Markets mostly rise but tech earnings dent recovery optimism

Disappointing earnings from Wall Street titans Apple, Amazon and Alphabet — who together are worth almost $5 trillion — indicated higher borrowing costs

HONGKONG: Asian equities mostly rose Friday following gains on Wall Street but optimism over a possible pause in Federal Reserve interest rate hikes was being weighed against worries about the global economy after a year of monetary tightening.

Disappointing earnings from Wall Street titans Apple, Amazon and Alphabet — who together are worth almost $5 trillion — indicated higher borrowing costs and elevated inflation were weighing on consumer demand.

The readings came in towards the end of a week when the stocks rally that defined most of January hit the barriers as traders worried that the buying had been overdone and that there were plenty more bumps in the road for the economy.

Those concerns overshadowed optimism about China's reopening and recovery from nearly three years of zero-COVID policies that hammered business activity.

They also offset the positive mood created by an acknowledgement from the Fed that it was making progress in bringing inflation down from multi-decade highs, fuelling hopes it was nearing the end of its rate hike cycle.

Eyes are now turning to the release of US jobs data later on Friday, which will provide a clearer idea about the state of the world's biggest economy.

"A softer payrolls data, so long as it does not fall off a cliff triggering a recessionary (backlash), could re-engage all the favourite trades of the year," said SPI Asset Management's Stephen Innes.

"Not least, it would provide the most critical evidence to date to suggest that the market's rates pricing is more in line with reality than the Fed's own more subtly hawkish higher for longer signalling."

Wall Street's three main indexes ended broadly higher, with the Nasdaq piling on more than 3% thanks to forecast-beating results from Facebook owner Meta.

However, the after-hours reports from Apple, Amazon and Google's parent firm Alphabet brought investors back down to earth.

Fresh Adani pain

Apple said sales dropped more than expected in October-December, Amazon's revenue was hit by weak consumer demand and Alphabet results fell short of estimates.

"The war in Ukraine, inflationary pressures, economic uncertainty and macroeconomic headwinds kept the consumer sentiment weak in 2022 while smartphone users reduced the frequency of their purchases," Harmeet Singh Walia, of Counterpoint Research, said in a report on Apple.

Still, after a shaky start, most Asian markets enjoyed gains.

Tokyo, Sydney, Seoul, Singapore, Wellington, Taipei, Manila, Bangkok and Jakarta were all higher, though Hong Kong dropped on a sell-off in tech firms while Shanghai was also off.

Futures in the Nasdaq and S&P 500 were both deep in the red, while London, Paris and Frankfurt opened lower.

Mumbai posted gains, though tycoon Gautam Adani took another battering, having lost more than $100 billion from their valuations since a report last week accused his empire of "brazen stock manipulation and accounting fraud".

Flagship Adani Enterprises was repeatedly suspended in Mumbai, hitting multiple trading stops on the way to falling by 30% before paring losses.

Adani Power, Adani Green Energy, Adani Total Gas — in which French giant TotalEnergies has a 37.4% stake — and Adani Transmission were also suspended when they hit their limits.

On currency markets, the euro and pound lost further ground after weakening Thursday despite the European Central Bank and the Bank of England hiking interest rates more than the Fed.

Crude prices extended Thursday's losses on concerns about the economic outlook and demand, with US stockpiles rising last week more than expected.

"Oil's in a bit of a limbo as the market awaits tangible signs of China's oil demand recovery," Vandana Hari, of Vanda Insights, said.

Key figures around 0820 GMT

Tokyo - Nikkei 225: UP 0.4% at 27,509.46 (close)

Hong Kong - Hang Seng Index: DOWN 1.4% at 21,660.47 (close)

Shanghai - Composite: DOWN 0.7% at 3,263.41 (close)

London - FTSE 100: DOWN 0.1% at 7,815.55

Dollar/yen: UP at 128.64 yen from 128.62 yen on Thursday

Euro/dollar: DOWN at $1.0895 from $1.0918

Pound/dollar: DOWN at $1.2196 from $1.2225

Euro/pound: UP at 89.35 pence from 89.21 pence

West Texas Intermediate: DOWN 0.4% at $75.57 per barrel

Brent North Sea crude: DOWN 0.3% at $81.91 per barrel

New York - Dow: DOWN 0.1% at 34,053.94 (close)

