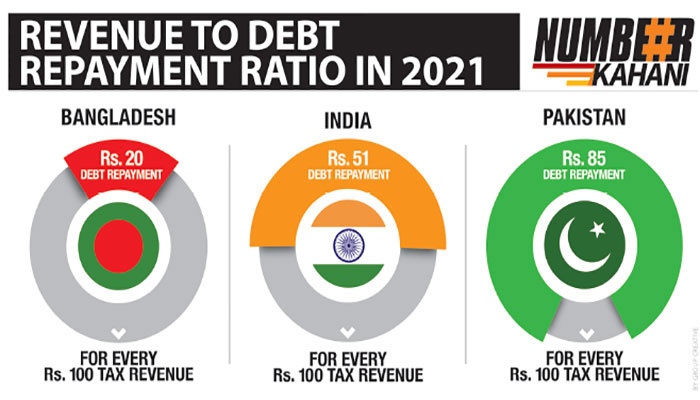

Out of total revenue last fiscal year, Pakistan spent Rs85 out of 100 in debt servicing

The country’s total debt and liabilities crossed Rs50.5 trillion mark as of September 21, 2021

ISLAMABAD: Pakistan’s net revenue receipts will only meet debt servicing requirements during the current fiscal year 2021-22 so the country’s defense, development, subsidies, running of civil government including salaries and pensions of the federal government will be paid out through “borrowed” money.

Out of total net revenue receipts of Rs100, the federal government utilised around Rs85 for payment of debt servicing while India’s central government spent Rs51 and Bangladesh around Rs20 out of total collected tax and non-tax amounts of Rs100 in last fiscal year i.e. 2020-21. The fiscal position is going to witness further worsening scenario as renowned economist Dr Ashfaque Hassan Khan has predicted that the net revenue receipts could only meet debt servicing bill during the current fiscal year ending on June 30, 2022, and all remaining expenditure heads including the country’s defense requirements would be met through “borrowed” money.

For an in depth analysis, there is a need to give a fiscal position by quoting figures of the last fiscal year ended on June 30, 2021. In the last fiscal year 2020-21, the FBR collected Rs4,764 billion and after providing a share to provinces under the National Finance Commission (NFC) Award to the tune of Rs2,741 billion, the net revenue receipts remained at Rs2,023 billion. The non-tax revenue collection fetched Rs1,480 billion so the federal government’s receipts touched Rs3,503 billion. The debt servicing consumed the largest ticket item on the expenditure front so it consumed Rs2,749 billion and the federal government was left with just Rs754 billion.

All remaining major expenditure items such as the country’s defense, development, provision of subsidies, and running of the government including salaries and pensions bills were paid through borrowed money. The defense spending utilized Rs1,316.418 billion, federal Public Sector Development Program Rs441 billion, running of civil government Rs505 billion, pension bill Rs440 billion, subsidies Rs425 billion, and grants to others Rs827.3 billion. In order to meet pressing expenditure requirements after collecting insufficient resources, the government had borrowed Rs3,403 billion equivalent to 7.1 percent of GDP to finance the yawning budget deficit.

The country’s total debt and liabilities crossed Rs50.5 trillion mark as of September 21, 2021, against Rs29.8 trillion three and half years back when the PTI took over the reign of power after winning the last elections. This indicates that the net increase in public debt and liabilities rose sharply to the tune of around Rs21 trillion, the highest ever jump in three year period. The external debt and liabilities increased from $95 billion in 2017-18 to $127 billion as of September 30, 2021. The external debt and liabilities jumped up by $32 billion only in the last three years and three months period.

Pakistan’s former finance minister and renowned economist Dr. Hafiz A Pasha when contacted said that the net revenue receipts were only meeting major expenditure heads of debt servicing and during FY 2018 the federal revenue receipts could only meet the increased requirement of debt servicing. He said that India’s debt accumulation was also witnessing a rising trend but their reporting of Central and states governments depicted different situations. Indian states, he said, borrowed 25 t0 30 percent in addition to the Central government so their federal debt did not depict the whole debt situation. Bangladesh’s debt servicing was much less than in comparison with Pakistan and India, he added.

