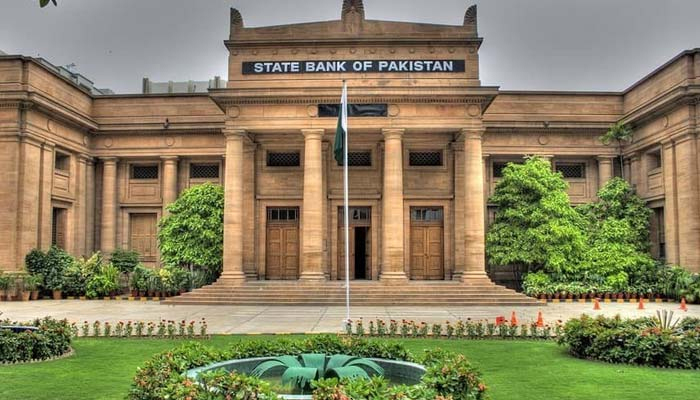

SBP keeps policy rate steady, sees inflation easing from March

KARACHI: The State Bank of Pakistan (SBP) kept its benchmark interest rate unchanged at 22 percent for a fifth consecutive meeting on Monday, citing high inflation and energy prices, and said it expected inflation to ease from March onwards.

The decision was in line with market expectations, as analysts had predicted the central bank would maintain its tight monetary policy stance due to the elevated levels of headline inflation.

The SBP maintained the policy rate at 22 percent as the large and frequent changes in administered energy prices have not only impeded a persistent fall in inflation expectations but also slowed down the rate of inflation decline that was previously expected, SBP governor Jameel Ahmad told a news briefing.

"The tight monetary policy stance must be maintained due to the elevated levels of core and headline inflation." December saw a 29.7 percent rate of inflation.

Ahmad said there was an increase in the bank's average inflation projection from a previous estimate of 20–22 percent for the fiscal year that ends in June to 23–25 percent.

The SBP in its monetary policy statement said the non-energy inflation continues to moderate, in line with the Monetary Policy Committee’s expectations. “On balance, the Committee viewed that the real interest rate remained significantly positive on a 12-month forward looking basis, as inflation is expected to remain on a downward path.”

Governor Ahmad said inflation pressure will ease from March onwards.

“The announcement was in line with market consensus. An increase in the average CPI [consumer price index] estimate was also expected as SBP revised its estimate in July and January only,” said Mohammed Sohail, the CEO at Topline Securities Limited.

“SBP agrees that the external account position and business confidence have improved, but inflation, though falling, is still high for an immediate rate cut.”

The central bank governor said Pakistan is expected to repay $24.5 billion in total in FY24, which includes roughly $20.7 billion in principal repayments and $3.8 billion in interest payments. The majority of the debt has been successfully repaid or rolled over, leaving $10 billion in unpaid balances. Of this outstanding sum, about $5 billion is expected to be rolled over.

As a result, the net amount to be repaid stands at approximately $5 billion, scheduled for repayment in the remaining months of FY24. Additionally, the reserves as of right now total just over $8.3 billion, which are sufficient to cover the upcoming debt obligations.

Ahmad said the country's reserve growth has not been hampered by the SBP's forward obligations being reduced from $4.5 billion in July to $3.5 billion. Current account balance surpluses and foreign inflows are the reasons for this increase. The SBP governor stated that the government makes the final choice on the next programme with the IMF in answer to a query. However, he highlighted that, in comparison to the last negotiation when Pakistan entered the stand-by arrangement programme in June, the government is now in a more advantageous position.

In the past few months, the total dividend and profit repatriation amounted to approximately $700 million. Up until September, all requests for dividend and profit repatriation have been fulfilled, except for $356 million. Within this outstanding amount, $232 million pertains to banks, and $124 million pertains to non-banks (corporations), according to the SBP.

The governor said that Pakistan's external debt profile has shown improvement. Approximately $8 billion in short-term commercial borrowings have been repaid, leaving multilateral obligations with extended maturities. The new inflows predominantly come from multilateral sources, contributing to an elongated debt maturity profile, aligning with the recommendations of the IMF.

-

Winter Olympics 2026: When & Where To Watch The Iconic Ice Dance ?

Winter Olympics 2026: When & Where To Watch The Iconic Ice Dance ? -

Melissa Joan Hart Reflects On Social Challenges As A Child Actor

Melissa Joan Hart Reflects On Social Challenges As A Child Actor -

'Gossip Girl' Star Reveals Why She'll Never Return To Acting

'Gossip Girl' Star Reveals Why She'll Never Return To Acting -

Chicago Child, 8, Dead After 'months Of Abuse, Starvation', Two Arrested

Chicago Child, 8, Dead After 'months Of Abuse, Starvation', Two Arrested -

Travis Kelce's True Feelings About Taylor Swift's Pal Ryan Reynolds Revealed

Travis Kelce's True Feelings About Taylor Swift's Pal Ryan Reynolds Revealed -

Michael Keaton Recalls Working With Catherine O'Hara In 'Beetlejuice'

Michael Keaton Recalls Working With Catherine O'Hara In 'Beetlejuice' -

King Charles, Princess Anne, Prince Edward Still Shield Andrew From Police

King Charles, Princess Anne, Prince Edward Still Shield Andrew From Police -

Anthropic Targets OpenAI Ads With New Claude Homepage Messaging

Anthropic Targets OpenAI Ads With New Claude Homepage Messaging -

US Set To Block Chinese Software From Smart And Connected Cars

US Set To Block Chinese Software From Smart And Connected Cars -

Carmen Electra Says THIS Taught Her Romance

Carmen Electra Says THIS Taught Her Romance -

Leonardo DiCaprio's Co-star Reflects On His Viral Moment At Golden Globes

Leonardo DiCaprio's Co-star Reflects On His Viral Moment At Golden Globes -

SpaceX Pivots From Mars Plans To Prioritize 2027 Moon Landing

SpaceX Pivots From Mars Plans To Prioritize 2027 Moon Landing -

J. Cole Brings Back Old-school CD Sales For 'The Fall-Off' Release

J. Cole Brings Back Old-school CD Sales For 'The Fall-Off' Release -

King Charles Still Cares About Meghan Markle

King Charles Still Cares About Meghan Markle -

GTA 6 Built By Hand, Street By Street, Rockstar Confirms Ahead Of Launch

GTA 6 Built By Hand, Street By Street, Rockstar Confirms Ahead Of Launch -

Funeral Home Owner Sentenced To 40 Years For Selling Corpses, Faking Ashes

Funeral Home Owner Sentenced To 40 Years For Selling Corpses, Faking Ashes