Prices of edible oils jump by 130pc in three years

This unusual soaring of prices has paved the way for the manufacturers, wholesalers and middlemen to collectively extract around Rs170 bn to Rs190 bn as an extra profit from August 2018 to Sep 2021

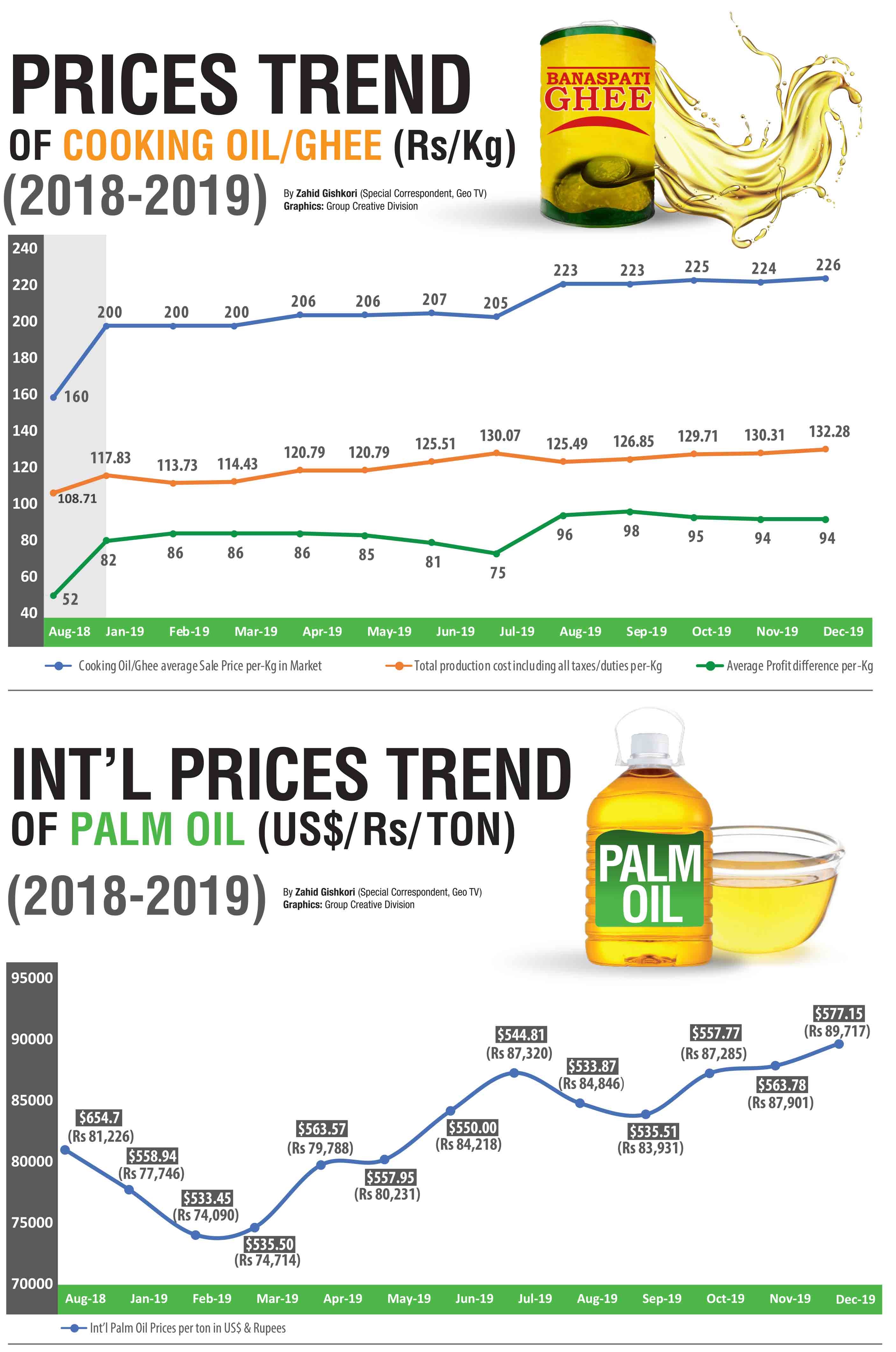

ISLAMABAD: The prices of edible oils jumped up to 130 percent (Rs160 to Rs369 per 1-kg) since the Pakistan Tehreek-e-Insaf government came to power, witnessing an alarming hike in the country's history.

