Profit rates on savings schemes raised by up to 2.3 percent

The government on Thursday increased profit margins on all national savings schemes by up to 2.3 percent to bring the NSS rates in line with recent hike in the central bank’s interest rate.

KARACHI: The government on Thursday increased profit margins on all national savings schemes by up to 2.3 percent to bring the NSS rates in line with recent hike in the central bank’s interest rate.

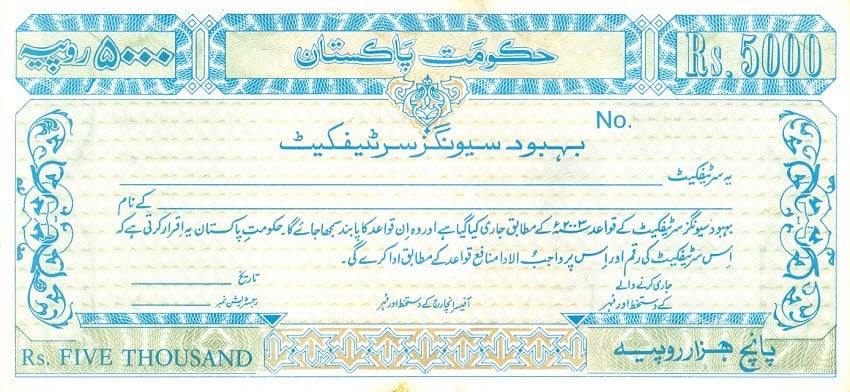

Profit on Pensioners’ Benefit Account, Behbood Savings Certificates, and Shuhuda’s Family Welfare Account has been increased by 48 basis points to 14.76 percent per annum from 14.28 percent in January 2019.

This translates into a profit of Rs61.50/month on minimum purchase of Rs5,000 Behbood Savings Certificates with effect from July 1. The revised rate sheets showed that the Defence Savings Certificates went up 54 basis points to 13.01 percent from 12.47 percent since January 2019.

According to the notices issued to the directors of Central Directorate of National Savings (CDNS), Pakistan Post Office, and BSC (Bank) State Bank of Pakistan (SBP), the NSS rates would be implemented from July 1, 2019 until further notice.

This move could improve the domestic savings rate and inflows due to attractive returns. The National Savings Schemes rates are connected to the central bank benchmark interest rate and its subsequent impact on the long-term Pakistan Investment Bonds.

The central bank had increased its interest rate by 150 basis points to 12.25 percent back on May 20, 2019. It had taken the measure to address the inflationary pressures from higher month-on-month headline and core inflation outturns and rupee depreciation. The government announced the rates of National Savings Schemes after every two months. It was the sixth raise since June 2018.

Likewise, return on Regular Income Certificates has been increased by 96 basis points, with the new rate of profit standing at 12.96 percent from 12.0 percent previously. This will translate into a payable profit of Rs540/month on Rs50,000 denomination.

Average profit payable on Special Savings Certificates (Registered) / Accounts went up by 1.33 percent to 12.90 percent from 11.57 percent (average) at the start of the calendar year. Also, the return on Short-Term Savings Certificates with 3-12 month tenure was increased by 2.3 percent to 12.08 percent from 9.80 percent.

The CDNS notice said that the profit rate on Savings Accounts would now be 10.25 percent, up from 8.50 percent. This shows an increase of 1.75 percent. The CDNS has instructed all regional offices that existing stock of blank Special Savings Certificates, Regular Income Certificates and Defence Saving Certificates would now be used by affixing rubber stamps with “Issue 49”, “Issue 46” and “Issue 45”, respectively, along with revised rates before issuance.

-

Rebecca Gayheart Breaks Silence After Eric Dane's Death

Rebecca Gayheart Breaks Silence After Eric Dane's Death -

Kate Middleton 2026 BAFTA Dress Honours Queen Elizabeth Priceless Diamonds

Kate Middleton 2026 BAFTA Dress Honours Queen Elizabeth Priceless Diamonds -

Sterling K. Brown's Wife Ryan Michelle Bathe Reveals Initial Hesitation Before Taking On New Role

Sterling K. Brown's Wife Ryan Michelle Bathe Reveals Initial Hesitation Before Taking On New Role -

BAFTA Film Awards Winners: Complete List Of Winners Updating

BAFTA Film Awards Winners: Complete List Of Winners Updating -

Millie Bobby Brown On Her Desire To Have A Big Brood With Husband Jake Bongiovi

Millie Bobby Brown On Her Desire To Have A Big Brood With Husband Jake Bongiovi -

Biographer Exposes Aftermath Of Meghan Markle’s Emotional Breakdown

Biographer Exposes Aftermath Of Meghan Markle’s Emotional Breakdown -

Backstreet Boys Admit Aging Changed Everything Before Shows

Backstreet Boys Admit Aging Changed Everything Before Shows -

Ryan Coogler Makes Rare Statements About His Impact On 'Black Cinema'

Ryan Coogler Makes Rare Statements About His Impact On 'Black Cinema' -

Rising Energy Costs Put UK Manufacturing Competitiveness At Risk, Industry Groups Warn

Rising Energy Costs Put UK Manufacturing Competitiveness At Risk, Industry Groups Warn -

Kate Middleton Makes Glitzy Return To BAFTAs After Cancer Diagnosis

Kate Middleton Makes Glitzy Return To BAFTAs After Cancer Diagnosis -

NFL Star Rondale Moore Dies Aged 25, Minnesota Vikings Pay Tribute

NFL Star Rondale Moore Dies Aged 25, Minnesota Vikings Pay Tribute -

Kim Kardashian Makes Huge Career Move Weeks After Going Public With Lewis Hamilton

Kim Kardashian Makes Huge Career Move Weeks After Going Public With Lewis Hamilton -

Shia LaBeouf Draws Attention For Sweet Reason After Spending Time In Jail Over Brawl Incident Amid Mardi Gras Bash

Shia LaBeouf Draws Attention For Sweet Reason After Spending Time In Jail Over Brawl Incident Amid Mardi Gras Bash -

Princess Eugenie, Beatrice Receive Strong Warning After Andrew Arrest: 'Zero Tolerance'

Princess Eugenie, Beatrice Receive Strong Warning After Andrew Arrest: 'Zero Tolerance' -

Rihanna 38th Birthday Detail Breaks The Internet, Featuring Unexpected Huge Item

Rihanna 38th Birthday Detail Breaks The Internet, Featuring Unexpected Huge Item -

Liza Minnelli Recalls Rare Backstage Memory With Mum Judy Garland In New Memoir

Liza Minnelli Recalls Rare Backstage Memory With Mum Judy Garland In New Memoir