WeWork files to withdraw IPO

WeWork’s decision to pull its IPO was widely expected after the company postponed the share sale earlier in September

WeWork’s parent The We Company said on Monday it will file to withdraw its initial public offering, a week after the SoftBank-backed office-sharing startup removed founder Adam Neumann as its chief executive officer.

WeWork’s decision to pull its IPO was widely expected after the company postponed the share sale earlier in September, the following push-back from perspective stock market investors over its widening losses and Neumann’s unusually firm grip on the company.

SoftBank, which owns nearly a third of We Company, invested in the startup at a $47 billion valuation in January. But investor scepticism led to it earlier this month considering a potential IPO valuation of as low as $10 billion, Reuters reported.

“We have decided to postpone our IPO to focus on our core business, the fundamentals of which remain strong,” WeWork’s newly appointed co-CEOs Artie Minson and Sebastian Gunningham said on Monday.

“We have every intention to operate WeWork as a public company and look forward to revisiting the public equity markets in the future,” Minson and Gunningham added.

We Company had vowed to pursue the IPO and complete the share sale by the end of the year after Neumann stepped down as CEO. However, sources had told Reuters last week that the IPO was unlikely to be completed this year.

-

Shanghai Fusion ‘Artificial Sun’ achieves groundbreaking results with plasma control record

-

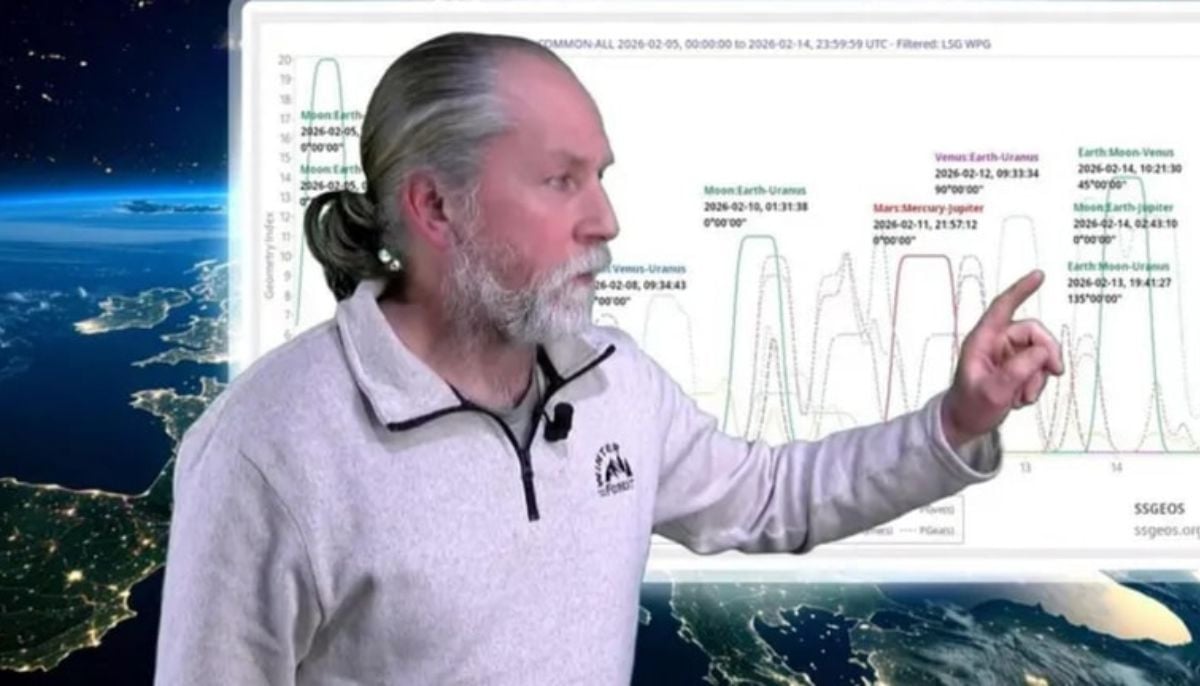

Polar vortex ‘exceptional’ disruption: Rare shift signals extreme February winter

-

Netherlands repatriates 3500-year-old Egyptian sculpture looted during Arab Spring

-

Archaeologists recreate 3,500-year-old Egyptian perfumes for modern museums

-

Smartphones in orbit? NASA’s Crew-12 and Artemis II missions to use latest mobile tech

-

Rare deep-sea discovery: ‘School bus-size’ phantom jellyfish spotted in Argentina

-

NASA eyes March moon mission launch following test run setbacks

-

February offers 8 must-see sky events including rare eclipse and planet parade