OpenAI cloud partners rack up $100B debt amid AI bubble fears: Here’s why

A group of banks is also in talks to lend another $38 billion to Oracle and Vantage

OpenAI’s cloud partners are set to amass almost $100 billion in debt which is linked to the unprofitable start-up, allowing the ChatGPT maker to take an advantage from a debt-financed spending spree.

These partners including Oracle, CoreWeave, and SoftBank have acquired $30 billion to fuel its AI ambitions and build data centers as reported by The Financial Times.

Moreover, Blue Owl Capital, an investment group, and Crusoe also depend on lucrative deals with OpenAI to service $28 billion in existing loans.

A group of banks is also in talks to lend another $38 billion to Oracle and Vantage, a data center builder, to fund sites for OpenAI.

Further details of the deal are not known yet. However, the deal is expected to be finalized soon in the coming weeks.

OpenAI intends to raise the debt to finance these contracts. However, the immediate financial burden for these contracts has fallen on the shoulders of counterparties and lenders.

According to a senior OpenAI executive, “That’s been kind of the strategy. How does [OpenAI] leverage other people’s balance sheets?”

As a result of the massive loan, OpenAI’s $ 1.4 trillion worth deals’ scrutiny will be intensified, which the tech giant signed in this year.

These deals are meant to procure computing power from data center companies and chipmakers over the next 8 years.

These deals are highly significant as it surpassed the startup’s expected annual revenue of $20 billion for this year.

OpenAI said in a statement, “Building AI infrastructure is the single most important thing we can do to meet surging global demand . . . The current computer shortage is the single biggest constraint on OpenAI’s ability to grow.”

-

Gmail for Android now lets users create labels on mobile

-

Microsoft AI chief says AI will replace most white-collar jobs within 18 months

-

AI regulation battle heats up: Anthropic pledges $20m to rival OpenAI

-

X product head warns AI spam can make iMessage and Gmail unusable

-

ByteDance’s new AI video model ‘Seedance 2.0’ goes viral

-

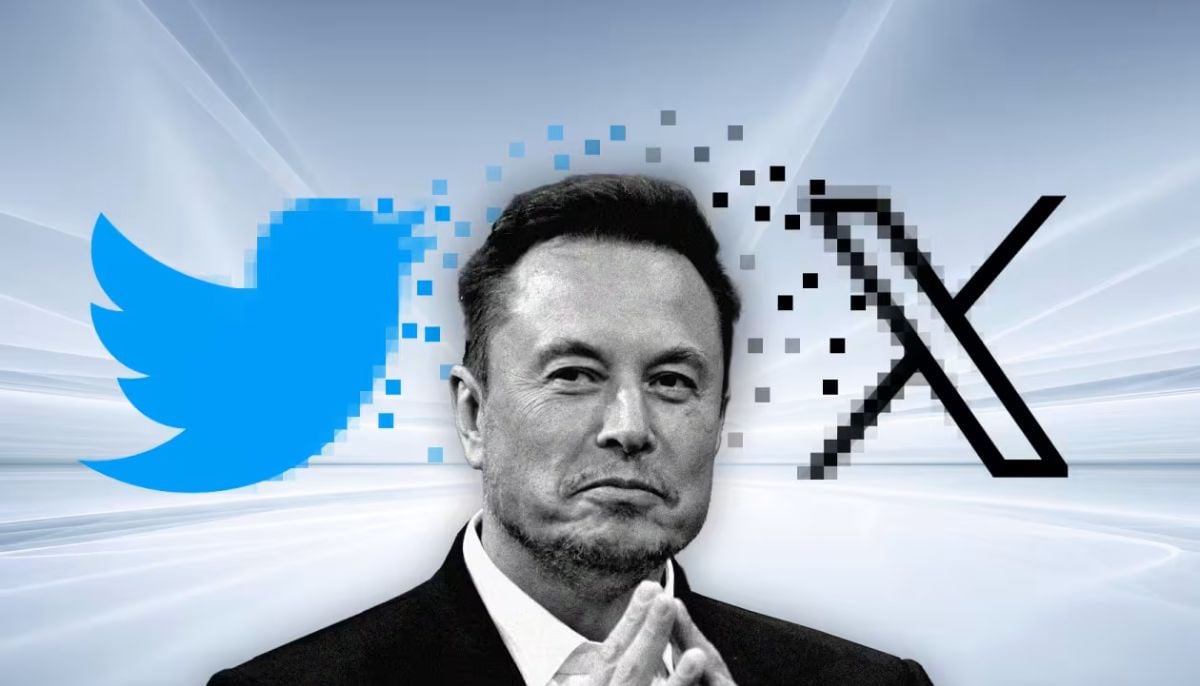

Elon Musk unveils X Money Beta: ‘Game changer’ for digital payments?

-

Russia Blocks WhatsApp to promote state app ‘Max’

-

Seedance 2.0: How it redefines the future of AI sector