This unusual soaring of prices has paved the way for the manufacturers, wholesalers and middlemen to collectively extract around Rs170 bn to Rs190 bn as an extra profit from August 2018 to Sep 2021, official statistics suggested. The Geo News scanned the official record which shows nearly 300 influentials (manufacturers, wholesalers & middlemen) have captured the entire market having collective business turnover of Rs1,500 bn.

The official record suggested that the profiteers earned maximum profit between Nov 2019 to 2020 to July 2020, then in Oct/Dec 2020 and yet again Jun/Jul of 2021 when edible oils prices were witnessing a drastic decrease in international market.

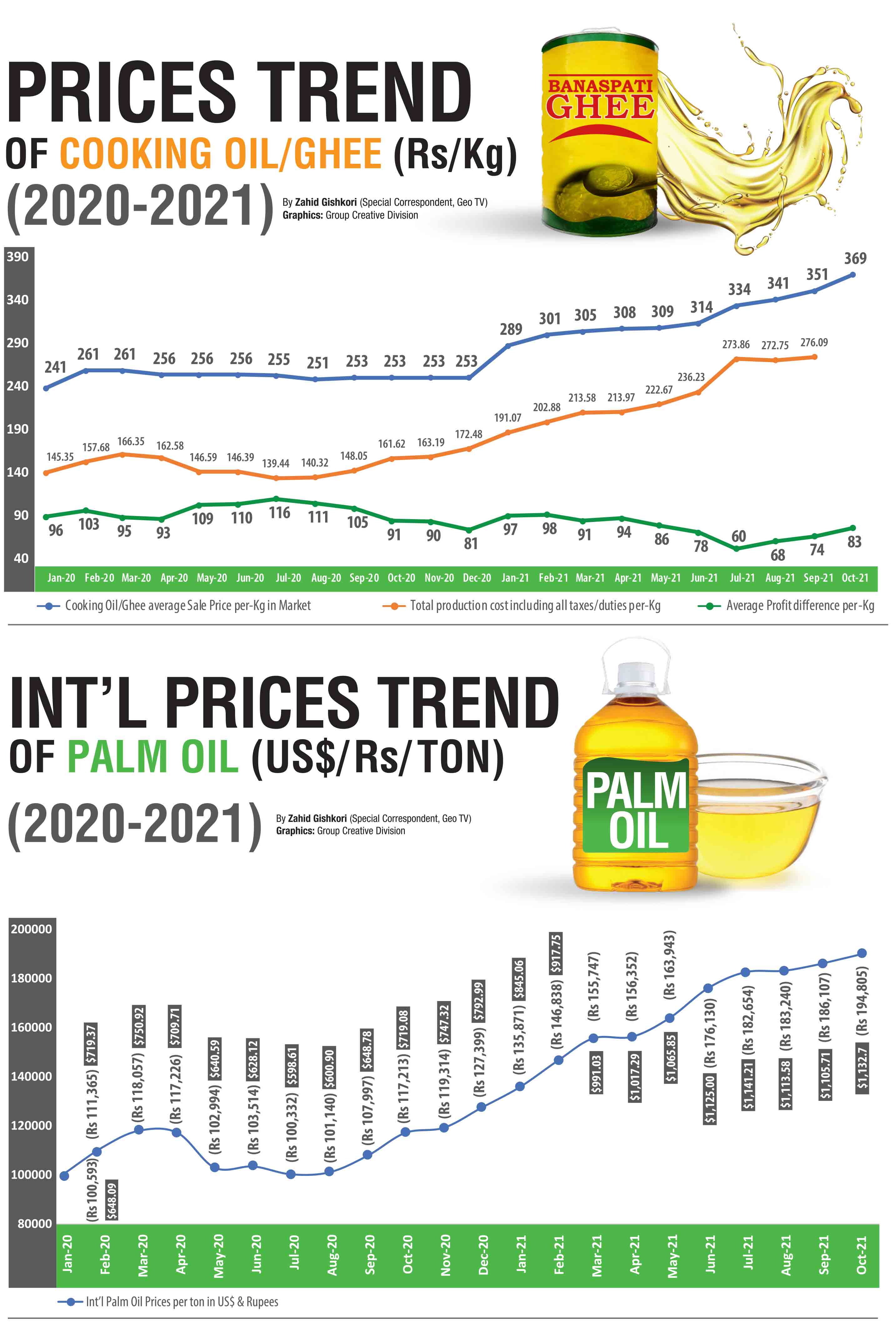

The price of cooking oil/ghee, continued to soar, even though duties on import of palm oil were also cut down by the government from Jan 2020 to Apr 2020. The price of cooking oil jumped up from Rs213 to Rs261 per/kg between Nov 2019 to Mar 2020 while price of palm oil dramatically dropped from $750 to $518 per ton (1,000 kg) in the international market.

The manufacturers did not pass on the relief to consumers while their average production cost remained from Rs123.5 to Rs166.3 per/kg during this period. Thus, they apparently earned the highest ever profit (Rs98 to Rs116 per/kg) during those six months. This moved PM Imran Khan, who directed the Ministry of Industries and Production (MoIP) and the Competition of Commission of Pakistan (CCP), to act against profiteers.

