BRUSSELS: Britain and the European Union agreed on Monday to a transition period to avoid a “cliff edge” Brexit next year — though only after London accepted a potential solution for the border with the Irish Republic that may face stiff opposition at home.

The pound surged on confirmation that Britain would remain effectively a non-voting EU member for 21 months until the end of 2020. Some business leaders, however, echoed a warning from EU negotiator Michel Barnier that the deal is legally binding only if London agrees the whole withdrawal treaty by next March.

That means solving outstanding issues, notably how to avoid a “hard border” that could disrupt peace in Northern Ireland. Britain says an EU-UK free trade deal to be sealed by 2021 can do that. But Dublin insists the Brexit treaty must lock in a “backstop” arrangement in case that future pact does not work.

Both sides are committed to keeping a free flow of people and goods over the intra-Irish border without returning to checkpoints, as during the three decades of violence in Northern Ireland. However, finding a practical solution for any customs checks needed post-Brexit has proved elusive so far.

The dispute with Ireland had threatened to derail May’s hopes of a formal political endorsement of the transition deal by EU leaders when they meet in Brussels on Friday. A weekend of intensive talks, however, has broken the deadlock — for now.

Prime Minister Theresa May, who relies on pro-British Northern Ireland members of parliament to pass her Brexit legislation, rejected a fallback proposed by Brussels three weeks ago. She said an EU offer to keep Northern Ireland under EU trade rules would isolate the province from the mainland.

However, her Brexit Secretary David Davis, in Brussels, has now signed up to following similar principles as negotiators resume work to find an “operational” compromise — a situation Dublin said it was happy to accept as it bound London in to not “backsliding” on pledges May had made on the issue in December.

“We agree on the need to include legal text detailing the ‘backstop’ solution for the border,” Davis told a news conference with Barnier. “But it remains our intention to achieve a partnership that is so close as to not require specific measures in relation to Northern Ireland.”

The question will remain as to whether negotiations on the future trade partnership between Britain and the EU, which are expected to start only next month after EU leaders endorse Barnier’s negotiating guidelines on Friday, can produce results — and quickly enough to avoid having language in the withdrawal treaty that Britain, and May’s Belfast allies, cannot accept.

Longer term, the transition deal may buy people time but business still faces a “cliff edge” of uncertainty come 2021.

“DECISIVE DAY”

Davis agreed with Barnier that Monday’s agreement was “decisive” and increased the odds on finding an orderly deal to avoid Europe’s second biggest economy simply crashing out of the bloc in just over a year. He hailed the certainty that the deals on the transition and other issues, including rights for expatriate citizens, would offer businesses and individuals.

However, Barnier warned: “A decisive step remains a step; we are not at the end of the road and there still remains a lot of work to be done, including on Ireland and Northern Ireland.”

Ireland has been anxiously making sure that the other 26 remaining EU states continue to back it over the border and did not give up the leverage over London that the transition deal offered without a clear new pledge from Britain on the backstop.

Foreign Minister Simon Coveney, who met Barnier in Brussels before the announcements on Monday, said he was satisfied.

The two sides issued a new, 129-page draft withdrawal treaty that was awash with green highlighter denoting final agreement on large areas of the legal text, including transition.

The pound rose as much as 1 percent against the dollar to $1.4088 GBP=D3, its strongest since Feb. 16.

-

Travis Kelce's mom Donna Kelce breaks silence on his retirement plans

-

Hailey Bieber reveals KEY to balancing motherhood with career

-

Hillary Clinton's Munich train video sparks conspiracy theories

-

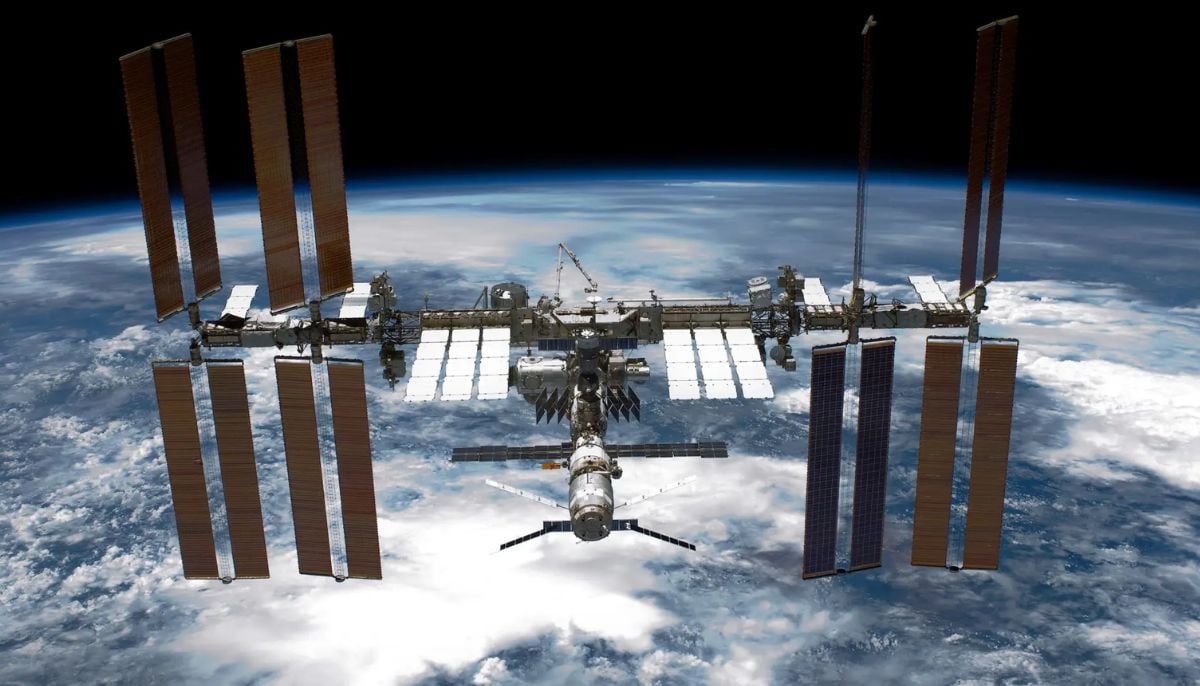

Woman jailed over false 'crime in space' claim against NASA astronaut

-

Columbia university sacks staff over Epstein partner's ‘backdoor’ admission

-

Ohio daycare worker 'stole $150k in payroll scam', nearly bankrupting nursery

-

Michelle Yeoh gets honest about 'struggle' of Asian representation in Hollywood

-

US, China held anti-narcotics, intelligence meeting: State media reports