High costs and rising rates make homeownership a challenge for young Americans

US housing market is facing a severe shortage, especially for affordable options, and higher interest rates are adding more pressure for younger generation

Young Americans are finding it increasingly tough to buy their own homes due to soaring costs and surging mortgage rates.

For many, the dream of homeownership is slipping further away, and this trend is concerning not only for families but also for President Joe Biden's re-election campaign.

Millennials, who were the most active homebuyers from 2014 to 2022, have lost their top spot to baby boomers, who can afford to buy homes outright. The housing market is facing a severe shortage, especially for affordable options, and the higher interest rates are adding more pressure for the younger generation.

Adding to the financial stress is the restart of student loan payments in October after a pause during the pandemic. For many first-time buyers, moving directly from their family's home into homeownership has become more common, reaching levels not seen since the 1980s. These first-time buyers are also getting older, with the median age now at 36.

The situation has led to a slowdown in existing home sales, reaching their lowest rate since January. US mortgage rates hit a two-decade high in August, reaching an average of 7.2 percent for a 30-year fixed-rate mortgage. The median sales price for homes remains high, making it even more challenging for aspiring homeowners.

As housing costs continue to rise, buyers are turning to neighbouring markets, exacerbating the price surge. In areas like New York, the "American dream" of owning a four-bedroom family house is becoming unattainable. A house that would have sold for mid-$400,000s before the pandemic in Philadelphia suburbs now goes for $600,000 or more.

While some experts predict a slowdown in housing price inflation, the US still faces a shortage of around 5.5 million homes. To tackle this issue, vacant office buildings are being considered for conversion into residential spaces. However, these trends are deepening wealth gaps and housing inequality, affecting younger buyers with limited resources and fewer opportunities for Black and Hispanic buyers to enter the market.

These challenges not only impact families but also contribute to housing and wealth inequality, a matter of growing concern for policymakers.

-

Travis Kelce's mom Donna Kelce breaks silence on his retirement plans

-

Hailey Bieber reveals KEY to balancing motherhood with career

-

Hillary Clinton's Munich train video sparks conspiracy theories

-

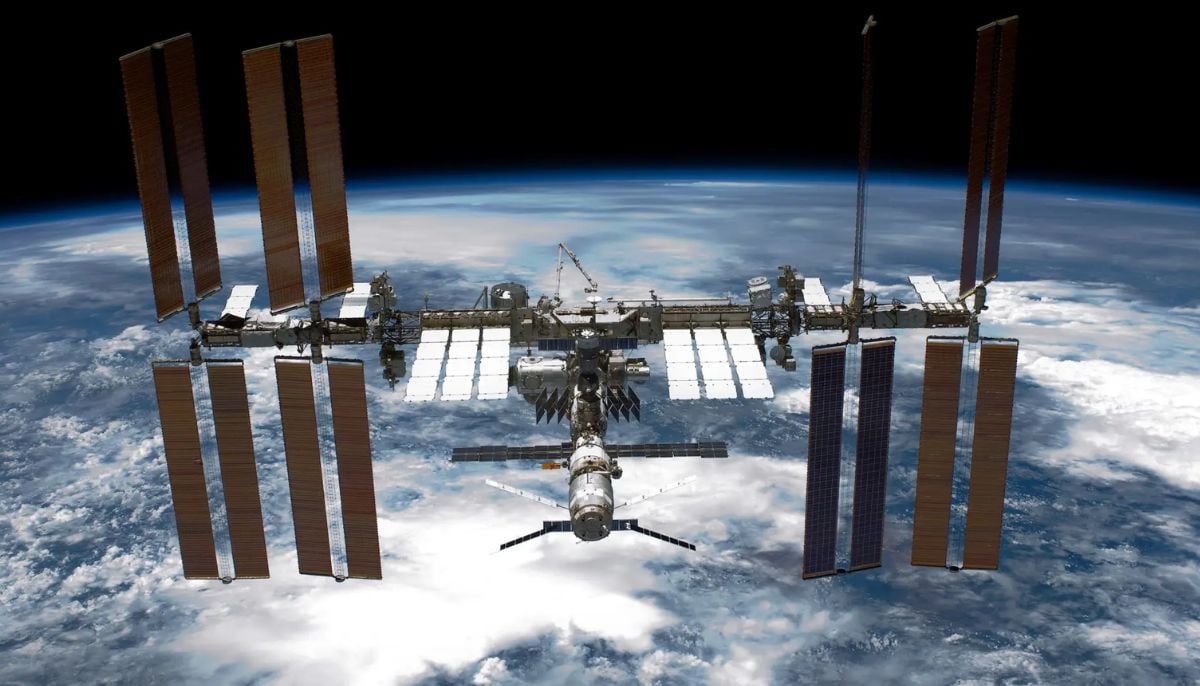

Woman jailed over false 'crime in space' claim against NASA astronaut

-

Columbia university sacks staff over Epstein partner's ‘backdoor’ admission

-

Ohio daycare worker 'stole $150k in payroll scam', nearly bankrupting nursery

-

Michelle Yeoh gets honest about 'struggle' of Asian representation in Hollywood

-

US, China held anti-narcotics, intelligence meeting: State media reports