Is AI boom turning into bubble? Circular deals fuel investors concerns

The slew of AI deals among the tech giants have raised the fears of bursting of bubble

In the rapid age of technological advancement, the AI boom is the most significant one characterized by slate of deals among the tech moguls.

The burgeoning investments in AI chips and infrastructure have skyrocketed companies’ values, taking the US stock indexes to new highs.

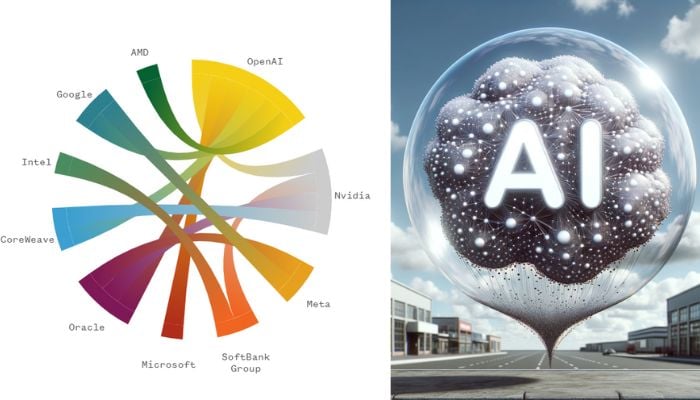

Deal webs fueling the AI boom

Recently, Advanced Micro Devices (AMD) and OpenAI joined the partnership with the announcement of a multibillion-dollar deal.

Under this agreement, OpenAI will buy AMD’s chips for an undefined sum, in turn the company will be entitled to take a stake of as much as 10 percent in the semiconductor giant.

In addition, Nvidia has announced plans to invest $100 billion in ChatGPT maker OpenAI in a bid to establish state-of-the-art 10 gigawatts of AI data centers equipped with millions of Nvidia GPUs.

According to Nvidia CEO, Jensen Huang, the investments in OpenAI are based on the “confidence in the revenues” generated by the company.

Nvidia and OpenAI have also entered into an indirect collaboration through CoreWeave, which has an agreement with OpenAI to sell Nvidia systems to OpenAI.

The web is also complicated by the collaboration of OpenAI and Oracle with Japan’s SoftBank group. Under this deal, they plan to invest $500 billion on additional data centers in a project named Stargate.

Besides, Nvidia is a major technology partner to Stargate and Softbank owns a $3 billion stake in Nvidia.

Concerns over AI bubble driven by investments

Concerns are rising regarding the expanding AI market as the financial analysts label the expansion as one of the most significant financial bubbles of contemporary times after the 2008 financial crisis.

According to an analysis conducted by MacroStrategy Partnership, the current AI bubble is larger than the past crises, 17-times more bigger than the 1990s dot-com bubble and four times the scale of the 2008 financial crisis.

For some investors, the Nvidia-OpenAI deal shows the resemblance to the one that led to the dom-com bubble burst.

In the 2000s March, Nasdaq Composite stock dropped by 77 percent, thereby eliminating billions of dollars in market value. It reached its market value after 15 years of struggle.

“There’s a healthy part and an unhealthy part” to the AI boom, said Gil Luria, a managing director at D.A. Davidson financial group who covers technology.

The unhealthy part belongs to “related-party transactions” driven by the close collaboration among tech giants. The close partnerships will lead to deflating activity and bubble’s bursting.

According to Sam Altman, “Between the ten years we’ve already been operating and the many decades ahead of us, there will be booms and busts.”

Jeff Bezos’ acknowledgement of AI bubble

Jeff Bezos has also acknowledged that unprecedented investments in AI is also creating an “industrial bubble”. On the other hand, he also emphasized on the immense societal benefits the technology brought.

Bezos said, “Investors often confront challenges in discerning between promising and unpromising ventures during periods of fervor,” suggesting that this phenomenon is prevalent in the AI industry.

According to Amazon’s founder, such kind of industrial bubbles can bring promising opportunities characterized by the massive investments in innovation and technological infrastructure that could benefit humanity in the long run.

AI boom: Engine of revenue generation

Peter Boockvar, chief investment officer of OnePoint BFG Wealth Partners and author of The Boock Report, said, “For this whole massive experiment to work without causing large losses, [OpenAI] and its peers now have got to generate huge revenues and profits to pay for all the obligations they are signing up for and at the same time provide a return to its investors.”

As long as tech giants valuations keep increasing and investors keep getting lucrative deals, the doomsday scenario related to AI will be ignored by the companies.

-

Milo Ventimiglia reveals favourite activity with baby daughter

-

Sydney Sweeney feels 'misunderstood' amid Scooter Braun romance

-

'The Last Thing He Told Me' star Jennifer Garner reveals why her kids find her 'embarrassing'

-

Bad Bunny makes bold move after historic Super Bowl Halftime show

-

Halle Bailey, Regé-Jean Page spark romance rumours with recent outing

-

Keith Urban feels 'anger' over Nicole Kidman's 'love life' after divorce

-

Rae Sremmurd ‘Black Beatles’ Mannequin Challenge returns in 2026

-

Robert Pattinson reveals moment therapist questioned his state of mind