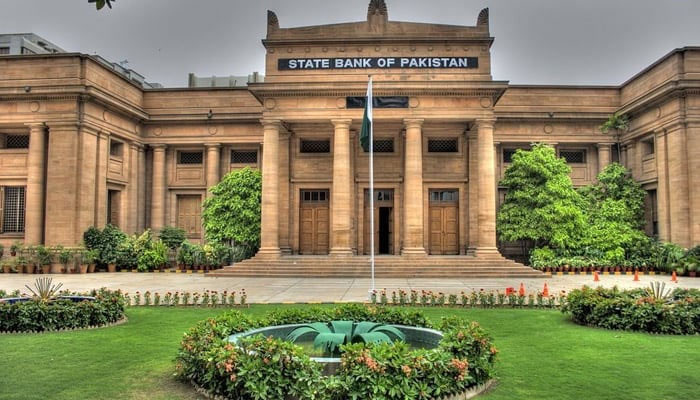

Policy rate

On Monday, central bank announced it was reducing the key interest rate by 150 basis points

With a reduction in the policy rate by the State Bank of Pakistan (SBP), the economy is likely to get some much-needed boost. On Monday, the central bank announced it was reducing the key interest rate by 150 basis points. As Budget FY24-25 looms, both the timing and margin of this rate are significant – coming on the heels of data showing a noteworthy slowdown in inflation to a 30-month low of 11.8 per cent in May. This improves the overall real interest rate, moving it into deep positive territory. Many would see the rate cut as a sign of a cautiously optimistic outlook on Pakistan’s economic trajectory. The Monetary Policy Committee (MPC) has likely assessed the subsiding inflationary pressures, supported by fiscal consolidation, as foundation enough for the rate cut. While acknowledging the potential risks associated with upcoming budgetary measures and energy price adjustments, the committee seems to be confident in the cumulative impact of earlier monetary tightening to keep inflationary pressures in check.

The rate reduction had been expected, with various surveys predicting a decline and hoping for a shift towards monetary easing. For people, what is important to know is that the SBP’s monetary policy reduction could stimulate economic activity, providing much-needed relief to businesses and consumers alike and offering a favourable environment for investment and borrowing. This reduction in interest rates marks the beginning of a monetary easing cycle in the country, with economists forecasting further cuts in the key rate throughout the year. Such measures are vital for sustaining economic momentum and enhancing fiscal stability, particularly in the face of ongoing negotiations with the IMF for additional financial support. The upcoming budget is poised to introduce stringent fiscal and monetary measures aimed at securing the IMF’s approval for further assistance. The MPC has also said that, given the limited progress in broadening the tax net, the coming budgetary measures will likely be "largely rate-based". It has also noted that in May 2024, worker remittances reached a record high of $3.2 billion, contributing to a reduced current account deficit and bolstering the SBP’s foreign exchange reserves. This, along with increased foreign direct investment (FDI) and the disbursement of a tranche from the SBA in April, facilitated significant debt repayments. According to the MPC, timely financial inflows to meet external financing requirements, strengthen foreign exchange buffers, and support sustainable economic growth, especially in the face of potential external shocks, are important.

Essentially, the decision to reduce the monetary policy rate is a positive sign, a strategic move towards revitalizing the economy – especially as the country prepares to navigate the complexities of the upcoming budget.

-

'Euphoria' Star Eric Made Deliberate Decision To Go Public With His ALS Diagnosis: 'Life Isn't About Me Anymore'

'Euphoria' Star Eric Made Deliberate Decision To Go Public With His ALS Diagnosis: 'Life Isn't About Me Anymore' -

Toy Story 5 Trailer Out: Woody And Buzz Faces Digital Age

Toy Story 5 Trailer Out: Woody And Buzz Faces Digital Age -

Andrew’s Predicament Grows As Royal Lodge Lands In The Middle Of The Epstein Investigation

Andrew’s Predicament Grows As Royal Lodge Lands In The Middle Of The Epstein Investigation -

Rebecca Gayheart Unveils What Actually Happened When Ex-husband Eric Dane Called Her To Reveal His ALS Diagnosis

Rebecca Gayheart Unveils What Actually Happened When Ex-husband Eric Dane Called Her To Reveal His ALS Diagnosis -

What We Know About Chris Cornell's Final Hours

What We Know About Chris Cornell's Final Hours -

Scientists Uncover Surprising Link Between 2.7 Million-year-old Climate Tipping Point & Human Evolution

Scientists Uncover Surprising Link Between 2.7 Million-year-old Climate Tipping Point & Human Evolution -

NASA Takes Next Step Towards Moon Mission As Artemis II Moves To Launch Pad Operations Following Successful Fuel Test

NASA Takes Next Step Towards Moon Mission As Artemis II Moves To Launch Pad Operations Following Successful Fuel Test -

GTA 6 Price Leaked Online Ahead Of Rockstar Announcement

GTA 6 Price Leaked Online Ahead Of Rockstar Announcement -

Eric Dane Got Honest About His Struggle With ALS In Final Public Appearance: 'No Reason To Be In A Good Spirit'

Eric Dane Got Honest About His Struggle With ALS In Final Public Appearance: 'No Reason To Be In A Good Spirit' -

Google AI Overviews And Mental Health: Why Experts Say It’s ‘very Dangerous’

Google AI Overviews And Mental Health: Why Experts Say It’s ‘very Dangerous’ -

Prince Harry Issues A Statement For His 'incredible' WellChild Children

Prince Harry Issues A Statement For His 'incredible' WellChild Children -

5 Famous Celebrities Who Beat Cancer

5 Famous Celebrities Who Beat Cancer -

Spinosaurus Mirabilis: New Species Ready To Take Center Stage At Chicago Children’s Museum In Surprising Discovery

Spinosaurus Mirabilis: New Species Ready To Take Center Stage At Chicago Children’s Museum In Surprising Discovery -

ByteDance Expands Artificial Intelligence Operations In US

ByteDance Expands Artificial Intelligence Operations In US -

Angelina Jolie’s Breast Cancer Surgeon Appreciates Her For Calling Scars 'a Choice': 'They Are Choices To Survive'

Angelina Jolie’s Breast Cancer Surgeon Appreciates Her For Calling Scars 'a Choice': 'They Are Choices To Survive' -

Detective Chief Inspector Reveals How Andrew Got Treated In Police Custody

Detective Chief Inspector Reveals How Andrew Got Treated In Police Custody