High tariffs, tax burden threaten economic stability: PBC

The Pakistan Business Council (PBC), in a detailed letter to the government, highlighted a range of issues undermining the manufacturing sector

KARACHI: Pakistan’s economy faces a daunting challenge as it grapples with premature deindustrialisation, leading to job losses and a decline in its share of world exports, an advocacy business forum said on Monday.

The Pakistan Business Council (PBC), in a detailed letter to the government, highlighted a range of issues undermining the manufacturing sector, including an excessive tax burden, prolonged periods of unrealistic exchange rates, unhelpful import tariffs, a poorly negotiated Free Trade Agreement (FTA) with China, frequent power outages, and non-competitive energy costs.

These factors have contributed to a decline in the role of manufacturing within the national economy, the council said. "Several challenges have become more acute. If not addressed urgently, more jobs will be lost, exports will struggle, reliance on imports will grow, and with a decline in profits, so will the government’s tax revenue," the PBC said.

It stated that the industrial sector is burdened with power and gas tariffs that are significantly higher than those in neighboring countries such as India, Bangladesh, and Vietnam. This disparity makes it unrealistic for Pakistan’s textile exports to compete internationally and for domestic energy-intensive industries to offer goods at competitive prices compared to imports.

"Tariff increases are not a sustainable way to stem the growth of the energy circular debt. Besides creating an even larger incentive to steal electricity, higher tariffs burden the few that pay their bills," the PBC said.

"Industry bears the costs and consequences of idle generation capacity, gaps in power transmission resulting in the use of expensive fuel, line losses, theft, under-recovery of dues, and cross-subsidy to residential users. In gas too, cross-subsidies and UFG increase the costs for industry. As a result of the high cost, domestic output of yarn and cloth is at a 20-year low. Imports of these higher energy-consuming products are rising, reducing the net value-added through exports."

The council said there are no quick-fix solutions such as tariff increases to resolve the challenges of the energy sector. "Fundamental reforms will take time. By committing to pursue these reforms with determination, the government must engage the IMF in a more reform-centric and phased program."

Industry is the source of employment, exports, and tax revenue. Fifty-six percent of direct taxes are paid by industry, which is more than twice its share in the GDP. Denying industry competitive energy tariffs undermines its positive contribution to the economy.

"Tariff increases may provide short-term relief to the fiscal deficit but undermine the health of the economy. The aim should be to boost demand through lower tariffs, at least for the productive sectors. The highest priority should be to provide energy to exporters at a competitive cost."

The council said a large fiscal deficit, on account of high government spending and low tax and other revenues, together with an increase in energy tariffs, is preventing inflation from subsiding sufficiently to trigger a cut in the policy rate.

"A high level of government borrowing also crowds out the private sector from bank credit. Both the private sector’s profitability and the government’s finances suffer from high borrowing costs. Notwithstanding the ineffectiveness of the policy rate as a tool to dampen demand (which is already at an all-time low), and the disproportionate impact that the policy rate has on the formal sector, it is vital to control government spending and borrowing."

The PBC said the IMF must be engaged to shift away from the hopeless pursuit of energy tariff increases as a cure for our challenges in the energy sector. These steps should lower the rate of inflation and lead to cuts in the policy rate.

The council said it encouraged the government's resolve to broaden the tax base. "The recent launch of the “Tajir-Dost” initiative is one step towards this objective. We also hope you will consider a “Sanat-Dost” programme to reduce the disproportionate burden of taxes on industry and the formal tax-paying sector, as also on their heavily taxed salaried employees," it added.

"Super Tax and double taxation of inter-corporate dividends is discouraging scale and listing of companies on the stock exchange. There needs to be a clear order of preference favouring listed companies, followed by other companies, then association of persons and finally, individuals in business. Presently, the effective tax rate on the corporate sector after taking account of tax on dividends is higher than on the unincorporated sector. On no account should the formal sector suffer from more onerous tax regime than those who pay no taxes. The government should clearly support wealth creation through fair means."

-

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War

Netflix, Paramount Shares Surge Following Resolution Of Warner Bros Bidding War -

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement

Bling Empire's Most Beloved Couple Parts Ways Months After Announcing Engagement -

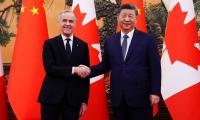

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit

China-Canada Trade Breakthrough: Beijing Eases Agriculture Tariffs After Mark Carney Visit -

London To Host OpenAI’s Biggest International AI Research Hub

London To Host OpenAI’s Biggest International AI Research Hub -

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub

Elon Musk Slams Anthropic As ‘hater Of Western Civilization’ Over Pentagon AI Military Snub -

Walmart Chief Warns US Risks Falling Behind China In AI Training

Walmart Chief Warns US Risks Falling Behind China In AI Training -

Wyatt Russell's Surprising Relationship With Kurt Russell Comes To Light

Wyatt Russell's Surprising Relationship With Kurt Russell Comes To Light -

Elon Musk’s XAI Co-founder Toby Pohlen Steps Down After Three Years Amid IPO Push

Elon Musk’s XAI Co-founder Toby Pohlen Steps Down After Three Years Amid IPO Push -

Is Human Mission To Mars Possible In 10 Years? Jared Isaacman Breaks It Down

Is Human Mission To Mars Possible In 10 Years? Jared Isaacman Breaks It Down -

‘Stranger Things’ Star Gaten Matarazzo Reveals How Cleidocranial Dysplasia Affected His Career

‘Stranger Things’ Star Gaten Matarazzo Reveals How Cleidocranial Dysplasia Affected His Career -

Google, OpenAI Employees Call For Military AI Restrictions As Anthropic Rejects Pentagon Offer

Google, OpenAI Employees Call For Military AI Restrictions As Anthropic Rejects Pentagon Offer -

Peter Frampton Details 'life-changing- Battle With Inclusion Body Myositis

Peter Frampton Details 'life-changing- Battle With Inclusion Body Myositis -

Waymo And Tesla Cars Rely On Remote Human Operators, Not Just AI

Waymo And Tesla Cars Rely On Remote Human Operators, Not Just AI -

AI And Nuclear War: 95 Percent Of Simulated Scenarios End In Escalation, Study Finds

AI And Nuclear War: 95 Percent Of Simulated Scenarios End In Escalation, Study Finds -

David Hockney’s First English Landscape Painting Heads To Sotheby’s Auction; First Sale In Nearly 30 Years

David Hockney’s First English Landscape Painting Heads To Sotheby’s Auction; First Sale In Nearly 30 Years -

How Does Sia Manage 'invisible Pain' From Ehlers-Danlos Syndrome

How Does Sia Manage 'invisible Pain' From Ehlers-Danlos Syndrome