Abraaj founder Arif Naqvi, another official charged in US but deny wrongdoing

Arif Naqvi has historically stressed he neither misused nor misappropriated any Abraaj funds; no case against Naqvi or Abraaj in UK or Europe.

LONDON: The founder of the collapsed Dubai-based private-equity firm The Abraaj Group has been charged with fraud and conspiracy in New York in relation to the collapse of the equity firm he headed.

Assistant US Attorney Andrea Griswold said at a hearing in Manhattan federal court that Arif Naqvi, the Pakistani born Abraaj founder and Chief Executive, and managing partner Mustafa Abdel-Wadood were arrested last Friday in London and New York respectively and charged with fraud and conspiracy. Both of them have pleaded not guilty, denying each and every charge against them.

There is no case against Arif Naqvi in Britain where he lives and maintains an office, a police source said. The US media reported that the arrest was made on request of the US authorities on recommendations by the US Securities and Exchange Commission but a spokesman of the Scotland Yard said that it had no knowledge of any arrest made in London.

Abraaj was the largest private equity player in the Middle East until its collapse last year following a row with investors that included the Gates Foundation over a $1 billion health care fund. American prosecutors have alleged that the Abraaj executives defrauded their investors, including the Bill & Melinda Gates Foundation.

Abdel-Wadood appeared at the hearing in Manhattan and pleaded not guilty to securities fraud, wire fraud and conspiracy charges.

American prosecutor said that they would like to have Arif Naqvi extradited to USA to face charges but it is understood that lawyers for Mr Naqvi will resist the move since the collapse of the fund has nothing to do with Arif Naqvi in person and there is no personal liability in this case.

Arif Naqvi has always denied any wrongdoing related to the collapse. Abraaj, one of the largest emerging-markets private equity investors, claiming $14bn of assets under management, was sent into a death spiral last year after investors complained about mishandling of their monies in the group’s healthcare fund.

Arif Naqvi was born in Karachi to middle class parents but through sheer hard work he went on to turn around the face of emerging markets and reaches to the level of financial success probably few other self-made Pakistanis have reached.

Naqvi was the first of his kind to break into the western world of finance and for years. He set an example for even other western firms to follow, as many lacked his deep understanding of emerging markets.

Arif Naqvi has previously denied reports in some sections of media that he was involved in corruption either at the Abraaj or in the sale of Pakistan’s K-Electric. He had denied any misuse or appropriation of Abraaj funds.

Naqvi maintains that the allegations “are entirely false”.

He has strongly maintained that he “neither misused nor misappropriated any Abraaj funds.”

“There was nothing untoward about my requests for transfers or Abraaj Group funds to me or my family, or for my personal investments or obligations,” he had said.

“In drawing down funds from Abraaj, I acted in accordance with the arrangements put in place by the Abraaj Group,” he had said when the issue started, adding that any drawdowns were “properly recorded and accounted for”.

Naqvi has maintained said that the use of monies from Abraaj’s healthcare fund for general corporate purposes was undertaken only after having “sought and received independent legal advice as to whether it was permissible”.

-

Michelle Obama gets candid about spontaneous decision at piercings tattoo

-

Bunnie Xo shares raw confession after year-long IVF struggle

-

Disney’s $336m 'Snow White' remake ends with $170m box office loss: report

-

Travis Kelce's mom Donna Kelce breaks silence on his retirement plans

-

Hailey Bieber reveals KEY to balancing motherhood with career

-

Hillary Clinton's Munich train video sparks conspiracy theories

-

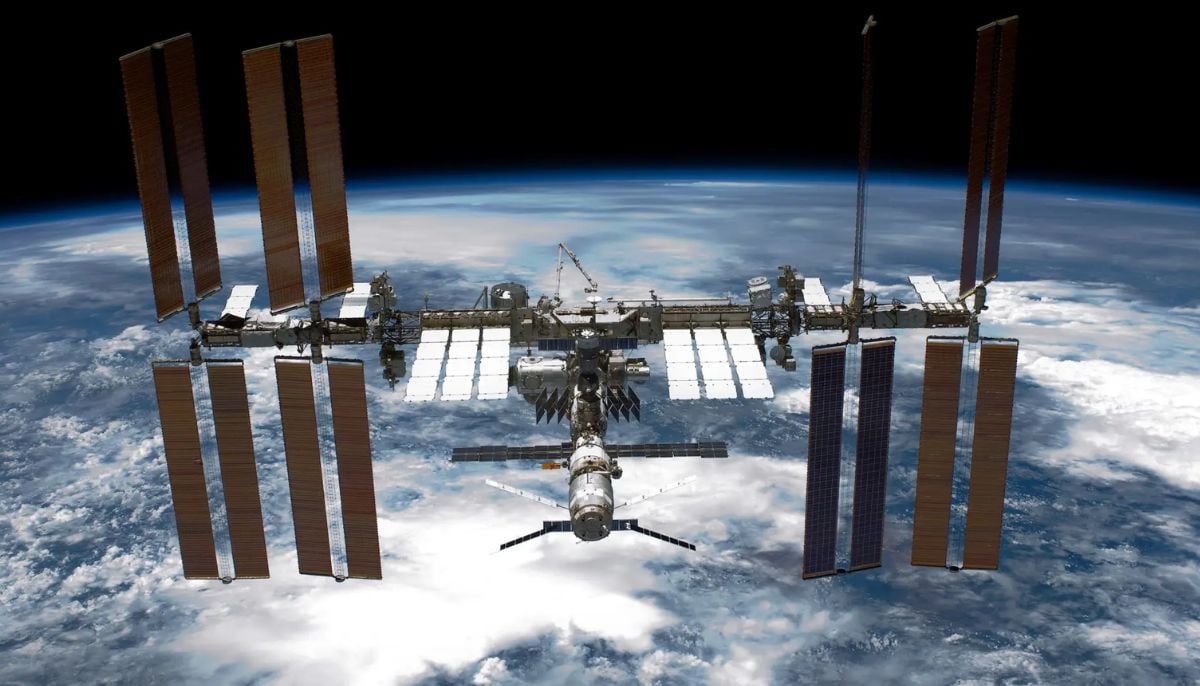

Woman jailed over false 'crime in space' claim against NASA astronaut

-

Columbia university sacks staff over Epstein partner's ‘backdoor’ admission