This scribe also contacted former economic advisor and renowned economist Dr. Ashfaque Hassan Khan, he said that with the existing pace of devaluation of the rupee and tightening of monetary stance, the net revenue receipts would consume 100 percent to pay only debt servicing bill during the current fiscal year. He said that he had advised the incumbent PM Imran Khan to refrain from joining the IMF club because the country would be plunged into a debt trap due to the harshest ever conditionalities.

He said that in the fiscal year 2006-7, Pakistan’s net revenue receipts could meet debt servicing, defense, and 86 percent other expenditure obligations including PSDP, subsidies, and running of the civil government. In 2018-19, he said that net revenue receipts after providing share to the provinces could meet interest payment bills and the government had to borrow Rs 53 billion to pay the total bill of debt servicing. All other expenditures were met through borrowed money. In the last fiscal year 2020-21, the net revenue receipts could meet 100 percent debt servicing bill and 59 percent of defense requirements. All remaining expenditures were met through borrowed money.

For the current fiscal year, Dr. Ashfaque Hassan Khan said that keeping in view the fiscal position and rampant devaluation of rupee against the US dollar and increasing discount rates, the net revenue receipts would only meet 100 percent debt servicing bill and all remaining expenditures including defense, subsidies, PSDP and running of civil government would be met through borrowed money.

-

Piers Morgan In Hospital: Here's Why

Piers Morgan In Hospital: Here's Why -

IPhone 18 Pro Leaked: New Design Reveals Radical Corner Camera Layout

IPhone 18 Pro Leaked: New Design Reveals Radical Corner Camera Layout -

Kung Fu Legend Siu-Lung Leung Passes Away At 77

Kung Fu Legend Siu-Lung Leung Passes Away At 77 -

Kim Kardashian To Remove Ex Kanye West From Her Kids' Names

Kim Kardashian To Remove Ex Kanye West From Her Kids' Names -

Queens Mother Arrested After Abducting Child From Court-ordered Visit

Queens Mother Arrested After Abducting Child From Court-ordered Visit -

Sarah Ferguson Ready To ‘spread Her Wings’ After Separating From ‘disgraced’ Andrew

Sarah Ferguson Ready To ‘spread Her Wings’ After Separating From ‘disgraced’ Andrew -

Finn Wolfhard Shares How Industry Views Him Post 'Stranger Things'

Finn Wolfhard Shares How Industry Views Him Post 'Stranger Things' -

Dylan O'Brien Gets Nostalgic After Reunion With Old Friend

Dylan O'Brien Gets Nostalgic After Reunion With Old Friend -

UK Doctors Warn Screen Time Is Harming Children’s Health

UK Doctors Warn Screen Time Is Harming Children’s Health -

Meghan Markle To Get Police Protection In UK If Travelling With Archie, Lilibet

Meghan Markle To Get Police Protection In UK If Travelling With Archie, Lilibet -

Spencer Pratt Expresses Hope For Taylor Swift, Travis Kelce's Wedding Invite

Spencer Pratt Expresses Hope For Taylor Swift, Travis Kelce's Wedding Invite -

Evan Peters Makes Unexpected Confession About 'American Horror Story' Season 13

Evan Peters Makes Unexpected Confession About 'American Horror Story' Season 13 -

Kentucky Grandmother Arrested After Toddlers With Broken Skulls, Ribs

Kentucky Grandmother Arrested After Toddlers With Broken Skulls, Ribs -

European Space Agency Hit By Cyberattack, Hundreds Of GBs Data Leaked

European Space Agency Hit By Cyberattack, Hundreds Of GBs Data Leaked -

Elon Musk’s XAI Launches World’s First Gigawatt AI Supercluster To Rival OpenAI And Anthropic

Elon Musk’s XAI Launches World’s First Gigawatt AI Supercluster To Rival OpenAI And Anthropic -

Google Adds On-device AI Scam Detection To Chrome

Google Adds On-device AI Scam Detection To Chrome