Stocks seen in range; Saudi support eyed

Stocks in the outgoing week sustained worst weekly losses since Covid-19 outbreak, but there are bets Saudi dollars may spur a rally with the caveat of any macroeconomic shocks that can limit trade.

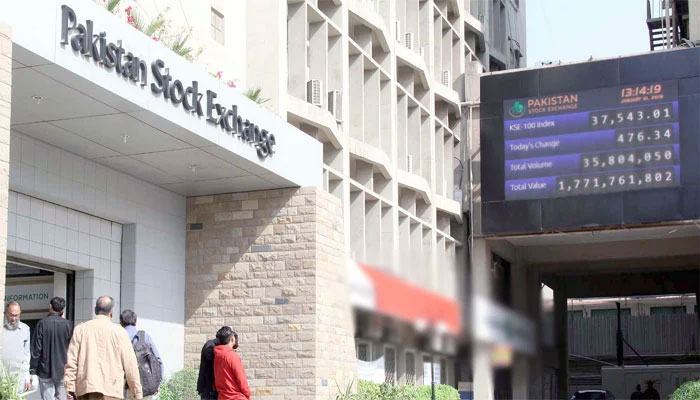

Week-on-week, KSE-100 Shares Index, the benchmark of Pakistan Stock Exchange (PSX) lost 2,375 points or 5.11 percent to close at 44,114 points, the highest weekly decline since March 27, 2020.

“Going forward, we expect the market to show positivity, attributable to Saudi Arabian assistance in terms of safe deposits of $3 billion due next week that will take some pressure off of foreign exchange reserves,” said Arif Habib Ltd (AHL), in its weekly market review. While slowdown in international oil prices was also likely to dent inflationary burdens with the roll-over week coming to an end, the brokerage said.

“However, last date of MSCI rebalancing on November 30, 2021 might trigger foreign selling, while current macroeconomic concerns like rising imports, higher inflationary reading due to a spike in commodities’ prices, and exchange rate pressures may keep the market range-bound,” the AHL report said. Average daily volumes and traded value for the outgoing week were up by 8 percent and 13 percent to 264 million shares and $60 million, respectively.

According to analysts, this weekly decline is a likely outcome of State Bank of Pakistan’s increasing policy rate by 150bps to 8.75 percent, current account deficit surging to $5.1 billion in 4MFY21, beginning of the roll-over week, net foreign selling, amid transition from Emerging Market to the Frontier Market, and decline in foreign exchange reserves putting pressure on rupee-dollar parity.

Moreover, they said announcement of a staff level agreement with IMF failed to rejuvenate investors’ sentiments.

Albeit, index rebounded after the petroleum dealers called off strike after the government agreed to increase their profit margins, news of Saudi inflow of $3 billion expected next week, and plunge in international oil prices which might be a breather for the economy, they added.

Foreigners offloaded stocks worth of $39.1 million compared to a net sell of $25.0 million last week. Major selling was witnessed in commercial banks ($15.7 million) and fertiliser ($6.3 million). On the local front, buying was reported by individuals ($16.0 million) followed by companies ($13.3 million).

Contribution to the downside was led by cements (-462 points), commercial banks (-326 points), technology and communication (-290 points), fertiliser (-270 points), and oil & gas exploration (-252 points).

Scrip-wise major losers were LUCK (205 points), TRG (177 points), HBL (114 points), PPL (98 points), and ENGRO (95 points).

Topline Securities in a note said along with an increase in the policy rate, selling by foreign corporate increased ahead of MSCI reclassification of Pakistan from Emerging Index to Frontier Index, which exerted further pressure on the index.

Major events during the outgoing week were: Government committed to introduce a supplementary budget as part of an agreement with the IMF for a net fiscal adjustment of almost Rs550 billion during the remaining part of the current fiscal year through a 22 percent cut in development funds, about Rs300 billion increase in tax target and a Rs4/litre monthly hike in petroleum levy on major petroleum products.

Federal Board of Revenue (FBR) confirmed it has prepared Amendment Bill, 2021, to withdraw sales tax exemptions, reduce sales tax rates, and zero-ratings of Rs330 billion in line with IMF’s prior action demands.

-

Hilary Duff’s Son Roasts Her Outfit In New Album Interview

Hilary Duff’s Son Roasts Her Outfit In New Album Interview -

Alexandra Daddario, Andrew Form Part Ways After 3 Years Of Marriage

Alexandra Daddario, Andrew Form Part Ways After 3 Years Of Marriage -

Eric Dane Rejected Sex Symbol Label

Eric Dane Rejected Sex Symbol Label -

Avan Jogia Says Life With Fiancee Halsey Feels Like 'coming Home'

Avan Jogia Says Life With Fiancee Halsey Feels Like 'coming Home' -

Kate Middleton's Role In Handling Prince William And Harry Feud Revealed

Kate Middleton's Role In Handling Prince William And Harry Feud Revealed -

Tucker Carlson Says Passport Seized, Staff Member Questioned At Israel Airport

Tucker Carlson Says Passport Seized, Staff Member Questioned At Israel Airport -

David, Victoria Beckham Gushes Over 'fiercely Loyal' Son Cruz On Special Day

David, Victoria Beckham Gushes Over 'fiercely Loyal' Son Cruz On Special Day -

Taylor Swift Made Sure Jodie Turner-Smith's Little Girl Had A Special Day On 'Opalite' Music Video Set

Taylor Swift Made Sure Jodie Turner-Smith's Little Girl Had A Special Day On 'Opalite' Music Video Set -

Eric Dane Says Touching Goodbye To Daughters Billie And Georgia In New Netflix Documentary

Eric Dane Says Touching Goodbye To Daughters Billie And Georgia In New Netflix Documentary -

Channing Tatum Reveals What He Told Daughter After Violent Incident At School

Channing Tatum Reveals What He Told Daughter After Violent Incident At School -

King Charles Lands In The Line Of Fire Because Of Andrew Mountbatten-Windsor

King Charles Lands In The Line Of Fire Because Of Andrew Mountbatten-Windsor -

Denise Richards Doubles Down On Abuse Claims Against Ex Husband Aaron Phypers Amid Show Return

Denise Richards Doubles Down On Abuse Claims Against Ex Husband Aaron Phypers Amid Show Return -

Russia Set To Block Overseas Crypto Exchanges In Sweeping Crackdown

Russia Set To Block Overseas Crypto Exchanges In Sweeping Crackdown -

Gwyneth Paltrow Reveals Deep Personal Connection With Kate Hudson

Gwyneth Paltrow Reveals Deep Personal Connection With Kate Hudson -

Prince Harry, Meghan Markle’s Game Plan For Beatrice, Eugenie: ‘Extra Popcorn For This Disaster’

Prince Harry, Meghan Markle’s Game Plan For Beatrice, Eugenie: ‘Extra Popcorn For This Disaster’ -

OpenAI To Rollout AI Powered Smart Speakers By 2027

OpenAI To Rollout AI Powered Smart Speakers By 2027