-

Northern Lights: Calm conditions persist amid low space weather activity

-

SpaceX pivots from Mars plans to prioritize 2027 Moon landing

-

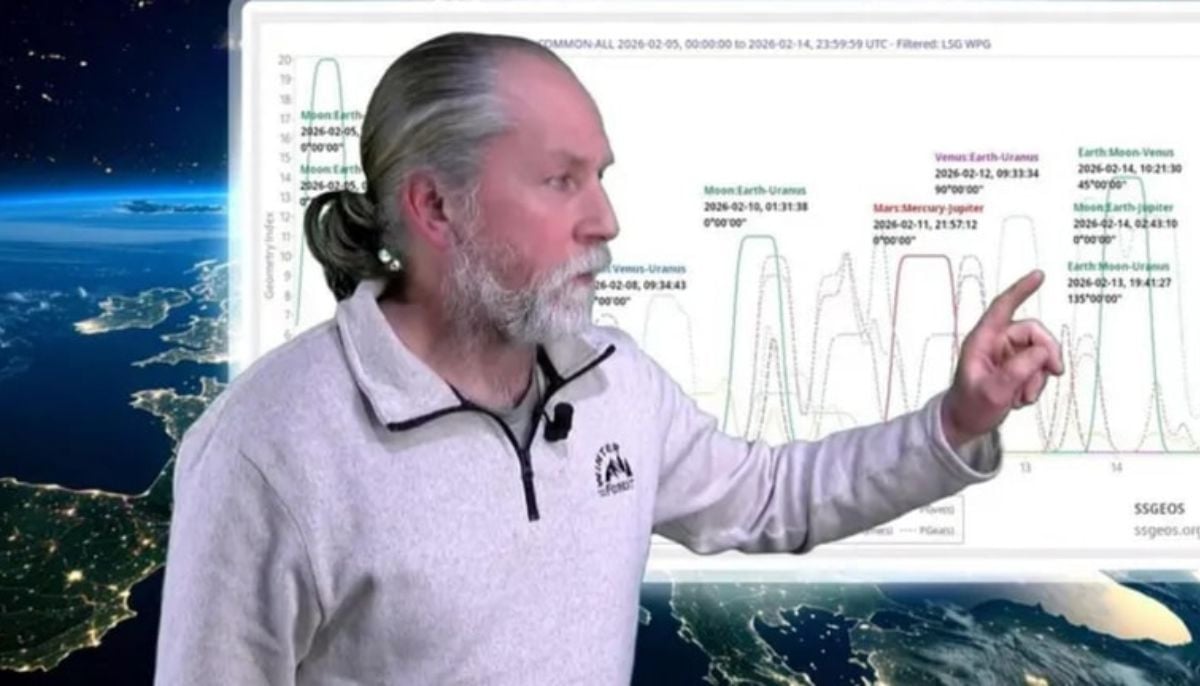

Dutch seismologist hints at 'surprise’ quake in coming days

-

SpaceX cleared for NASA Crew-12 launch after Falcon 9 review

-

Is dark matter real? New theory proposes it could be gravity behaving strangely

-

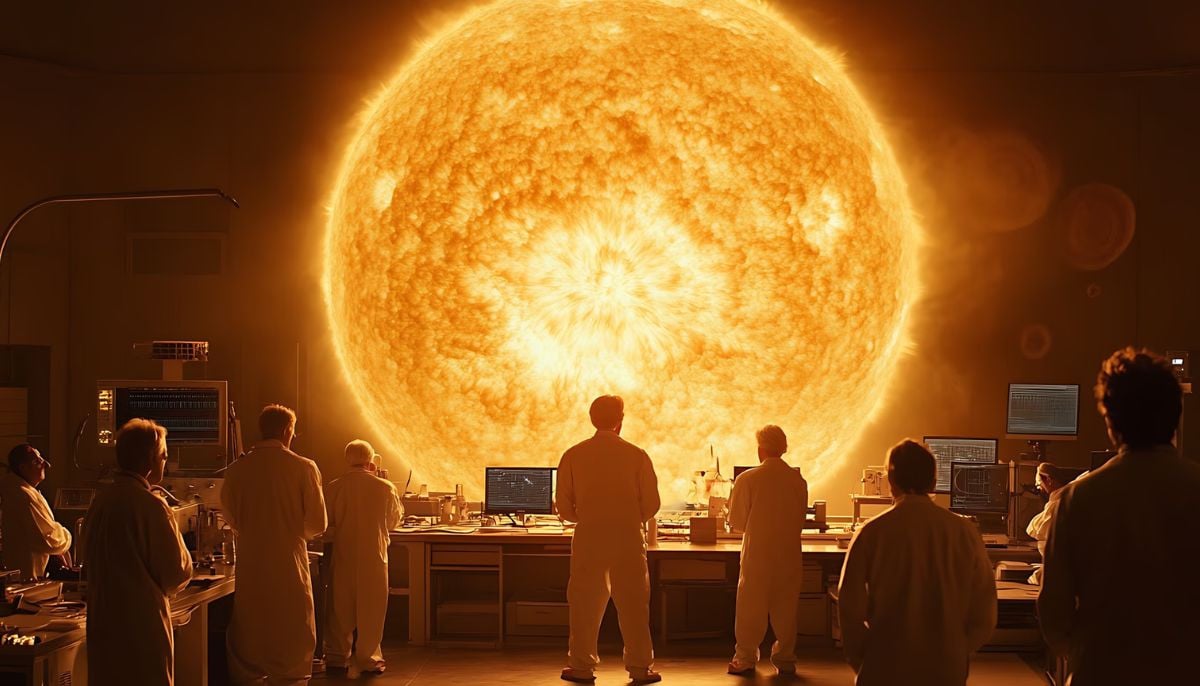

Shanghai Fusion ‘Artificial Sun’ achieves groundbreaking results with plasma control record

-

Polar vortex ‘exceptional’ disruption: Rare shift signals extreme February winter

-

Netherlands repatriates 3500-year-old Egyptian sculpture looted during Arab Spring