IMF: Global corruption costs trillions in bribes, lost growth

Public sector corruption siphons $1.5 trillion to $2 trillion annually from the global economy in bribes and costs far more in stunted economic growth, lost tax revenues and sustained poverty, the International Monetary Fund said

WASHINGTON: Public sector corruption siphons $1.5 trillion to $2 trillion annually from the global economy in bribes and costs far more in stunted economic growth, lost tax revenues and sustained poverty, the International Monetary Fund said on Wednesday.

In a new research paper, the IMF said that tackling corruption is critical for the achievement of macroeconomic stability, one of the institution´s core mandates.

The Fund argues that strategies to fight corruption require transparency, a clear legal framework, a credible threat of prosecution and a strong drive to deregulate economies.

"While the direct economic costs of corruption are well known, the indirect costs may be even more substantial and debilitating," IMF Managing Director Christine Lagarde wrote in an essay accompanying the paper. "Corruption also has a broader corrosive impact on society.

It undermines trust in government and erodes the ethical standards of private citizens," Lagarde added.

The paper, titled "Corruption: Costs and Mitigating Strategies," follows Lagarde´s warning to Ukraine in February that the IMF would halt its $17.5-billion bailout for the strife-torn eastern European country unless it takes stronger action to fight corruption, including new governance reforms.

Lagarde is due to participate in a British government-sponsored anti-corruption summit in London on Thursday that will include U.S. Secretary of State John Kerry and other senior officials including the presidents of Nigeria and Afghanistan.

Extrapolating from 2005 World Bank research, the paper estimated that around 2 percent of global gross domestic product is now paid in bribes annually.

But it said corruption´s indirect costs are substantially higher, reducing government revenues by encouraging tax evasion and reducing incentives to pay taxes, leaving less money available for public investments in infrastructure, health care and education.

-

Chinese New Year explained: All you need to know about the Year of the Horse

-

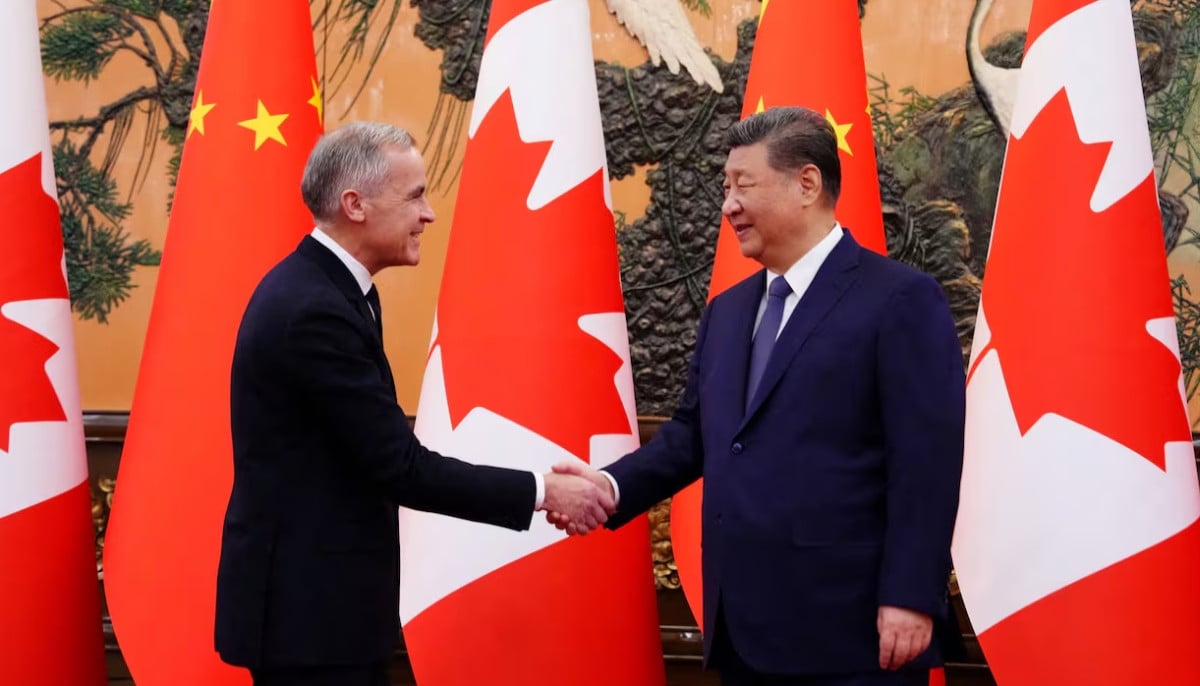

Canadian passport holders can now travel to China visa-free: Here's how

-

Edmonton weather warning: Up to 30 cm of snow possible in parts of Alberta

-

ICE agents 'fake car trouble' to arrest Minnesota man, family says

-

China confirms visa-free travel for UK, Canada nationals

-

Bad Bunny's star power explodes tourism searches for his hometown

-

Murder suspect kills himself after woman found dead in Missouri

-

Poll reveals majority of Americans' views on Bad Bunny