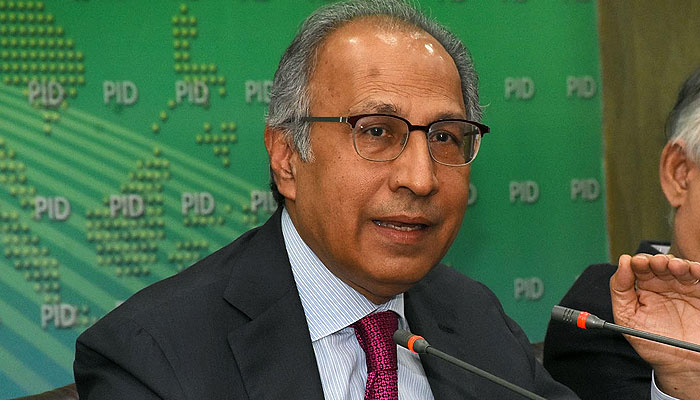

Finance adviser’s presser

Advisor to the PM on Finance Dr Abdul Hafeez Sheikh was beaming with confidence as he addressed a press conference declaring that the infamous twin “deficits [were] under complete control”.

The press was informed that against a deficit of Rs738 billion, the Q1 deficit was Rs478 billion, a reduction of 35 percent. It was further stated that this was due to non-issuance of supplementary grants during the quarter and cuts in other expenditures. Also, development spending was larger than Q1 of last year.

More: Hafeez Shaikh flies to US to attend annual IMF/WB meeting

The most remarkable performance was witnessed in non-tax revenues (NTR), which were reported at Rs406 billion compared to only Rs116 billion during Q1 last year. It seems the finance adviser also includes petroleum levy (PL) in NTR as he mentioned during the press conference (though it is part of tax revenues). Last year, PL was Rs44 billion and thus last year’s NTR receipts were Rs160 billion. This gives a growth of 153 percent as opposed to 140 percent reported in the press conference. The details of the receipts were not made available. The key receipts under NTR were reported as SBP profit at Rs185 billion, compared to Rs51 billion last year and PTA profits of Rs.0 billion compared to Rs6 billion last year. Buoyed with this performance, the finance adviser also announced that as against the budget estimate of Rs1.2 trillion, the NTR is likely to be close to Rs1.6 trillion.

On the external account, the trade deficit also fell by 35 percent as exports rose by close to 3 percent and imports fell by 21 percent. The adviser also emphasized exchange rate stability and rising foreign reserves. He particularly underlined the foreign investment of $345 million, which he said had resumed after three year. Two more developments were noted by the adviser. First, during this period no borrowing was made from the SBP. Second, a record number of emigrants were sent abroad. The data given to him showed that against about 150,000 workers more than 300,000 workers were sent in 2019.

It is understandable that the government would focus on good news, which, in its view, is showing ‘return of stability’ in the economy. However, there are many other signs that remain a source of concern for analysts. Before we point them out, let us make few observations on the results reported in the press conference.

First, it would have been desirable to release the full details of fiscal operations so that an informed comment could be made, particularly on the remarkable improvement in fiscal deficit, primarily due to enhanced NTR. Second, the first quarter NTR of Rs406 billion is larger than the collection of Rs364 billion for the full year. With PL receipts of Rs260 billion, it is Rs624 billion. Even then the increase is remarkable. The full year target for this year was Rs894 billion and with PL of Rs267 billion, the target is Rs1161 billion. It is said that this target is raised to Rs1.6 trillion. This is a good target but needs details for proper analysis. It may also be noted that IMF projection for NTR plus PL is Rs970 billion.

Third, the fact that no borrowing was made from the central bank is a positive step but its ultimate benefits will not flow until the money and bond markets have the depth to accommodate government borrowings. The amount of Rs1782 billion reduced from SBP borrowing up October 4 was made-up by Rs1731 billion borrowings from commercial banks. But this amount was lent by the SBP to commercial banks through open market operations (OMO), which stood at Rs2.21 trillion. So long as this monetary accommodation remains, inflation fears will not abate.

Finally, the data available at the Emigration Bureau website shows that until August 2019, 373,335 workers were registered for employment abroad against 382,439 registered last year. The average number of workers sent abroad during the five-year period of 2013-17 has been 619,390. Clearly, there is significant room for expansion in this area.

