers from harmful financial practices and ensuring data privacy.

-

Humans may have 33 senses, not 5: New study challenges long-held science

-

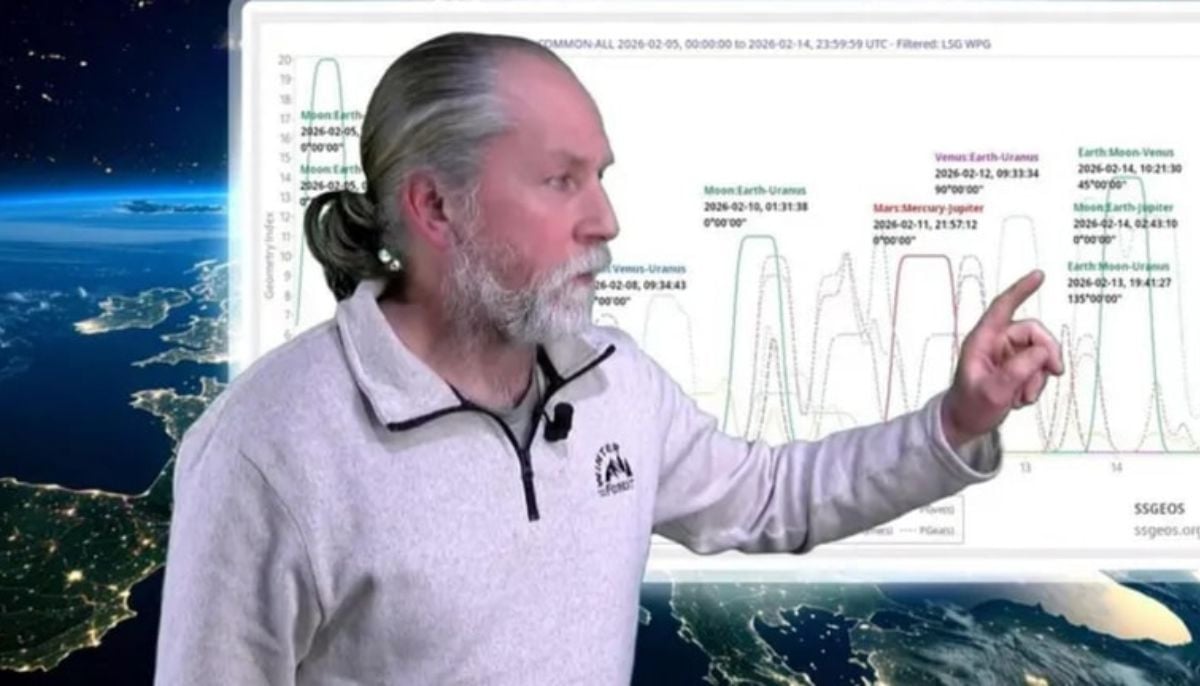

Northern Lights: Calm conditions persist amid low space weather activity

-

SpaceX pivots from Mars plans to prioritize 2027 Moon landing

-

Dutch seismologist hints at 'surprise’ quake in coming days

-

SpaceX cleared for NASA Crew-12 launch after Falcon 9 review

-

Is dark matter real? New theory proposes it could be gravity behaving strangely

-

Shanghai Fusion ‘Artificial Sun’ achieves groundbreaking results with plasma control record

-

Polar vortex ‘exceptional’ disruption: Rare shift signals extreme February winter