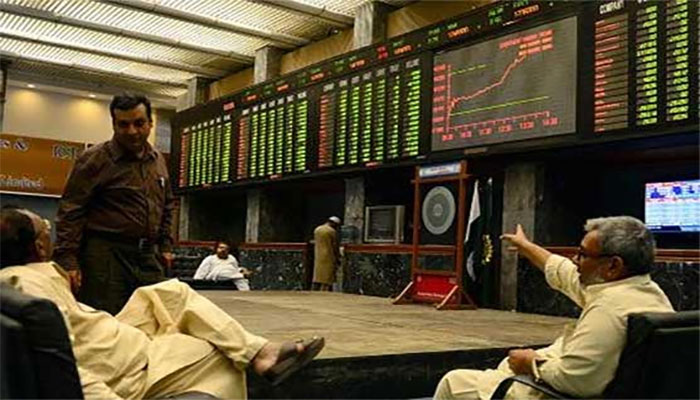

Stocks seen slowing as economy hits a bump

Stocks largely remained on the wrong side of the ledger in the outgoing week and are mostly seen in the woods down the road owing to deepening economic concerns, traders said.

Pakistan Stock Exchange’s benchmark KSE-100 Shares Index lost 179 points to close at 46,957 points week-on-week.

“We may see the market exhibiting range-bound behavior next week,” said a report of Arif Habib Ltd, a brokerage house.

Still, there was no letup in concerns over how manageable the deficit on the current account might be, the brokerage added.

Stocks closed down this week primarily amid external account alarms. Imports clocked in at Rs6.3 billion for August 2021, taking the trade deficit to around Rs4 billion, which is the highest ever for a single month.

The rupee continued to slide downwards with the PKR/USD settling at 166.9. Meanwhile, the cement sector was also under pressure in the week with coal prices continuing to increase.

Average volumes clocked in at 462 million shares, up by 20 percent, while average value traded settled at $83 million, up by 5 percent.

Foreign selling continued this week, settling at $5.9 million against a net sell of $5.4 million last week.

Selling was witnessed in commercial banks ($4.3 million), cement ($1.3 million), and exploration and production ($0.8 million).

On the domestic front, major buying was reported by individuals ($5.1 million) and insurance companies ($4.0 million).

Sector-wise negative contributions came from commercial banks (-301 points), cement (-100 points), automobile assembler (-77 points), textile composite (-20 points), and oil & gas marketing companies (-19 points). Stocks that contributed negatively included HBL (-105 points), MEBL (-80 points), UBL (-63 points), MCB (-48 points) and MLCF (-24 points).

Positively contributing sectors included technology and communication (176 points), power generation & distribution (77 points) and refinery (51 points).

Meanwhile, stock-wise positive contribution came from SYS (141 points), HUBC (82 points) and TRG (33 points).

Other major news of the week included: PPL-led consortium was awarded offshore block 5 in Abu Dhabi, TPL unveiled plans for launching Pakistan’s biggest REIT to gain from construction push, trade gap widened to $7.33 billion in July-August, forex reserves hit all-time high of $27 billion, and Engro Fertilizers and BoP joined hands to support farmers.

One analyst said earnings season was almost over and it also failed to support the market, as economic indicators kept concerns high. The topmost concern was the depreciation of rupee against the US Dollar, he added.

Foreign selling during the outgoing week remained a major concern for the local investors, as they were unable to capture all the shares sold by the foreigners, who got rid of their shares because of rupee devaluation.

Zafar Moti, former director PSX, said although the political situation had normalised in Afghanistan, nothing could lift the market up that was hanging between 46,800 points and 48,000 points.

“It is mainly because of unstable currency. Until and unless State Bank interferes and controls the dollar, the market will not receive any support,” Moti said.

-

Woman Jailed Over False 'crime In Space' Claim Against NASA Astronaut

Woman Jailed Over False 'crime In Space' Claim Against NASA Astronaut -

James Van Der Beek’s Close Pal Reveals Family's Dire Need Of Donations

James Van Der Beek’s Close Pal Reveals Family's Dire Need Of Donations -

Prince William And Harry's Cousins Attend 'Wuthering Heights' Event

Prince William And Harry's Cousins Attend 'Wuthering Heights' Event -

Hailey Bieber Turns Heads Just Hours After Major Business Win

Hailey Bieber Turns Heads Just Hours After Major Business Win -

King Charles' Andrew Decision Labelled 'long Overdue'

King Charles' Andrew Decision Labelled 'long Overdue' -

Timothee Chalamet 'forever Indebted' To Fan Over Kind Gesture

Timothee Chalamet 'forever Indebted' To Fan Over Kind Gesture -

Columbia University Sacks Staff Over Epstein Partner's ‘backdoor’ Admission

Columbia University Sacks Staff Over Epstein Partner's ‘backdoor’ Admission -

Ozzy Osbourne's Family Struggles Behind Closed Doors

Ozzy Osbourne's Family Struggles Behind Closed Doors -

Dua Lipa Claims Long-distance Relationship 'never Stops Being Hard'

Dua Lipa Claims Long-distance Relationship 'never Stops Being Hard' -

BTS Moments Of Taylor Swift's 'Opalite' Music Video Unvieled: See Photos

BTS Moments Of Taylor Swift's 'Opalite' Music Video Unvieled: See Photos -

Robin Windsor's Death: Kate Beckinsale Says It Was Preventable Tragedy

Robin Windsor's Death: Kate Beckinsale Says It Was Preventable Tragedy -

Rachel Zoe Shares Update On Her Divorce From Rodger Berman

Rachel Zoe Shares Update On Her Divorce From Rodger Berman -

Kim Kardashian Officially Takes Major Step In Romance With New Boyfriend Lewis Hamilton

Kim Kardashian Officially Takes Major Step In Romance With New Boyfriend Lewis Hamilton -

YouTube Tests Limiting ‘All’ Notifications For Inactive Channel Subscribers

YouTube Tests Limiting ‘All’ Notifications For Inactive Channel Subscribers -

'Isolated And Humiliated' Andrew Sparks New Fears At Palace

'Isolated And Humiliated' Andrew Sparks New Fears At Palace -

Google Tests Refreshed Live Updates UI Ahead Of Android 17

Google Tests Refreshed Live Updates UI Ahead Of Android 17