We now turn to some areas that were not covered under in the press conference. The major concern should be the growth rate which now seems to be falling behind the projected growth of even 2.4 percent by the IMF. The July production data was negative by 3.3 percent. The slowdown since then has accelerated as reported by the automobile sector where Q1 sales were down by 41 percent. Cement and petroleum products have also shown no growth or significant decline.

The fall in imports should be alarming as leading production sectors from textiles to automobiles, iron & steel to machinery and food to petroleum have all recorded significant falls. Most of these imports go as raw materials in finished products and as such a massive fall in their imports would lead to further decline in industrial output. The government was pinning hopes for growth from the agriculture sector but the first crop of cotton has suffered major losses, estimated at 30 percent. This will adversely affect the whole value chain.

The price situation is also worrying because of food inflation that rose to 15 percent, which was only 2.0 percent in January 2019 and one percent in September 2018. Top kitchen items experienced a phenomenal increase in their prices over the last year. Some example are: onions (102.31 percent), chicken (63.47 percent), Pulse Moong (48.54 percent), sugar (38.25 percent), potatoes (34.08 percent), cooking oil (21.23 percent), fresh vegetables(20.09 percent), tea (15.24 percent), wheat flour (12.85 percent), meat (11.58 percent) and fresh fruits (10.74 percent).

It is not very difficult to see that people’s real incomes have been hit very badly because of this abnormal surge in prices. This is the combined effect of over-shooting efforts in the form of massive devaluation, more than doubling of interest rates and supply disruptions on account of heavy rains and ban on imports from India.

It is high time the government began to worry about reviving the economy so that income-earning opportunities are created. If the two deficits have been brought under control, there is room to relax some of those policies that have given rise to this situation, and which undoubtedly were needed when this government started its term. But now the results are before us.

As we argued earlier, an evolving recession is building alongside some of the successes in economic management and as such a balancing act is warranted.

The writer is a former financesecretary.

Email: waqarmkn@gmail.com

-

Melissa Jon Hart Explains Rare Reason Behind Not Revisting Old Roles

Melissa Jon Hart Explains Rare Reason Behind Not Revisting Old Roles -

Meghan Markle Eyeing On ‘Queen’ As Ultimate Goal

Meghan Markle Eyeing On ‘Queen’ As Ultimate Goal -

Japan Elects Takaichi As First Woman Prime Minister After Sweeping Vote

Japan Elects Takaichi As First Woman Prime Minister After Sweeping Vote -

Kate Middleton Insists She Would Never Undermine Queen Camilla

Kate Middleton Insists She Would Never Undermine Queen Camilla -

King Charles 'terrified' Andrew's Scandal Will End His Reign

King Charles 'terrified' Andrew's Scandal Will End His Reign -

Winter Olympics 2026: Lindsey Vonn’s Olympic Comeback Ends In Devastating Downhill Crash

Winter Olympics 2026: Lindsey Vonn’s Olympic Comeback Ends In Devastating Downhill Crash -

Adrien Brody Opens Up About His Football Fandom Amid '2026 Super Bowl'

Adrien Brody Opens Up About His Football Fandom Amid '2026 Super Bowl' -

Barbra Streisand's Obsession With Cloning Revealed

Barbra Streisand's Obsession With Cloning Revealed -

What Did Olivia Colman Tell Her Husband About Her Gender?

What Did Olivia Colman Tell Her Husband About Her Gender? -

'We Were Deceived': Noam Chomsky's Wife Regrets Epstein Association

'We Were Deceived': Noam Chomsky's Wife Regrets Epstein Association -

Patriots' WAGs Slam Cardi B Amid Plans For Super Bowl Party: She Is 'attention-seeker'

Patriots' WAGs Slam Cardi B Amid Plans For Super Bowl Party: She Is 'attention-seeker' -

Martha Stewart On Surviving Rigorous Times Amid Upcoming Memoir Release

Martha Stewart On Surviving Rigorous Times Amid Upcoming Memoir Release -

Prince Harry Seen As Crucial To Monarchy’s Future Amid Andrew, Fergie Scandal

Prince Harry Seen As Crucial To Monarchy’s Future Amid Andrew, Fergie Scandal -

Chris Robinson Spills The Beans On His, Kate Hudson's Son's Career Ambitions

Chris Robinson Spills The Beans On His, Kate Hudson's Son's Career Ambitions -

18-month Old On Life-saving Medication Returned To ICE Detention

18-month Old On Life-saving Medication Returned To ICE Detention -

Major Hollywood Stars Descend On 2026 Super Bowl's Exclusive Party

Major Hollywood Stars Descend On 2026 Super Bowl's Exclusive Party