Asian markets rise as investors track trade talks, US shutdown

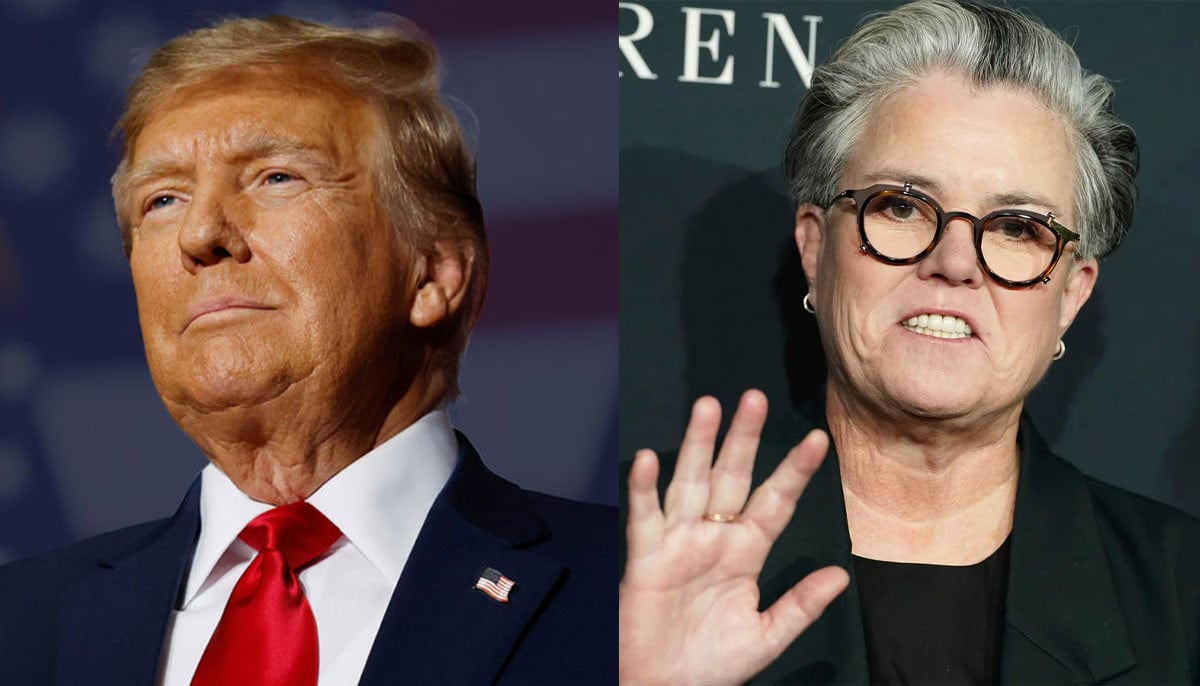

However, the US government shutdown continued to rankle, with Democrats and Donald Trump digging their heels in over the president´s border wall budget demand, while a White House official warned it could hammer the world´s top economy.

Asian markets rose Thursday as investors try to ascertain the state of play in the China-US trade row, while the pound edged higher on optimism Britain will not crash out of the European Union.

However, the US government shutdown continued to rankle, with Democrats and Donald Trump digging their heels in over the president´s border wall budget demand, while a White House official warned it could hammer the world´s top economy.

For a second day, equities swung to and fro, with few solid catalysts to drive trade, though Wall Street provided a positive lead as all three main indexes ended higher following upbeat earnings from the likes of market titans Procter & Gamble and IBM.

Hong Kong rose 0.3 percent in the afternoon, Shanghai ended up 0.4 percent, Sydney gained 0.4 percent and Seoul jumped 0.8 percent, while Singapore added 0.5 percent.

There were also advances in Wellington, Taipei, Manila and Jakarta though Tokyo closed 0.1 percent lower.

Trump on Wednesday gave an upbeat assessment of the state of affairs in the trade stand-off, saying "we´re doing very well in the negotiations" and that China "wants to make a deal".

However, his remarks come in a week that has seen the White House deny Financial Times and CNBC reports that officials had rejected Beijing´s offer of preparatory discussions ahead of high-level talks in Washington.

Earlier, Bloomberg said the two sides were struggling to see eye to eye on the delicate issue of intellectual property.

- ´Very close to zero´ -

The talks come as China struggles to reinvigorate its economy, which is growing at its weakest pace in almost three decades, while Trump is facing an increasingly bitter government shutdown just as the presidential campaign season gets into gear.

The impact of the shutdown -- with Democrats refusing to provide Trump billions for his Mexico border wall -- was laid out by the head of the White House Council of Economic Advisers, who warned the economy could grow "very close to zero" if it continued through March.

But Kevin Hassett said there would likely be a massive rebound as soon as the stand-off ended.

