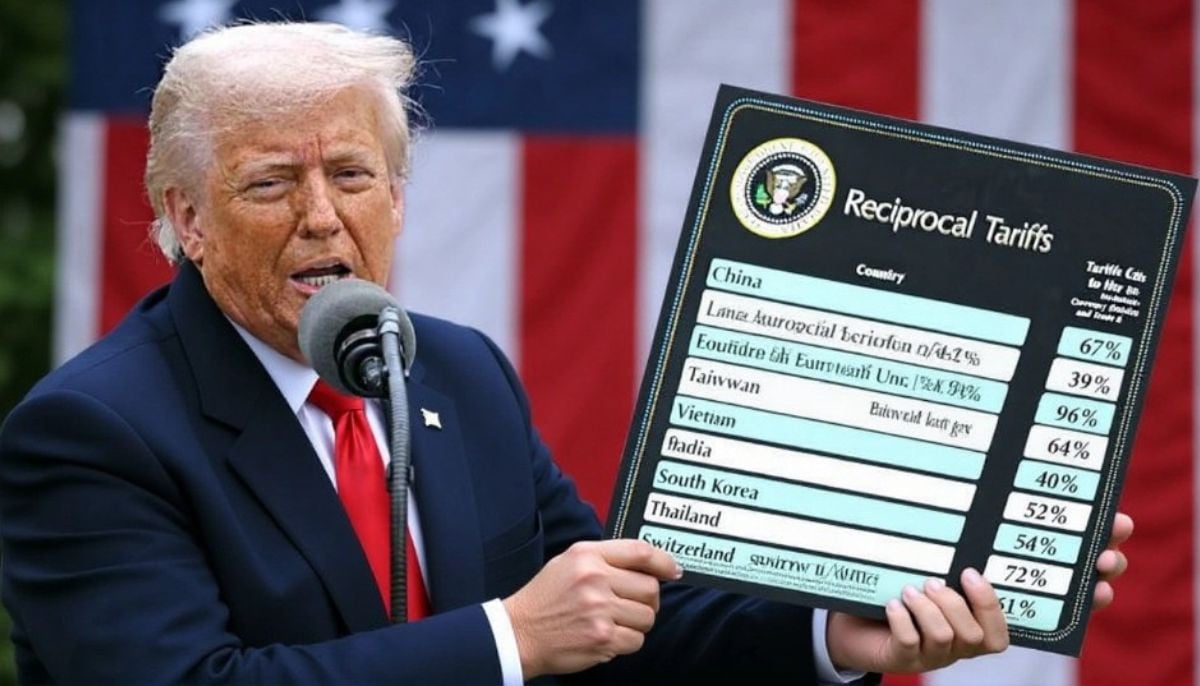

Donald Trump's financial future hinges on shareholders' decision

Donald Trump's wealth could soar by $3.4 billion if shareholder decide in his favour on Friday

If shareholders decide in his favour on Friday, former president Donald Trump could get $3.4 billion richer.

This would happen if they approve his plan to make his Trump Media business public via merger with a special purpose acquisition company (Spac), Digital World Acquisition.

If approved by shareholders, this merger would allow Trump Media to sell shares on the stock market for the first time.

The Spac, which is named Digital World Acquisition, plans to vote on merging with Trump Media this Friday.

However, there is a problem.

Digital World is in a legal fight with sponsor ARC Global Investments. ARC wants to delay the deal, but Digital World is pushing to move forward with the merger.

The potential benefit for Donald Trump is that his ownership of Trump Media could be valued at billions of dollars. However, there are a few things to consider. First, he wouldn't be able to access this money right away. The merger agreement includes a provision that prohibits major shareholders, like Trump, from selling their shares for six months post-merger.

Secondly, the success of this plan depends on Trump's media company doing well financially. But, it is not doing great as it relies on the former's president's popularity.

Finally, some experts believe the value of the company is tied to Trump's popularity in politics, not the company's performance.

Recently, Trump faced a legal setback, being ordered by a New York judge to pay $454m following a civil fraud case. Despite denouncing the ruling as a "witch-hunt" and expressing intent to appeal, Trump faces mounting financial pressure.

The Spac mechanism, through which Trump Media aims to go public, involves raising funds via a stock market flotation and subsequently merging with an existing company. In this case, the combined entity would sport a stock market ticker comprising Trump's initials, DJT.

Trump's prospective windfall, estimated at $3.4 billion based on the Spac's closing share price of $42.90 on Wednesday, hinges on Trump Media's sustained market performance post-flotation, despite its modest financial track record thus far.

The financial landscape is further complicated by Digital World's status as a meme stock, influenced by internet memes on platforms like Truth Social and Reddit. This unconventional trading pattern underscores the speculative nature of Digital World's valuation, which is heavily influenced by perceptions of Trump's electoral prospects.

Moreover, the merger agreement includes a customary provision preventing "founder share" owners, such as Trump, from selling their stock until six months after the merger, aimed at maintaining market stability post-listing debut.

Julian Klymochko, the chief executive of Accelerate Financial Technologies, said: “Digital World Spac’s trading is 100% influenced by the probability of Trump winning the election. It surged in January when Ron DeSantis threw in the towel.”

Referring to its valuation, he said: “DWAC is not a traditional stock based on fundamentals, but a meme stock used for betting on whether Trump gets elected.”

-

Kelly Clarkson explains decision to quit 'The Kelly Clarkson Show'

-

Japan: PM Takaichi flags China ‘Coercion,’ pledges defence security overhaul

-

Angorie Rice spills the beans on major details from season 2 of ' The Last Thing He Told Me'

-

Teacher arrested after confessing to cocaine use during classes

-

Milo Ventimiglia recalls first meeting with Arielle Kebbel on the sets of 'Gilmore Girls' amid new project

-

Leading astrophysicist shot dead at southern California home

-

Will Savannah Guthrie ever return to 'Today' show? Here's what insiders predict

-

Amazon can be sued over sodium nitrite suicide cases, US court rules