Wall Street analyst predicts which US bank will go down next

Co-founder of The Rich Dad Company stated how the bond market will cause "severe difficulties" for the US since he anticipates a decline in the value of the dollar

Global financial markets were affected by the failure of Silicon Valley Bank and Signature Bank in the United States. Stock markets fell in Asia and Europe, and banks fell because of concerns about a contagion effect following the failure of two lenders.

Another large bank is now expected to fail, according to a recent investor prediction. Robert Kiyosaki, a Wall Street analyst best renowned for correctly predicting the demise of Lehman Brothers in 2008, asserts that Credit Suisse is the next bank in danger of failing.

"The problem is the bond market, and my prediction, I called Lehman Brothers years ago, and I think the next bank to go is Credit Suisse," Kiyosaki told Fox News.

The co-founder of The Rich Dad Company stated how the bond market will cause "severe difficulties" for the US since he anticipates a decline in the value of the dollar.

"The bond market is much bigger than the stock market. The Fed is up and they're the firemen and the arson," Kiyosaki said on Fox News' "Cavuto: Coast to Coast" show.

"The US dollar is losing its hegemony in the world right now. So they're going to print more and more and more of this... trying to keep this thing from sinking," he added.

Due to the "perfect storm" created by the bond market meltdown and the impending retirement of his generation, Kiyosaki stated that he is "worried" about Credit Suisse, the eighth-largest investment bank in the world.

Also, he suggested investing in gold and silver securities amid a shaky market.

Only hours before Credit Suisse acknowledged a "significant flaw" in its reporting practises for the fiscal years 2021 and 2022, Kiyosaki made his prediction.

"The material weaknesses that have been identified relate to the failure to design and maintain an effective risk assessment process to identify and analyse the risk of material misstatements in its financial statements," the report said.

In recent years, Credit Suisse has faced a plethora of issues, including its connection to the collapses of American asset management Archegos and UK business Greensill, reported NDTV.

After being shaken by the bankruptcy of Greensill in March 2021, the first of a string of scandals, Credit Suisse has lost about 80% of its market value.

-

Germany’s ruling coalition backs social media ban for children under 14

-

Quinton Aaron reveals why he does not want to speak to wife Margarita ever again

-

Why Mikaela Shiffrin celebrated Olympic Gold with Taylor Swift song?

-

Political tensions steal spotlight at Berlin Film Festival closing ceremony

-

Hong Kong touts stability,unique trade advantages as Trump’s global tariff sparks market volatility

-

Friedrich Merz heads to China for high stakes talks in an effort to reset strained trade relations

-

Nvidia CEO praises Elon Musk, calls him an ‘extraordinary engineer'

-

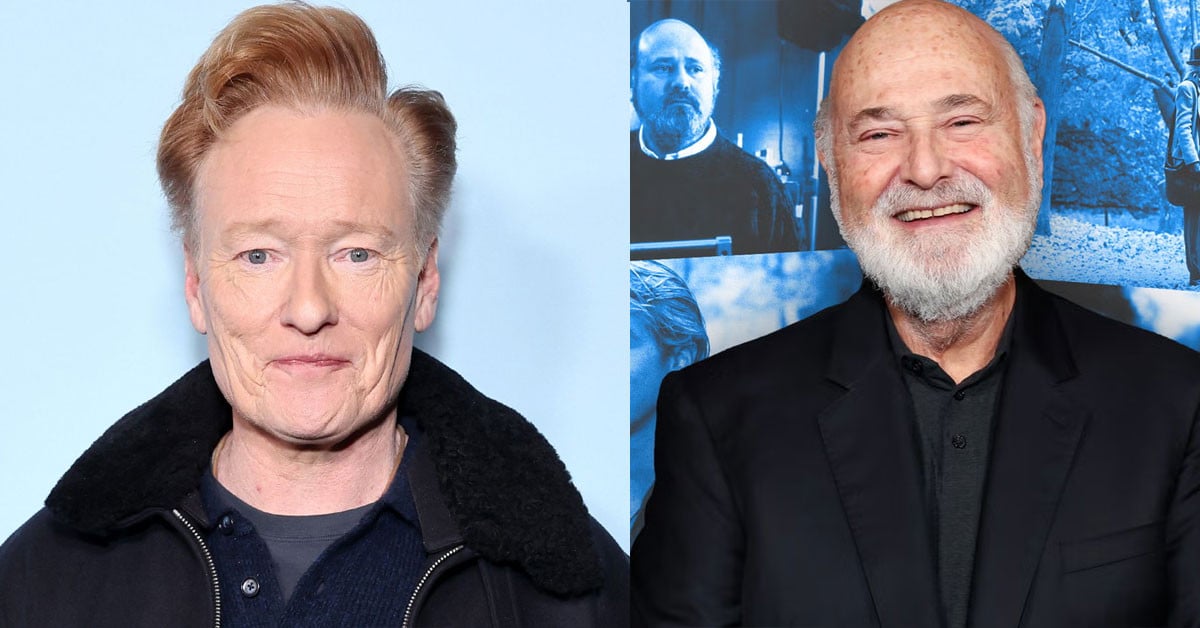

Conan O'Brien speaks first time after Rob Reiner's killing