There seems no end in sight, with Trump hitting out at House Speaker Nancy Pelosi after she disinvited him from the chamber for his upcoming State of the Union speech, citing security worries while parts of the government are not working.

Trump backed down late Wednesday, agreeing to delay the address until the shutdown, which is in its fifth week, has ended.

The pound is holding at two-month highs against the dollar, supported by a belief that Britain will not exit the EU without a deal, despite Prime Minister Theresa May´s controversial agreement being soundly defeated by MPs last week.

Traders are increasingly "convinced that the ´worst´ that might happen on Brexit is that May´s previously doomed Withdrawal Agreement might actually get over the line if the ´hard Brexiteers´ in her government become convinced that the alternative is a (delay in leaving), a second referendum and potentially no Brexit", said National Australia Bank´s Ray Attrill.

- Key figures around 0710 GMT -

Tokyo - Nikkei 225: DOWN 0.1 percent at 20,574.63 (close)

Hong Kong - Hang Seng: UP 0.3 percent at 27,090.67

Shanghai - Composite: UP 0.4 percent at 2,591.69 (close)

Pound/dollar: UP at $1.3070 from $1.3068

Euro/dollar: UP at $1.1385 from $1.1383 at 2200 GMT

Dollar/yen: UP at 109.73 yen from 109.60

Oil - West Texas Intermediate: DOWN 27 cents at $52.35 per barrel

Oil - Brent Crude: DOWN 31 cents at $60.83 per barrel

New York - DOW: UP 0.7 percent at 24,575.62 (close)

London - FTSE 100: DOWN 0.9 percent at 6,842.88 (close)

-

California cop accused of using bogus 911 calls to reach ex-partner

-

'Elderly' nanny arrested by ICE outside employer's home, freed after judge's order

-

key details from Germany's multimillion-euro heist revealed

-

Uber enters seven new European markets in major food-delivery expansion

-

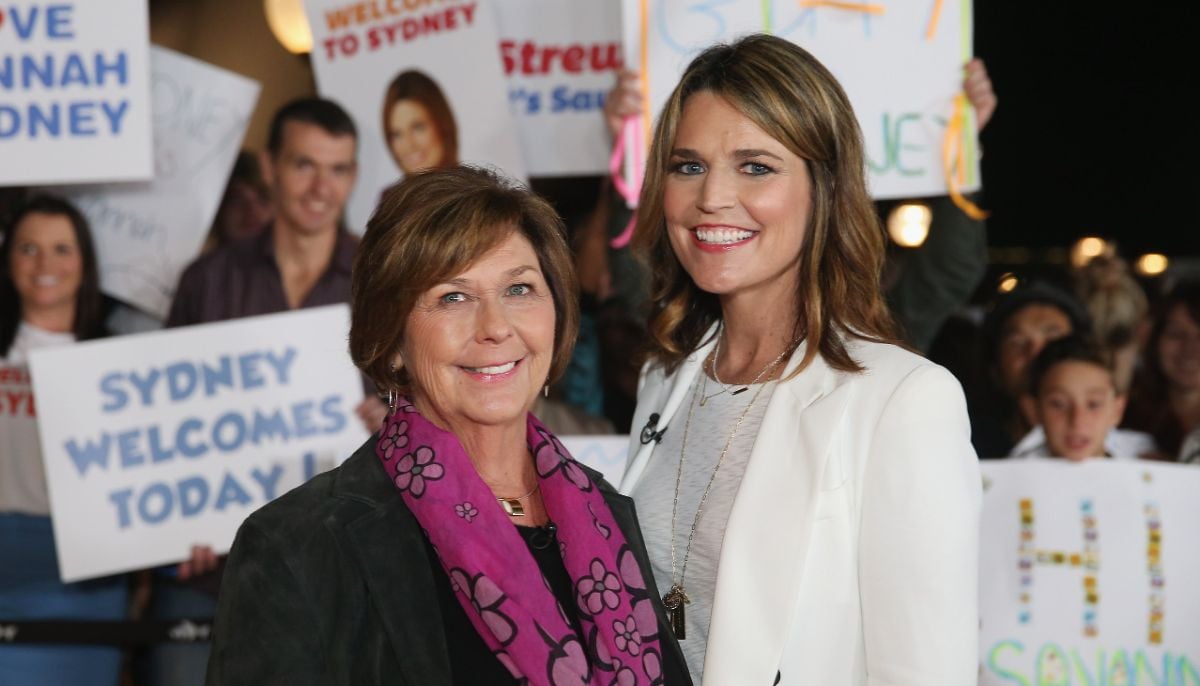

Search for Savannah Guthrie’s abducted mom enters unthinkable phase

-

Barack Obama addresses UFO mystery: Aliens are ‘real’ but debunks Area 51 conspiracy theories

-

Rosie O’Donnell secretly returned to US to test safety

-

'Harry Potter' star Rupert Grint shares where he stands politically