He also approved a Rs7 bn utility relief package. But further problems emerged when MoIP through its officer Amjad Hafeez, unearthed a cartel in the edible oils industry that extracted extra profit of Rs25 bn to Rs30 bn from consumers' during the first quarter of 2020, official record suggested. Also, MoIP, through an internal audit, learned that subsidy given on ghee/cooking sustained a loss of Rs699.117m.

Data received from the FBR, Pakistan Revenue Automation Ltd. (PRAL) and other regulators reveals that average collective taxes/duties on cooking oil remained from Rs17.3 to Rs39.7 per/kg during Jan 2019 to Sep 2021, while those were being sold at an average cost of Rs262.3 per/kg. The data on production cost of cooking oil showed, "all inclusive duties/taxes/charges were Rs117.3 (Rs30.95 inclusive of all taxes/duties) per/kg in 2019, Rs164 (33.24 inclusive taxes/duties) per1- kg in 2020 and Rs237.92 (Rs39.4 to Rs43 inclusive taxes/duties) per/kg from Mar 2021 to Sep 2021."

The Geo News acquired data and held meetings with officials of FBR, PRAL, Ministries of National Food Security and Research (MoNFSR), Commerce (MoC), MoIP and Finance, Pakistan Bureau of Statistics, Competition Commission of Pakistan (CCP), Competition Commission of Pakistan, State Bank of Pakistan, Pakistan Vanaspati Manufacturers Association (PVMA) and All Pakistan Solvent Extractors' Association to collect facts relating to this record hike. The official record shows that around 13,334 ton edible oil is consumed daily where profiteers extracted an extra average profit of Rs537 to Rs666m per day from the consumers. This record profit margin falls under 'Price Control and Prevention of Profiteering and Hoarding Act, 1977'. But key regulators, MoIP and MoNFSR, failed to move actively against the profiteers.

