Government to raise Rs6.9trln in 3 months

KARACHI: The government is set to raise Rs6.90 trillion through the actions of market treasury bills, Pakistan Investment Bonds, and Sukuk from December 2021 to February 2022 to finance a budget deficit caused by low revenues.

The government sought to generate Rs6.75 trillion in the November-January period. The government will borrow Rs5.60 trillion from the auctions of MTBs, while it also plans to fetch Rs1 trillion via the sale of fixed and floating rate PIBs. The State Bank of Pakistan (SBP) would sale Rs300 billion worth of fixed-rate PIBs and Rs350 billion worth of floating rate PIB. It would also auction Rs175 billion worth of three-year and Rs175 billion two-year PIB.

The SBP would also sale Rs225 billion worth of variable rental rate five-year government-backed Ijara Sukuk and Rs75 billion worth of fixed rental rate domestic Islamic bond.

The government’s reliance on the banking system to meet its spending requirements remained on the higher side due to the widening of the budget deficit amid a fall in non-tax revenues.

The budget deficit rose to Rs745 billion or 1.4 percent of the gross domestic product in the first quarter of this fiscal year from Rs529 billion or 1.2 percent of GDP a year ago.

The government’s planned borrowings from the domestic market remain high, despite the revival of the International Monetary Fund’s loan programme. Pakistan and IMF have reached a staff-level agreement on policies and reforms needed to complete the sixth review under the Extended Fund Facility. Completion of this review would make available $1 billion and help unlock significant funding from bilateral and multilateral partners. The government borrowing from the central bank remained zero for the last two years.

As far as market participation in the T-bills and PIBs is concerned, investors are inclined towards short-term instruments due to strong expectations of an increase in inflation and further monetary tightening in coming months.

The SBP raised the policy rate by 150 bps to 8.75 percent on November 19. The SBP’s next monetary policy review is scheduled for December 14.

The increasing trend in the policy rate is expected to boost interest payments on domestic debt. For Shariah-compliant instruments, the market’s appetite is intact. The government has conducted auctions of Sukuk regularly and benefited from the lower yields offered compared with the conventional domestic debt instruments. Sukuk issuances have also helped the government to diversify its outstanding debt.

-

Will Smith, Jada Pinkett's Marriage Crumbling Under Harassment Lawsuit: Deets

Will Smith, Jada Pinkett's Marriage Crumbling Under Harassment Lawsuit: Deets -

'Fake' Sexual Assault Report Lands Kentucky Teen In Court

'Fake' Sexual Assault Report Lands Kentucky Teen In Court -

'Vikings' Star Shares James Van Der Beek's Birthday Video After His Death

'Vikings' Star Shares James Van Der Beek's Birthday Video After His Death -

Jennifer Aniston Receives Public Love Note From Jim Curtis On 57th Birthday

Jennifer Aniston Receives Public Love Note From Jim Curtis On 57th Birthday -

Microsoft AI Chief Says AI Will Replace Most White-collar Jobs Within 18 Months

Microsoft AI Chief Says AI Will Replace Most White-collar Jobs Within 18 Months -

Late Virginia Giuffre’s Brother Reacts To King Charles’ Promise Against Andrew Mountbatten-Windsor

Late Virginia Giuffre’s Brother Reacts To King Charles’ Promise Against Andrew Mountbatten-Windsor -

Ex-Arsenal Footballer Thomas Partey Charged With Additional Rape Counts

Ex-Arsenal Footballer Thomas Partey Charged With Additional Rape Counts -

AI Regulation Battle Heats Up: Anthropic Pledges $20m To Rival OpenAI

AI Regulation Battle Heats Up: Anthropic Pledges $20m To Rival OpenAI -

Queen Camilla Makes Poignant Visit To Police Stations To Inspect Work

Queen Camilla Makes Poignant Visit To Police Stations To Inspect Work -

Chloe Kim Set For Historic Halfpipe Gold Showdown At Milano Cortina

Chloe Kim Set For Historic Halfpipe Gold Showdown At Milano Cortina -

Brooklyn Beckham Gives Cold Response To Cruz's Olive Branch Amid Feud

Brooklyn Beckham Gives Cold Response To Cruz's Olive Branch Amid Feud -

Woman Arrested Months After Allegedly Staging Husband’s Murder As Suicide

Woman Arrested Months After Allegedly Staging Husband’s Murder As Suicide -

Senior US Politician Makes Formal Accusation Against Andrew As Woman Under Him Is Sex Trafficked

Senior US Politician Makes Formal Accusation Against Andrew As Woman Under Him Is Sex Trafficked -

X Product Head Warns AI Spam Can Make IMessage And Gmail Unusable

X Product Head Warns AI Spam Can Make IMessage And Gmail Unusable -

Tyler Childers, Wife Senora May Expecting Second Baby

Tyler Childers, Wife Senora May Expecting Second Baby -

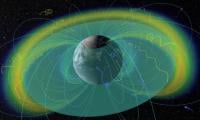

‘Smiling Electrons’ Discovered In Earth’s Magnetosphere In Rare Space Breakthrough

‘Smiling Electrons’ Discovered In Earth’s Magnetosphere In Rare Space Breakthrough