Who will audit the auditors?

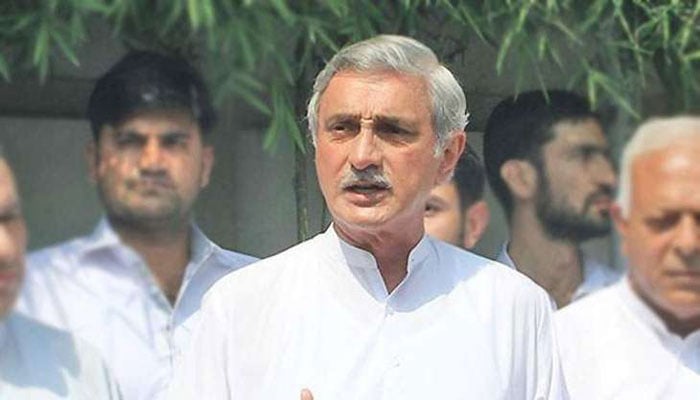

ISLAMABAD: The audit firm that gave Jehangir Khan Tareen’s JDW Sugar Mills Limited a clean bill of health year-on-year remains unaccounted for though a reference was filed against it but never followed through – apparently due to conflicting interests. The JDW Sugar Mills, together with 14 other mills, is currently facing a probe by the Federal Investigation Agency.

The Sugar Inquiry Commission in its final report submitted to the federal cabinet on May 21, 2020, accused the auditors of neither obtaining appropriate assurance that the financial reports were free from material misstatement nor ensuring that the accounting treatment was appropriately applied. The report further noted that the auditors also didn’t address any deficiencies detected so that the investors and other users of financial reports were not misled with regard to the quality of information they contained.

“Various observations were mentioned in the report against the JDW Sugar Mills Limited and these observations against the company indicates that its auditor…. prima facie, failed to fulfil its statutory obligations,” reads a reference filed by the Securities & Exchange Commission of Pakistan (SECP) to the Audit Oversight Body in the light of the commission’s report.

“The matter is being referred to initiate action against the auditor of the company under the regulatory ambit of the Audit Oversight Board and report findings and action taken, to the commission,” reads the SECP’s reference.

The JDW Sugar Mills has the largest market share of the total production (19.99pc) and remains the only company covered in the commission’s report that is listed on the Pakistan Stock Exchange. The role of an external auditor is the independent examination of the financial records prepared by the company. The company’s auditor has been the JDW Sugar Mills’ external auditor for four years till its resignation in 2020 after the commission report was released. Each year, the firm would offer a clean chit much like its opinion mentioned on page 47 of the sugar mill’s financial statement of 2019 gave it “true and fair view” of the state of the JDW’s affairs.

The reference was filed with the Audit Oversight Body in September last year but its fate still hangs in balance apparently because those who are to regulate the audit firms also belong to them in a classic case of conflict of interest. In Pakistan, audit regulation falls within the mandate of three institutions -- Institute of Chartered Accountants of Pakistan, the Securities & Exchange Commission of Pakistan and the Audit Oversight Board.

In reality, the state of audit regulation isn’t different from the other institutions as those who are to be audited have vital representation at the decision-making level in the regulatory bodies and eventually the responsibility is shifted from one to another.

The SECP, for example, is vested with extensive powers over auditors under Section 253 of the Companies Act 2017. But in the JDW’s auditor’s case under question, it sent a reference to the Audit Oversight Body (AOB) instead of exercising its own legal powers. As far as the AOB is concerned, its board is manned by the top notches of the big audit firms resulting in the conflict of interests as those facing the audit are represented in the decision-making body. A mere glance at the Audit Oversight Body’s website would make it clear. Members of the audit firms, including the accused in question, hold different seniors positions of the SECP Policy Board and the AOB board.

Their online profiles suggest that a number of members of the SECP’s policy board and AOB earn hefty meeting fees and perks as directors on boards of the listed companies, where they also take part in appointing large firms as auditors that these regulatory authorities are supposed to regulate.

In a way, they are part of the boards appointing firms and the ones who will hold them to account for the malpractices. This issue of conflict of interest has surfaced many a time but little progress has been made to fix it. The Asian Development Bank has somehow been able to push the SECP to incorporate such an amendment in its Act that has been approved by the federal cabinet, rendering directors of the listed companies ineligible to serve as members of the SECP Policy Board.

However, this leaves room for former partners of large accounting and auditing firms to be appointed on the boards of regulators without any break.

Commenting on the accusations that the audit firm didn't perform its job honestly, an official of the sugar mills association said even the allegations against JKT couldn't be considered authentic unless proven before the court of the law, what to say about allegations against auditing firms. He said the findings of the commission couldn't stand scrutiny in many instances and there are perhaps political motivations that needed to be considered while judging this case.

-

What You Need To Know About Ischemic Stroke

What You Need To Know About Ischemic Stroke -

Shocking Reason Behind Type 2 Diabetes Revealed By Scientists

Shocking Reason Behind Type 2 Diabetes Revealed By Scientists -

SpaceX Cleared For NASA Crew-12 Launch After Falcon 9 Review

SpaceX Cleared For NASA Crew-12 Launch After Falcon 9 Review -

Meghan Markle Gives Old Hollywood Vibes In New Photos At Glitzy Event

Meghan Markle Gives Old Hollywood Vibes In New Photos At Glitzy Event -

Simple 'finger Test' Unveils Lung Cancer Diagnosis

Simple 'finger Test' Unveils Lung Cancer Diagnosis -

Groundbreaking Treatment For Sepsis Emerges In New Study

Groundbreaking Treatment For Sepsis Emerges In New Study -

Roblox Blocked In Egypt Sparks Debate Over Child Safety And Digital Access

Roblox Blocked In Egypt Sparks Debate Over Child Safety And Digital Access -

Savannah Guthrie Addresses Ransom Demands Made By Her Mother Nancy's Kidnappers

Savannah Guthrie Addresses Ransom Demands Made By Her Mother Nancy's Kidnappers -

OpenAI Reportedly Working On AI-powered Earbuds As First Hardware Product

OpenAI Reportedly Working On AI-powered Earbuds As First Hardware Product -

Andrew, Sarah Ferguson Refuse King Charles Request: 'Raising Eyebrows Inside Palace'

Andrew, Sarah Ferguson Refuse King Charles Request: 'Raising Eyebrows Inside Palace' -

Adam Sandler Reveals How Tom Cruise Introduced Him To Paul Thomas Anderson

Adam Sandler Reveals How Tom Cruise Introduced Him To Paul Thomas Anderson -

Washington Post CEO William Lewis Resigns After Sweeping Layoffs

Washington Post CEO William Lewis Resigns After Sweeping Layoffs -

North Korea To Hold 9th Workers’ Party Congress In Late February

North Korea To Hold 9th Workers’ Party Congress In Late February -

All You Need To Know Guide To Rosacea

All You Need To Know Guide To Rosacea -

Princess Diana's Brother 'handed Over' Althorp House To Marion And Her Family

Princess Diana's Brother 'handed Over' Althorp House To Marion And Her Family -

Trump Mobile T1 Phone Resurfaces With New Specs, Higher Price

Trump Mobile T1 Phone Resurfaces With New Specs, Higher Price