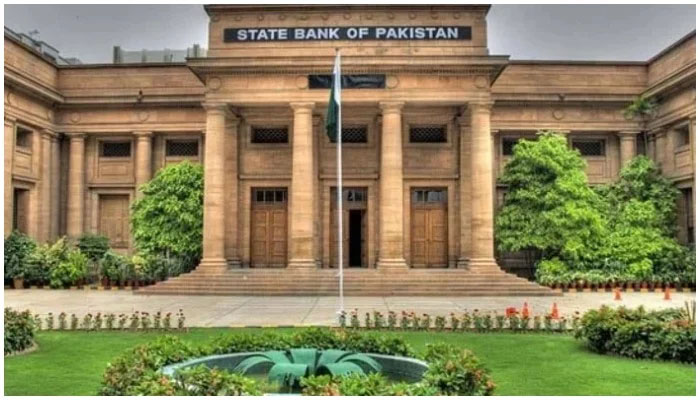

Pakistan to get $2bn from Qatar: SBP

The country will also get $1 billion in oil financing from Saudi Arabia

KARACHI: Pakistan will receive $2 billion from Qatar in bilateral support to help ease the South Asian nation’s funding crunch and the consequent risk of a default, the central bank said on Monday.

The country will also get $1 billion in oil financing from Saudi Arabia and a similar amount in investments from the UAE. All the funds are expected over twelve months, Murtaza Syed, deputy governor at the State Bank of Pakistan (SBP) said in a briefing. Prime Minister Shehbaz Sharif is visiting Qatar on August 23 (today) and 24. “An announcement of the assistance may or may not be announced during the trip,” Syed said.

The pledges come before an International Monetary Fund (IMF) board meeting on August 29 that could lead to the release of $1.2 billion in financing. Arab nations had committed to supporting Pakistan only after it secured an IMF programme, while the Washington-based lender has been seeking a commitment from Saudi Arabia.

The Pakistan rupee is the best performer globally this month and has gained 11 percent since dropping to a record low last month as worries over a possible default fade, according to data tracked by Bloomberg.

The SBP, meanwhile, left its benchmark interest rate unchanged due to easing external financing worries amid indications that the country may soon receive a bailout approval from the IMF.

Consistent with market expectations, the SBP’s Monetary Policy Committee (MPC) kept the policy rate at 15 percent as it thought it was wise to let several recent steps taken to cool the overheated economy and curb the current account deficit, such as monetary tightening, import control measures, and a robust fiscal consolidation plan, work their way through the system.

“With recent inflation developments in line with expectations, domestic demand beginning to moderate, and the external position showing some improvement, the MPC felt that it was prudent to take a pause at this stage,” the SBP said in a statement.

The policy rate has been hiked by a cumulative 800 basis points since September 2021. Last time, the SBP kept the borrowing cost steady in March 2022. “The headline inflation rose further to 24.9 percent in July, with core inflation also ticking up. This was expected given the necessary reversal of the energy subsidy package—effects of which will continue to manifest in inflation out-turns throughout the rest of the fiscal year—as well as momentum in the prices of essential food items and exchange rate weakness last month,” it added.

The trade balance fell sharply in July and the rupee reversed course during August, appreciating by around 10 percent on improved fundamentals and sentiment, it noted. The SBP said it will continue to monitor inflation outturns and global commodity prices.

“Looking ahead, the MPC intends to remain data-dependent, paying close attention to month-on-month inflation, inflation expectations, developments on the fiscal and external fronts, as well as global commodity prices and interest rate decisions by major central banks,” it said.

The SBP sees the IMF’s board approve a $1.2 billion tranche on August 29, which will help unlock funding from multilateral and bilateral lenders. In addition, Pakistan has also successfully secured an additional $4 billion from friendly countries over and above its external financing needs in FY2023. As a result, the foreign exchange reserves will be further augmented through the course of the year, helping to reduce external vulnerability.

The SBP expects the forex reserves to rise to around $16 billion this fiscal year. “To ensure this and to support the rupee going forward, it will be important to contain the current account deficit to around 3 percent of GDP by moderating domestic demand and energy imports. In addition, it will be critical to keep the IMF programme on-track by following through on the agreed fiscal tightening and structural reforms over the next 12 months,” it said.

