‘PM retains tax exemptions for SEZs’

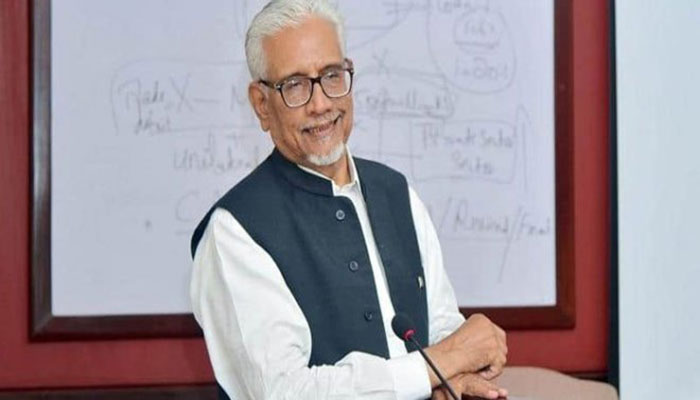

ISLAMABAD: Special Assistant to Prime Minister on Revenues Dr. Waqar Masood said on Friday that the government has retained the Special Economic Zones (SEZs) from the proposed withdrawal of income tax exemptions in order to protect investments, especially in the context of China Pakistan Economic Corridor (CPEC).

“Prime Minister Imran Khan himself kept the exemptions for SEZs, especially for CPEC intact, as the top guns who are promoting investment argued that if the government breached its commitment to providing tax exemptions on SEZs, it would hurt the investors’ confidence,” the SAPM, Dr. Waqar Masood, said in an interview with The News here at his office on Friday.

The government has tabled the Tax Amendment bill 2021 in the National Assembly and proposed to abolish around 80 corporate sector income tax exemptions with effect from July 1, 2021.

Dr. Waqar said that diplomats’ exemptions were protected and exemptions provided to IMF, WB, and other diplomats would continue. The total cost of the proposed withdrawal of tax exemptions would be standing at around Rs50 billion to Rs75 billion as there was no mechanical number, he said and added that its impact would depend upon the income earned by the corporate sector.

He said that it is a principle that tax policy should not be used for providing incentives for promoting economic activities but for the nascent stage, the industrial sector would be provided investment tax credits. This scheme is based on Universal Self Assessment Scheme (USAS), so the corporate sector would be entitled to deduct tax credits after getting audited accounts. He said that the new IPPs would have no exemptions after June 30, 2021. Those IPPs where the tax exemptions would expire after 2023 would have no income tax exemptions.

When asked about any proposal under consideration to do away with the Sales Tax exemptions, he refused to share any information about the upcoming budget. There are total tax expenditures of Rs1,185 billion as tax-to-GDP ratio declined.

“The World Bank assessed that potential of tax-to-GDP ratio in Pakistan should be 26 percent, so there is a long way to go,” he said. Our focus is to broaden the narrowed tax base, hemaintained.

To another query about broadening of the tax base, he said that the FBR had so far sent out second tax notices who did not bother to respond to our first notice, so in totality over one million notices were sent out. “If there is no response, the FBR will move ahead with an ex-party assessment and will generate tax demands,” he added. The Ministry of Power is updating details of consumers but they are facing some problems, he added.

When asked about the tax reforms in the FBR, he said that he discussed the proposed reform plan with Dr Ishrat Hussain who had proposed autonomous body status for the FBR. Usually, the status of autonomous bodies is given to those where there are no bureaucrats working but in the FBR, the civil service is the major cream in both IRS and Customs.

There is no problem if the FBR wants to remain within the ambit of the public sector, he said and added that the assessments were underway to ascertain its status.There is a proposal to keep the Tax Policy Unit under the Revenue Division and proposals in this regard are under consideration, he maintained.

The WB-funded project will be executed in five years and one of its major components of $80 million is to introduce technology as a new Chief Information Officer was hired and equipment upgrading would be done.

