UK inflation hits fresh 40-year high in cost-of-living crisis

British annual inflation has hit a fresh 40-year high, further eroding workers’ wages in a cost-of-living crisis

LONDON: British annual inflation has hit a fresh 40-year high, official data showed Wednesday, further eroding workers’ wages in a cost-of-living crisis, and heaping more pressure on the Bank of England to keep raising interest rates.

The inflation rate edged higher to 9.1% in May from 9.0% in April, remaining at the highest level since 1982, the Office for National Statistics (ONS) said.

UK inflation is set to top 11% before the end of the year according to the Bank of England, fuelled by soaring energy prices that have raised the prospect of a global recession.

Decades-high inflation is causing a cost-of-living crisis in Britain and elsewhere.

UK railway staff are this week staging the sector’s biggest strike action in more than 30 years, as soaring prices erode the value of wages.

Inflation increased in May on "continued steep food price rises and record-high petrol prices", said ONS chief economist Grant Fitzner.

This was offset by clothing costs rising by less than a year earlier and a drop in prices of computer games, he added.

‘Severe pressure’

"The further increase in Consumer Prices Index inflation to 9.1% underscores the severe pressure that businesses and households are under," said David Bharier, head of research at the British Chambers of Commerce.

"This inflationary surge sits alongside a poor economic outlook and unless the government acts with urgency to encourage businesses to invest, the chances of a recession will only increase."

Countries around the world are being hit by soaring inflation as the Ukraine war and the easing of Covid restrictions fuel energy and food price hikes.

That has forced central banks to hike interest rates, risking the prospect of recession as higher borrowing costs spark more pain for businesses and consumers.

The Bank of England has raised its key interest rate five times since December.

"The modest rise in CPI inflation... won’t prevent the Bank of England from raising interest rates further, but it may encourage it to opt again for a quarter-point rate hike at its next meeting in August rather than upping the ante" with a half-point rise, predicted Paul Dales, chief UK economist at Capital Economics.

Strike action

The rise comes as Britain faces strikes in several sectors.

Next week, senior lawyers in England and Wales begin a walkout in a row over legal aid funding.

Teaching staff, workers in the state-run National Health Service and the postal service are also mulling strike action.

The Rail, Maritime and Transport workers trade union confirmed Wednesday that rail staff will stage the second of three walkouts on Thursday after talks with Network Rail and train operators broke down.

A third strike is scheduled for Saturday, as a war of words escalated between the RMT and the government.

"We will continue with our industrial campaign until we get a negotiated settlement that delivers job security and a pay rise for our members that deals with the escalating cost of living crisis," said RMT boss Mick Lynch.

Lynch accused Transport Secretary Grant Shapps of having "wrecked" the negotiations by not allowing Network Rail to withdraw a letter threatening redundancies of 2,900 RMT members.

But Shapps called that "a total lie", accusing the RMT of trying to "deflect from the fact that the only people responsible for the massive public disruption this week is them".

-

Milo Ventimiglia recalls first meeting with Arielle Kebbel on the sets of 'Gilmore Girls' amid new project

-

Leading astrophysicist shot dead at southern California home

-

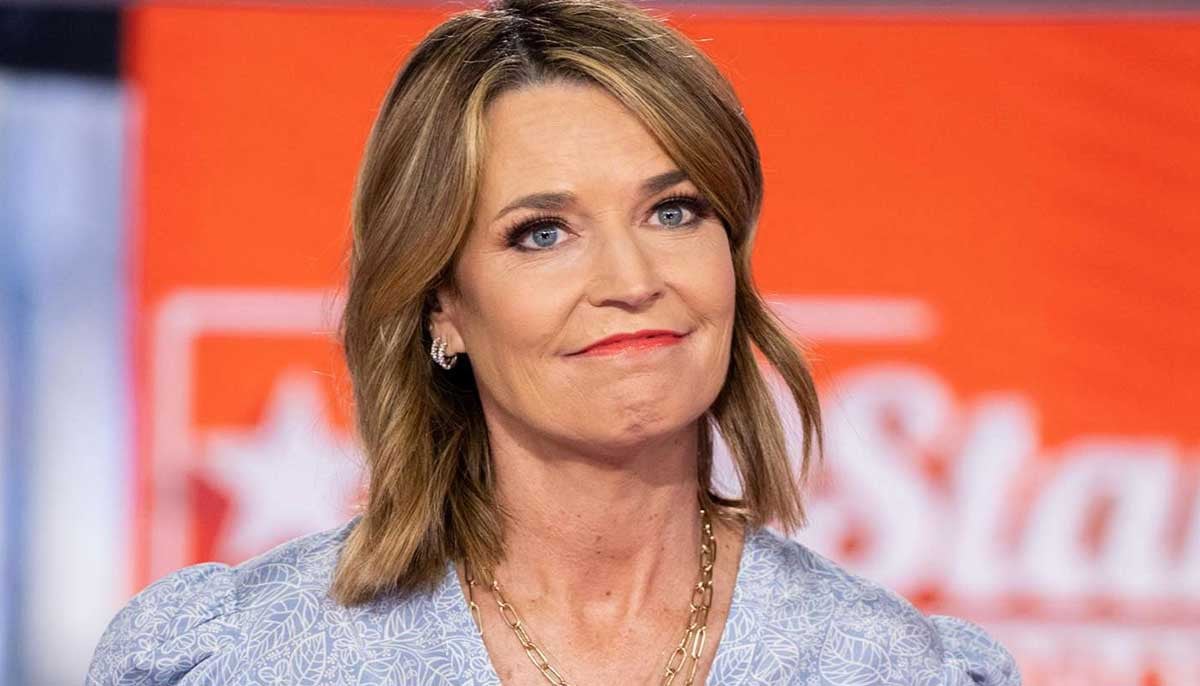

Will Savannah Guthrie ever return to 'Today' show? Here's what insiders predict

-

Amazon can be sued over sodium nitrite suicide cases, US court rules

-

Patrick Dempsey reveals Eric Dane's condition in final days before death

-

Epstein estate to pay $35M to victims in major class action settlement

-

South Korea’s ex-President Yoon issues public apology after being sentenced to life over martial law

-

Trump officially directs US agencies to identify and release files on extraterrestrial life