For people without taxable income: LHC declares collection of advance tax unconstitutional

The LHC has declared unconstitutional the collection of advance tax from people who do not have taxable income

LAHORE: The Lahore High Court has declared unconstitutional the collection of advance tax from people who do not have taxable income. It ordered that the collection of income tax is not allowed without estimating the income.

The Lahore High Court Justice Shahid Jameel issued the decision on 22 petitions of low-income mobile phone users and levying Rs20,000 advance tax on wedding hall bookings. The petitioners had challenged the levy of advance tax by amending Section 236D of the Income Tax Ordinance. The court clubbed all 22 petitions and sent them to chairman FBR for consultation with the attorney general. The court declared that an unreasonable tax is unconstitutional if it destroys businesses or deprives people of their property, ordering an amendment to the Income Tax Ordinance 2001. The court declared that following the judicial restraint, they are sending it to the FBR and attorney general for modification, all necessary steps should be taken within 90 days and the implementation report should be submitted to the court. The court stated that the interim relief given to the petitioners will continue till the FBR concludes the matter.

The judgment said that people without income are entitled to take the basic necessities of life from the state, unfortunately, the citizens without income already pay indirect taxes. The unconsolidated advance tax on such persons may be forfeited. The judgment further stated that tax is not an expropriation, which takes away the property of citizens or destroys the business of taxpayer and it should not be against the fundamental rights given in the Constitution. According to the judgment, collection of income tax is not allowed without estimating the income.

-

Jonathan Quick, The New York Rangers Face Mounting Pressure As Losses Pile Up

Jonathan Quick, The New York Rangers Face Mounting Pressure As Losses Pile Up -

Timothée Chalamet, Kylie Jenner Are Living Together In LA: Source

Timothée Chalamet, Kylie Jenner Are Living Together In LA: Source -

Johnny Knoxville Net Worth: How The Actor Built A $50mn Fortune

Johnny Knoxville Net Worth: How The Actor Built A $50mn Fortune -

Meghan Markle Hidden Agenda Behind Returning To UK Exposed

Meghan Markle Hidden Agenda Behind Returning To UK Exposed -

Raptors Vs Pacers: Toronto Shorthanded With Key Players Ruled Out Due To Injuries

Raptors Vs Pacers: Toronto Shorthanded With Key Players Ruled Out Due To Injuries -

Iran Flight Radar Update: Airspace Closure Extended Amid Heightened Tensions

Iran Flight Radar Update: Airspace Closure Extended Amid Heightened Tensions -

Toronto Snow Day: What To Expect After Environment Canada's Snow Storm Warning

Toronto Snow Day: What To Expect After Environment Canada's Snow Storm Warning -

Astrologer Gives Their Verdict On ‘Rat’ Prince Harry’s New Year

Astrologer Gives Their Verdict On ‘Rat’ Prince Harry’s New Year -

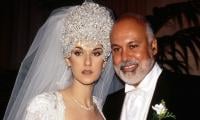

Céline Dion Honours Late Husband René Angélil On 10th Anniversary Of His Death

Céline Dion Honours Late Husband René Angélil On 10th Anniversary Of His Death -

Meghan Markle Seeks 'special Treatment' Ahead Of Possible UK Return: Report

Meghan Markle Seeks 'special Treatment' Ahead Of Possible UK Return: Report -

EBay Launches First Climate Transition Plan, Targets 'zero Emissions' By 2045

EBay Launches First Climate Transition Plan, Targets 'zero Emissions' By 2045 -

Rihanna To Announce Music Comeback And UK Stadium Shows

Rihanna To Announce Music Comeback And UK Stadium Shows -

Tish Cyrus Calls Post-divorce Period 'roughest' Time Of Her Life

Tish Cyrus Calls Post-divorce Period 'roughest' Time Of Her Life -

Prince Harry Turns To Hands-on Fatherhood As ‘crippling Social Anxiety’ Get Choke Hold

Prince Harry Turns To Hands-on Fatherhood As ‘crippling Social Anxiety’ Get Choke Hold -

Pete Davidson Launches New Talk Show From His Garage

Pete Davidson Launches New Talk Show From His Garage -

US To Suspend Immigrant Visa Processing For 75 Countries: Know All Details

US To Suspend Immigrant Visa Processing For 75 Countries: Know All Details