Apple stock hits new highs after solid report-What’s next?

Apple has revealed its fiscal fourth-quarter earnings report

Apple stock is currently reacting to it's stronger than expected fiscal fourth-quarter 2025 earnings report and revealed a cash reserve of over $132 billion, shocking traders who were expecting a rally as the stock fell by 5%.

The company's results showed that it is still struggling with supply issues, which made it difficult to beat Wall Street’s expectation where it matters.

According to CEO Tim Cook, the forecast for the holiday quarter is that iPhone sales will grow by double digits, with total revenue for the year expected to rise 10-12%.

In contrast, analysts had estimated only 9.8% growth for iPhones and 6.6% for overall revenue, meaning Apple’s higher forecasts put the company ahead of consensus for its fiscal first quarter of 2026.

The company is striving to meet demand for the iPhone 17 lineup, which remains particularly constrained even as orders pile up.

It has been observed that some models of the iPhone 16 are still facing setbacks, leaving Apple scrambling to meet demands approaching the holiday season.

While the remarkable performance of new AI-powered AirPods, which can translate languages in real time, has helped the company to retain the weaker iPhone numbers in the previous quarter, the company still faces major challenges in the China market.

Tim told Reuters that the delay in shipping new models to China was the prime reason for fewer sales.

He said, “We're very enthusiastic about China and we love the response to the new products here, and we expect to grow or to return to growth in Q1.”

On the contrary, he explained that the prime reason was the supply constraints we are experiencing on several models of the iPhone 17; however, we’re filling orders just as fast as we can.

The founding managing partner of Apeira Capital, Natalie Hwang, said, “The expectations of a strong holiday quarter give Apple a runway to reaffirm demand, and it will be interesting to see how effectively it converts that momentum into a durable AI and infrastructure damage.”

Apple has demonstrated strong growth momentum, driven by its high-margin Services and a better-than-expected iPhone product cycle, though it is also expected to incur $1.4 billion in tariff-related costs in the current quarter ending in December.

The expectations from the Wall Street analysts indicate that the company still has room to improve, pushing growth margins to 47-48% and the average estimate sits at 46.9%.

-

Timothée Chalamet faces major blow ahead of 2026 Oscars: 'In depth of disappointment'

-

Taylor Swift displays 'Elizabeth Taylor' cover art before Record Store Day vinyl release

-

Kesha criticizes Donald Trump for using her song in TikTok video: 'Disgusting'

-

'Deadliest Catch' star dies in tragic incident at 25

-

'Sinners' star Jayme Lawson calls out BAFTA organisers for exploiting Tourette's advocate

-

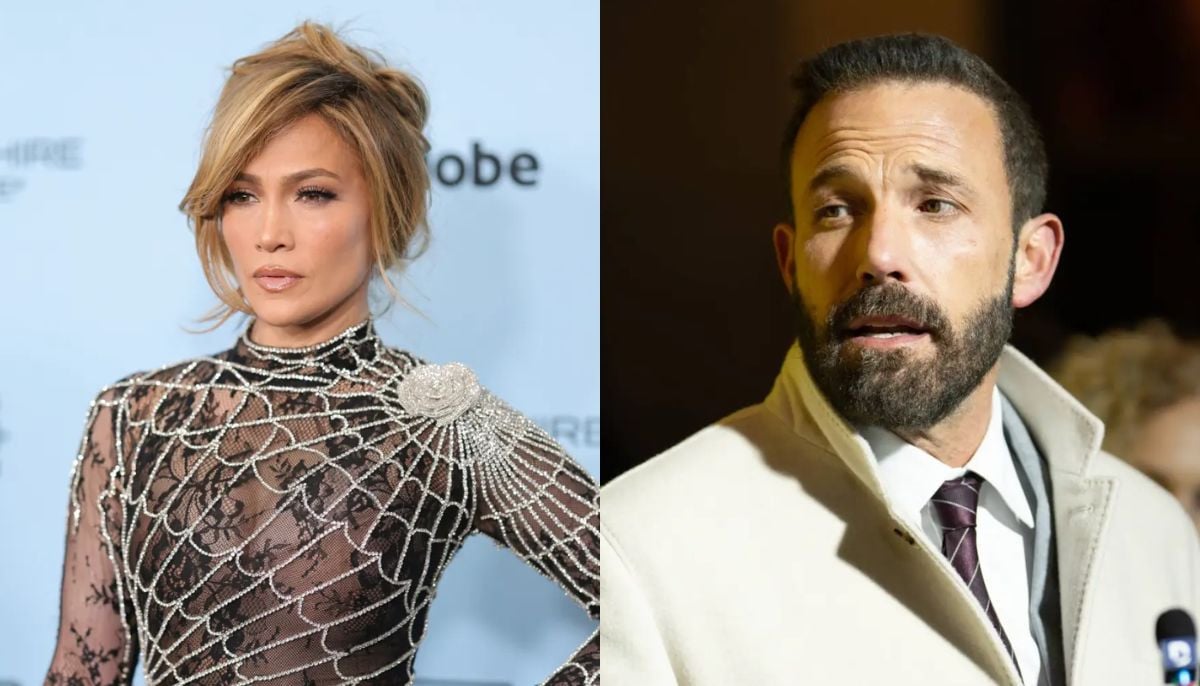

Jennifer Lopez dumps Ben Affleck again

-

Elisabeth Hasselbeck returns to 'The View' after 13 years: 'We're stronger'

-

'Bridgerton' stars explain Michael, Michaela gender swap in Francesa's love story