Pakistan consumed 13.5 MMT edible oils during three years and average price increase of Rs90.3/kg during that period resulted in multi-billion rupees in extra profits. The consumers carried an additional burden of Rs30 to Rs40 per/kg, which translates into Rs170 bn to Rs190 bn extra profits earned by the manufacturers, wholesalers and middlemen from Jan 2019 to Sep 2021, official record suggested. The market is divided into three categories where first category players were selling top quality edible oils with an average price of Rs390 to Rs470 per/kg, capturing 13pc market. Manufacturers of second and third category were selling at average price of Rs340 to Rs369 and Rs330 to Rs350 per/kg respectively. It is a fact that prices of edible oils went up in those countries which import palm/soyabean oil. India witnessed an increase from 40% to 52% in edible oil prices while Pakistan witnessed an unprecedented surge of over 130% with 90% palm oil import.

During Oct 2021, average palm oil prices remained $1,105.7 per ton while cooking oil prices jumped up to Rs369 per kg, official statistics revealed an average production price of Rs276 per/kg with a profit of Rs82 per/kg. Thus an average sale price of edible oil remained Rs321 per/kg with production cost of Rs237.9 per/kg where profiteers earned Rs83 per/kg in ten months of 2021, official record showed.

From July to Aug 2021, palm oil slightly decreased again from $1,141 to 1,113$ per ton but edible oils prices increased further from Rs314 to Rs341 with profit of Rs68 per/kg; official figures revealed a production cost of Rs272.5 per/kg during this period. Official figures continued to reveal that manufacturers and wholesalers sold edible oils at Rs289 per/kg with production cost remaining Rs191.07 per/kg, earning an average profit of Rs97 per/kg in Jan 2021.

Subsequently prices increased to Rs308 with production cost of Rs213.58 per/kg while palm oil prices remained $991 per ton during this period, according to official figures. In June 2021, palm oil prices again decreased from $1,189 to $1,015 but cooking oil increased to Rs314 with profit of Rs86 per/kg. During Jul to Dec 2020, prices of palm oil went up from $518 to $886 per ton and profiteers made extra profit of Rs81 to Rs116 per/kg as collective production cost remained from Rs139.3 to Rs172.48 per/kg during this period. Average sale price remained at Rs254 per/kg with overall production cost of Rs154.1 per/kg, resulting in extra profit of Rs100 per/kg during 2020.

Statistics for Jan 2019 showed that prices of palm oil dramatically dropped to $559 per ton but average price of cooking oil remained Rs200 per/kg, having a profit margin from 65 to Rs88 per/kg. The average cost of palm oil remained $551 per ton, average production price was Rs123.5 per/kg and cooking oil/ghee sold to consumers at Rs212 per/kg in 2019 with an average profit of Rs88 per/kg, official record showed. The cooking oil/ghee was being sold at Rs160 to Rs180 per/kg when value of one tonne palm remained $654.7 (Rs81226) in Aug 2018 with a total production cost of Rs113.4 per/kg. Thus profit margin remained Rs45 to Rs65 per/kg during this time. Pakistan imported 3MMT of palm oil by paying Rs340.5 bn with an average of $1035.8 per ton this year, 3MMT by paying Rs340.5 bn with average cost of $683 per ton in 2020 and the country imported 3.1MMT palm oil with cost of Rs262.1 bn in 2019. Average cost of palm oil remained $551 per ton in 2019, the official data states.

Official figures reveal that Pakistan has around 228 big industrial units and some 172 or smaller units manufacturing edible oils with a capacity of 6.6MMT. Five major players in the edible oils business are registered with the SECP. Two have not submitted their mandatory reports with the Commission, SECP officials said. Around a dozen key stakeholders in edible oil industry also have some degree of political backing as well, they added. All these units paid Rs7.2 bn on account of income taxes to the FBR in 2018, Rs7.7 bn in 2019 and Rs 8.4 bn in 2020, official record revealed. The government also collected Rs321m in 2018-19, Rs8.3 bn in 2019-20 and Rs10.4 bn in 2020-21 on account of sales tax, which were ultimately borne by the consumers. A senior official of FBR alleged that they not only found tax evasion of around Rs9 bn by the cooking oil industry but also this collective tax of Rs23.3 billion did not correspond to total business flow of this industry. Key regulators admitted that the profiteers extracted billions of rupees directly from consumers. When asked about their action against profiteers who extracted Rs170 bn Rs190 bn collectively, the CCP management said, "They do not have the mandate to look into profiteering and/or profitability or the reasonableness thereof."

