SBP-held reserves register small decrease

State Bank of Pakistan's foreign exchange reserves stand at $4.46 billion

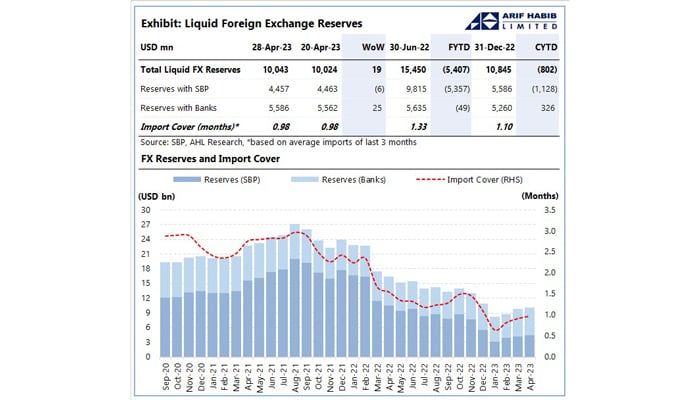

The State Bank of Pakistan's (SBP) foreign exchange reserves saw a minor drop during the week ending April 28, as the country of 220 million faces difficulties in arranging much-needed funding to avoid a possible default.

The State Bank's foreign reserves now stand at $4.46 billion after declining by $6 million, according to the central bank's weekly bulletin.

According to Arif Habib Limited, the current foreign reserves provide the country with less than a month's import cover — a position that has remained the same for the last several months as Pakistan faces an acute balance of payments crisis.

The SBP said that net foreign reserves held by commercial banks stand at $5.59 billion, around $1.13 billion less than SBP's reserves, taking the country's total liquid foreign reserves to $10.04 billion.

The country's foreign exchange reserves have declined to precarious levels since last year as the economic crisis worsened amid a delay in the revival of a stalled loan programme with the International Monetary Fund (IMF).

The government has been in talks with the Washington-based lender since November for the release of the $1.1 billion tranche. The IMF is now preparing to discuss budget plans for the upcoming fiscal year — a step considered to be one of the last hurdles before the lender approves a staff-level agreement.

Meanwhile, the government has imposed import curbs in a bid to reduce dollar outflows, which resulted in the country posting a current account surplus of $654 million in March — the highest since February 2015.

However, several companies across different sectors have partially or completely shut down operations in recent months citing inventory shortages and difficulties in opening letters of credit (LCs) due to the import curbs.

.With a low amount of dollars in the reserves, Pakistan's currency has also been trading in between the Rs283-284 range and is expected to fall further if the situation does not improve.

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold