IMF’s World Economic Outlook: ‘Resilient’ 2026 growth expected amid tariffs & AI boom

IMF forecasts 2026 global GDP growth at 3.3 percent

The International Monetary Fund (IMF) in its recently-released World Economic Outlook report, has projected resilient and steady growth in 2026 despite trade tensions, tariff disruptions, and surging AI investment boom.

The lender of the last resort updates global GDP growth at 3.3 percent in 2026, up from 0.2 percent point from the last October estimate.

Even in 2025, the global economic growth was projected at 3.3 percent. In 2027, the growth would be steady or unchanged with the forecast of 3.2 percent, IMF reports.

‘Resilient growth’

According to IMF chief economist Pierre-Olivier Gourinchas, “We find that global growth remains quite resilient. So, in a sense, the global economy is shaking off the trade and tariff disruptions of 2025 and is coming out ahead of what we were expecting before it all started.”

Factors behind steady growth

According to the global lender, businesses have weathered the disruptive impacts of US tariff rates by rerouting and re-diversify the supply chains.

Moreover, the implementation of trade agreements with lowered duties also dampens the impact of trade tensions.

Recently, China has also defied Trump’s tariffs with record-breaking trade surplus by diversifying its exports beyond non US-markets.

According to the IMF, U.S. tariff rate is now assumed at 18.5% down from about 25% in the Fund's April 2025 forecast.

Among all, AI-driven investments have brought a major shift in global growth.

For instance, the IMF projected US growth for 2026 at 2.4 percent on the grounds of major investment in AI-powered infrastructure, cloud computing and chips.

In Spain, the tech-driven investment brought a 0.3 percent point upgrade in the country’s 2026 GDP forecast to 2.3 percent.

In Britain, the growth would remain unchanged at 1.3 percent for 2026.

AI boom as a double-edged sword

According to Pierre-Olivier Gourinchas, the IMF’s Chief Economist, if the businesses keep investing in AI at the record-breaking speed, it could lead to inflation due to massive inflow of money.

The market could also face massive shockwaves if the unprecedented investments fail to deliver the profitable results, compelling people to spend less due to disappointment.

IMF views AI as “downside risk” along with other divergent forces like, shifting sands of geopolitics, trade wars, and legal uncertainties.

However, if everything goes well, AI could be a huge win. As a result, global growth may be lifted by as much as 0.3 percentage points in 2026 and between 0.1 and 0.8 percentage points per year in the medium-term, depending on the speed of adoption and improvements in AI readiness globally,” IMF reports.

Economic outlook for other China, EU & Japan

China’s economy is expected to grow by 4.5 percent in 2026 as the US lowered some tariffs on Chinese goods. But, the IMF warns that China’s heavy reliance on exporting goods to other countries could harm its growth prospects.

The projections are quite rosy for Europe, especially because of Germany’s high spending and resilient economic growth in Ireland and Spain. So, growth is expected to hit 1.4 percent by 2027.

Japan’s growth is on a better trajectory due to the government’s heavy fiscal stimulus package.

The global picture

Globally, the inflation is expected to fall from 4.1 percent in 2025 to 3.4 percent by 2027. Consequently, the easing of inflation will help in adopting suitable monetary policy and promote stable growth.

-

key details from Germany's multimillion-euro heist revealed

-

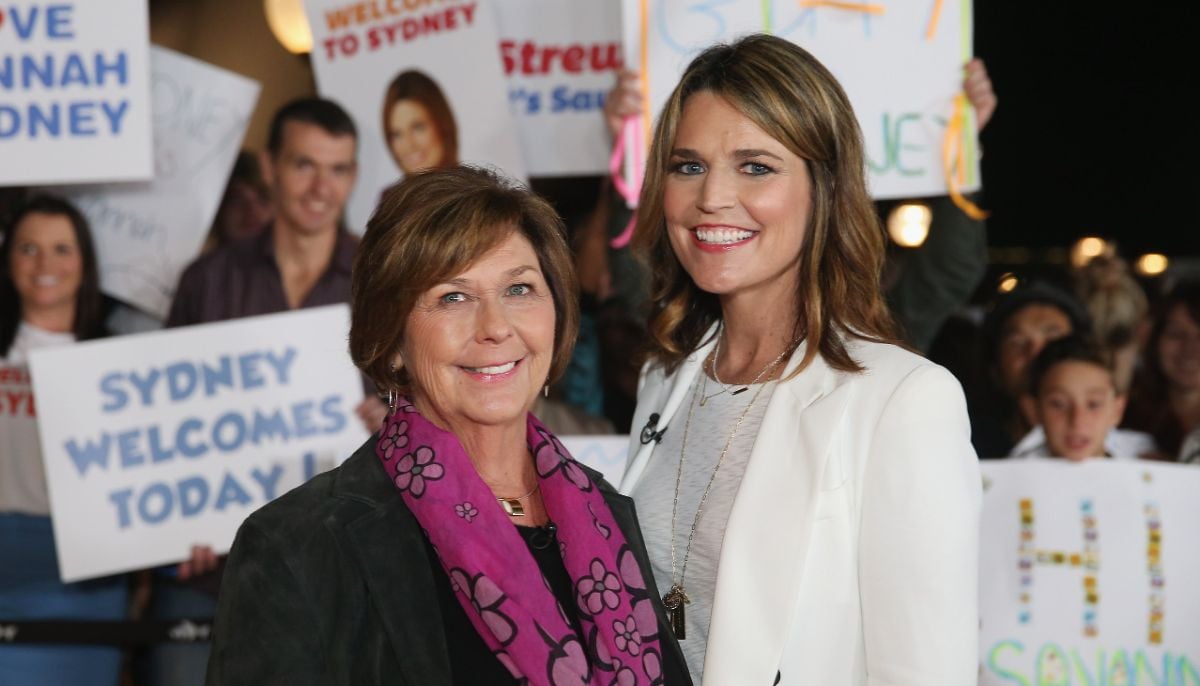

Search for Savannah Guthrie’s abducted mom enters unthinkable phase

-

Barack Obama addresses UFO mystery: Aliens are ‘real’ but debunks Area 51 conspiracy theories

-

Rosie O’Donnell secretly returned to US to test safety

-

'Harry Potter' star Rupert Grint shares where he stands politically

-

Drama outside Nancy Guthrie's home unfolds described as 'circus'

-

Marco Rubio sends message of unity to Europe

-

Hilarie Burton reveals Valentine's Day plans with Jeffrey Dean Morgan