The Track and Trace system-related contract has been awarded, so it will become operational for one sector under the pilot project. “The tax system cannot run without compliance,” he said and added that track and trace would help move towards becoming compliant. The track and trace will overcome all concerns as placement of stamps would identify tax-evading packets.

Dr Waqar Masood said that the FBR’s tax revenues were hovering around in the range of Rs3,800 billion but the nominal GDP was increasing, so the tax-to-GDP ratio declined in the last three years. It was the first year when the FBR achieved growth as the Bureau achieved Rs2,210 billion in the first six months of the current fiscal year. “Our tax-to-GDP ratio will improve,” he said and added that the FBR achieved growth during the period of pre-COVID-19 pandemic.

“It achieved an impressive growth in the range of 16 to 18 percent per month and in one instance even achieved 20 percent growth in one month.” Pakistan and the IMF, he said, agreed for revising downward the FBR’s target to Rs4,717 billion against an initial target of Rs4963 billion for the current fiscal year.

-

FAA Shuts Down El Paso Airport, Flights Suspended For 10 Days: Here’s Why

FAA Shuts Down El Paso Airport, Flights Suspended For 10 Days: Here’s Why -

Kate Middleton, Prince William's Major Plan Revealed After Statement On Andrew Scandal

Kate Middleton, Prince William's Major Plan Revealed After Statement On Andrew Scandal -

Teacher Abused Children Worldwide For 55 Years, Kept USB Log Of Assaults

Teacher Abused Children Worldwide For 55 Years, Kept USB Log Of Assaults -

Nick Jonas Set To Showcase Acting Skills In Upcoming Thriller 'Bodyman'

Nick Jonas Set To Showcase Acting Skills In Upcoming Thriller 'Bodyman' -

Milano-Cortina 2026: Assessing Italy’s Winter Olympics Economic Growth

Milano-Cortina 2026: Assessing Italy’s Winter Olympics Economic Growth -

Chris, Liam Hemsworth Support Their Father Post Alzheimer’s Diagnosis

Chris, Liam Hemsworth Support Their Father Post Alzheimer’s Diagnosis -

Savannah Guthrie Expresses Fresh Hope As Person Detained For Questioning Over Kidnapping Of Nancy

Savannah Guthrie Expresses Fresh Hope As Person Detained For Questioning Over Kidnapping Of Nancy -

ByteDance Suspends Viral Seedance 2.0 Photo-to-voice Feature: Here’s Why

ByteDance Suspends Viral Seedance 2.0 Photo-to-voice Feature: Here’s Why -

Tom Hanks Diabetes 2 Management Strategy Laid Bare

Tom Hanks Diabetes 2 Management Strategy Laid Bare -

Bad Bunny Wins Hearts With Sweet Gesture At Super Bowl Halftime Show

Bad Bunny Wins Hearts With Sweet Gesture At Super Bowl Halftime Show -

Why Angelina Jolie Loves Her 'scars' Following Double Mastectomy

Why Angelina Jolie Loves Her 'scars' Following Double Mastectomy -

‘World Is In Peril’: Anthropic AI Safety Researcher Resigns, Warns Of Global Risks

‘World Is In Peril’: Anthropic AI Safety Researcher Resigns, Warns Of Global Risks -

Meghan Markle Receives Apology As Andrew Puts Monarchy In Much Bigger Scandal

Meghan Markle Receives Apology As Andrew Puts Monarchy In Much Bigger Scandal -

Catherine O’Hara Becomes Beacon Of Hope For Rectal Cancer Patients

Catherine O’Hara Becomes Beacon Of Hope For Rectal Cancer Patients -

Nancy Guthrie: Is She Alive? Former FBI Director Shares Possibilities On 10th Day Of Kidnapping

Nancy Guthrie: Is She Alive? Former FBI Director Shares Possibilities On 10th Day Of Kidnapping -

Siemens Energy Profit Surges Nearly Threefold Amid AI Boom For Gas Turbines, Grids

Siemens Energy Profit Surges Nearly Threefold Amid AI Boom For Gas Turbines, Grids