Encouragingly, there is evidence that inflation expectations of businesses have eased significantly. Looking ahead, headline inflation is projected to peak in the first quarter before declining gradually through the rest of the fiscal year, according to the SBP.

Thereafter, inflation is expected to decline sharply and fall to the 5-7 percent target range by the end of FY2024, supported by the lagged effects of tight monetary and fiscal policies, the normalisation of global commodity prices, and beneficial base effects, it noted.

The SBP thinks this baseline outlook remains subject to uncertainty, with risks arising from the path of global commodity prices, the domestic fiscal policy stance, and the exchange rate. Pakistan’s external financing requirement (including current account deficit) will be slightly above $30 billion for FY2023 against available financing (including IMF) of around $37 billion, therefore over financed by $7 billion, said Arif Habib Limited, citing post-monetary policy analysts briefing given by the SBP Acting Governor Dr Murtaza Syed.

The breakdown of commitment of $4 billion from friendly countries includes $2 billion from Qatar, $1 billion from Saudi Arabia (deferred oil facility), and $1 billion from UAE (investment). These amounts are expected to be received over the next twelve months.

Pakistan’s short-term external debt is only six percent of its total external debt. The problem the country is having this year is the external debt repayments have bunched up, not due to any maturity problem, the SBP’s acting governor said.

Fiscal consolidation of around three percent of GDP given the election year will be challenging but this is what we have agreed with the IMF and to make this achievable, in acting governor’s view, we need to bring more people into the tax net.

-

Rihanna Takes Major Action After Gun Attack On Her Home

Rihanna Takes Major Action After Gun Attack On Her Home -

Georgia Special Election: Clay Fuller, Shawn Harris Lead Race For Marjorie Taylor Greene Seat

Georgia Special Election: Clay Fuller, Shawn Harris Lead Race For Marjorie Taylor Greene Seat -

Flash Flood Warning For Kent And Ottawa Counties After Heavy Rain Causes Flooding

Flash Flood Warning For Kent And Ottawa Counties After Heavy Rain Causes Flooding -

Tornado Warnings Issued As Severe Weather Moves Through Across Central US

Tornado Warnings Issued As Severe Weather Moves Through Across Central US -

David Beckham Sends Love To 'amazing' Mother-in-law On Special Day

David Beckham Sends Love To 'amazing' Mother-in-law On Special Day -

Cardi B Says 'sorry' After Unexpected Concert Moment With Fan

Cardi B Says 'sorry' After Unexpected Concert Moment With Fan -

Prince Harry Still Wants ‘accountability’ From Prince William

Prince Harry Still Wants ‘accountability’ From Prince William -

Nikki Garcia Reflects On 'crazy' Return To Dating Life After Artem Chigvinstev Split

Nikki Garcia Reflects On 'crazy' Return To Dating Life After Artem Chigvinstev Split -

Sarah Ferguson Always Looked For ‘quick Buck’ Even Before Exile

Sarah Ferguson Always Looked For ‘quick Buck’ Even Before Exile -

Jennifer Lopez Opens Up About Bittersweet Moment As Twins Prepare To Leave

Jennifer Lopez Opens Up About Bittersweet Moment As Twins Prepare To Leave -

Elon Musk Says 'X Money' Will Have Public Access From April 2026

Elon Musk Says 'X Money' Will Have Public Access From April 2026 -

Princess Eugenie 'finally Did The Right Thing' Amid Andrew Crisis

Princess Eugenie 'finally Did The Right Thing' Amid Andrew Crisis -

Candice Bergen Shares Her Honest Thoughts On Turning 80

Candice Bergen Shares Her Honest Thoughts On Turning 80 -

Queen Camilla Ditches Queen Elizabeth's Strictest Rule

Queen Camilla Ditches Queen Elizabeth's Strictest Rule -

Lauren Sanchez Recalls Tearful Moment At Wedding To Jeff Bezos

Lauren Sanchez Recalls Tearful Moment At Wedding To Jeff Bezos -

Travis Kelce Reveals Taylor Swift's Role In His NFL Comeback

Travis Kelce Reveals Taylor Swift's Role In His NFL Comeback