Takaichi victory propels Japanese stocks to all-time high

Investors cheer Japan’s new pro-business leader, sending Nikkei soaring 5%

With the appointment of Japan's first female Prime Minister, Sanae Takaichi, Japan’s stock market has skyrocketed to historic highs.

The ruling Liberal Democratic Party (LDP)’s pro-business leader sparked a powerful rally, driving the benchmark Nikkei 225 index up 4.75% to close at a record 47,944.76.

Investors have highly appreciated the new leadership result, as it is anticipated that Takaichi will move forward with the economic policies of her mentor, the late Shinzo Abe.

Shinzo Abe, also known for his “Abenomics,” signature economic program launched in 2012, worked rigorously to revitalise Japan’s economy.

His fiscal policy mainly focuses on flexible financial stimulus and structural reforms to promote growth.

Sectors including real estate, technology, and heavy industry led the gains, with shares of Mitsubishi Heavy Industries and Kawasaki Heavy Industries soaring over 11%.

However, there was an enormous side effect associated with the stock market euphoria, including a drastically weakened yen.

The currency has fallen below the psychological mark of 150 against the U.S. dollar, which increases the cost of imports to Japanese households.

Economists observe that a further increase in spending by the Japanese government, as outlined in Takiichi's plans, may further undermine the yen, as it will increase Japan's national debt to a significant level.

-

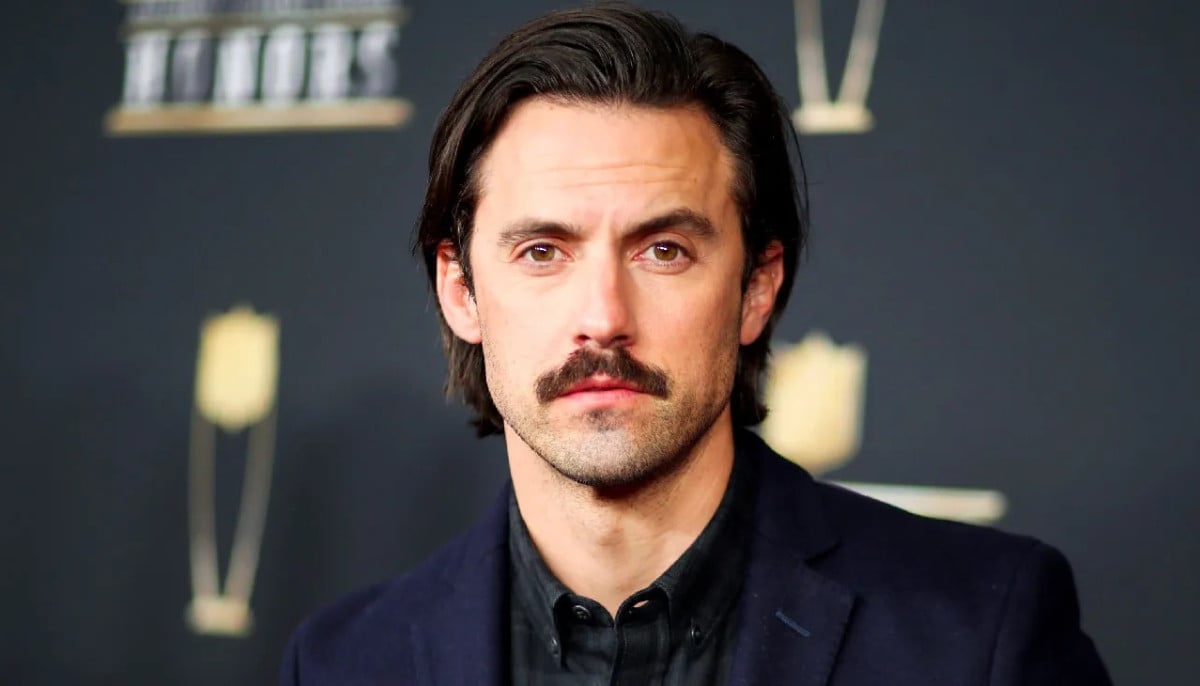

Milo Ventimiglia reveals favourite activity with baby daughter

-

Sydney Sweeney feels 'misunderstood' amid Scooter Braun romance

-

'The Last Thing He Told Me' star Jennifer Garner reveals why her kids find her 'embarrassing'

-

Bad Bunny makes bold move after historic Super Bowl Halftime show

-

Halle Bailey, Regé-Jean Page spark romance rumours with recent outing

-

Keith Urban feels 'anger' over Nicole Kidman's 'love life' after divorce

-

Rae Sremmurd ‘Black Beatles’ Mannequin Challenge returns in 2026

-

Robert Pattinson reveals moment therapist questioned his state of mind