Following the MoIP instructions, CCP raided the PVMA offices but the manufacturers went to the courts. The CCP officials claim that major players in the edible oils industry allegedly acted as a cartel in price manipulation. General Secretary PVMA Umer Islam Khan said, "monopoly and cartelization in edible oils industry is out of question." Cooking oil prices would jump up further if the government does not fix the dollar's value and decrease duties and taxes on edible products, he told the Geo News. "Due to immense pressure on limited cash flow of industry and unpredictable trends observed in int. market, the imports are retarded. It is an alarming state as the country has a stock of only 15-20 days," he said. On profit margin, pricing mechanism and CCP's notices, the PVMA has approached the courts now, he said.

-

Man Convicted After DNA Links Him To 20-year-old Rape Case

Man Convicted After DNA Links Him To 20-year-old Rape Case -

Royal Expert Shares Update In Kate Middleton's Relationship With Princess Eugenie, Beatrice

Royal Expert Shares Update In Kate Middleton's Relationship With Princess Eugenie, Beatrice -

Andrew Mountbatten-Windsor’s Leaves King Charles With No Choice: ‘Its’ Not Business As Usual’

Andrew Mountbatten-Windsor’s Leaves King Charles With No Choice: ‘Its’ Not Business As Usual’ -

Dua Lipa Wishes Her 'always And Forever' Callum Turner Happy Birthday

Dua Lipa Wishes Her 'always And Forever' Callum Turner Happy Birthday -

Police Dressed As Money Heist, Captain America Raid Mobile Theft At Carnival

Police Dressed As Money Heist, Captain America Raid Mobile Theft At Carnival -

Winter Olympics 2026: Top Contenders Poised To Win Gold In Women’s Figure Skating

Winter Olympics 2026: Top Contenders Poised To Win Gold In Women’s Figure Skating -

Inside The Moment King Charles Put Prince William In His Place For Speaking Against Andrew

Inside The Moment King Charles Put Prince William In His Place For Speaking Against Andrew -

Will AI Take Your Job After Graduation? Here’s What Research Really Says

Will AI Take Your Job After Graduation? Here’s What Research Really Says -

California Cop Accused Of Using Bogus 911 Calls To Reach Ex-partner

California Cop Accused Of Using Bogus 911 Calls To Reach Ex-partner -

AI Film School Trains Hollywood's Next Generation Of Filmmakers

AI Film School Trains Hollywood's Next Generation Of Filmmakers -

Royal Expert Claims Meghan Markle Is 'running Out Of Friends'

Royal Expert Claims Meghan Markle Is 'running Out Of Friends' -

Bruno Mars' Valentine's Day Surprise Labelled 'classy Promo Move'

Bruno Mars' Valentine's Day Surprise Labelled 'classy Promo Move' -

Ed Sheeran Shares His Trick Of Turning Bad Memories Into Happy Ones

Ed Sheeran Shares His Trick Of Turning Bad Memories Into Happy Ones -

Teyana Taylor Reflects On Her Friendship With Julia Roberts

Teyana Taylor Reflects On Her Friendship With Julia Roberts -

Bright Green Comet C/2024 E1 Nears Closest Approach Before Leaving Solar System

Bright Green Comet C/2024 E1 Nears Closest Approach Before Leaving Solar System -

Meghan Markle Warns Prince Harry As Royal Family Lands In 'biggest Crises' Since Death Of Princess Diana

Meghan Markle Warns Prince Harry As Royal Family Lands In 'biggest Crises' Since Death Of Princess Diana