Rs258 bn aggregate profits: Pakistan stock market claims highest profit in 10 years

The companies provided dividend to the tune of Rs498 billion for 2021 as compared to Rs271 billion for 2020

ISLAMABAD: Pakistan’s stock market is performing very well as aggregate profits after tax of companies falling in KSE 100 Index for quarter three of the current year 2021, stands at Rs258 billion, highest in last 10 years.

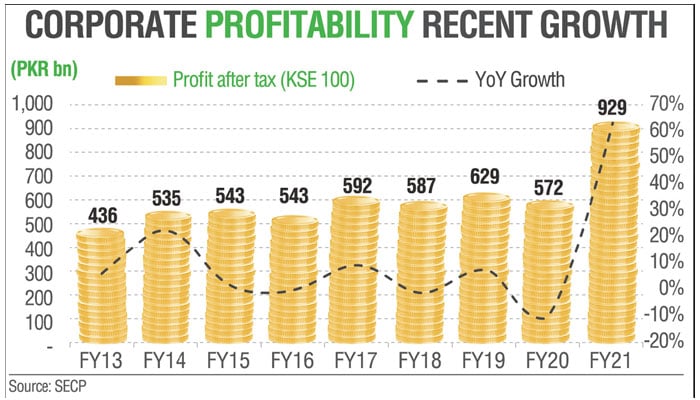

According to the official presentation of the Securities & Exchange Commission of Pakistan (SECP) made available to The News, the profit for first 9 months’ of calendar year (CY) 21 is also the highest in the last 10 years – a 59% year on year (YoY) growth from the corresponding period of the last year 2020. The financial year (FY) 2021 witnessed the highestYoY profitability growth in the last 10 years at 62% – the next highest figure being 23% in FY14. The average quarterly profit for CY18 to CY20 stands at Rs163 billion. The first three quarters of CY21 profit stands Rs252 billion (55% increase).

The companies provided dividend to the tune of Rs498 billion for 2021 as compared to Rs271 billion for 2020. The dividend provided by commercial banks stood at Rs140.309 billion, oil and gas exploration companies Rs71.127 billion, fertilizer Rs60.155 billion, power generation and distribution Rs33.306 billion, automobile Rs26.259 billion and others as well.

For corporatisation, the SECP claims 247% growth in companies’ incorporation (69,380 companies during Jul-18 to Dec-21 as compared to 19,996 companies during Jul-15 to Jun-18). As many as 44% of total 157,000 companies were registered in Pakistan during Jul-18 to Dec-21. There was 51% growth of new incorporations in year 2020-21. Also 98% companies, which were incorporated online during 2020-21.

There was a 494% growth in Real Estate Sector companies, followed by 194% growth in IT Sector and 136% in tourism sector during Jul-18 to Dec-21, as compared to Jul-15 to Jun-18. There was a 318 percent growth in incorporations in Gilgit-Baltistan, during the same period.

With regard to Capital Market Reforms, the SECP presentation informed that they had done simplification and digitalisation of IPO process – resulted in 19 IPOs (including 2 GEM) since July 2018. It resulted in amounting to Rs85 billion. The number of active investors at PSX increased by 8.8 percent in a single year (2020-21).

The nationalisation of requirements have sparked renewed interest in REIT (real estate investment trust) segment as 10 new REIT schemes, amounting to Rs146.250 billion and 8 REIT management companies are in process, compared to only 1 REIT scheme in existence (amounting to Rs58 billion).

Pakistan Stock Exchange (PSX) witnessed record trading volumes in 10 years. Since July 2018, it witnessed 109 percent and 57% increase in average trade daily volume and value, in the ready market respectively.

There has been 129% and 79% increase in average trade daily volume and value, in the futures market respectively. There has been 57 percent growth in Assets under management. For access to finance, the SECP said that they launched Secured Transaction Registry (STR) which enabled SMEs to secure credit from financial institutions. Since April 2020, more than 91,000 charges registered and three Housing Finance Companies (HFCs) licences were issued.

The SECP launch Growth Enterprise Market (GEM) Board that has enabled small enterprises to tap into the capital markets to raise funds (2 listings so far). The first Corporate Restructuring Company (CRC) licensed, for revival and rehabilitation of distressed entities and first Collateral Management Company (CMC) registered, paving the way for collateralisation and trading of future contracts based on e-warehouse receipts (eWR) of agri-commodities.

For ease of doing business, it stated that 12 of the 14 administered legislations have been reviewed and simplified. They introduced much needed improvements to empower business growth, through rationalising and streamlining requirements, leading to renewed interest in capital markets, NBFCs (nonbank financial companies), insurance and corporate sector. They enabled provisions added in the Companies Act to promote startups, stimulate capital formation and enable innovation (regulatory sandbox), overhaul of IPO process to simplify the listing process and reduce turn-around-times.

They enabled digital account opening and onboarding of non-resident Pakistanis to invest in capital market through Roshan Digital Accounts (RDA). When the Spokesperson for Finance Minister, Muzammil Aslam was contacted for his comments on the performance of stock market in last three years, he said, “Market has been under pressure since June 2017 till June 2020. However, the market has provided 40% return in 18 months and outperformed bonds, currency and other asset classes. Market is waiting to make all time high in the next 18 months. This is supported by all time high corporate profitability of 930 billion in 2021 and 500 billion divided payments, he added.

Fahad Rauf, Head of Research, Ismail Iqbal Securities, said that performance has been below par mainly due to foreign selling. The local investors have also preferred fixed income over equities. The Mutual Fund Industry’s Asset Under Management (AUMs) have doubled in last 2 years but only 15% of those went into equities. The lack of depth in the market (low investor base) and inconsistency in economic policies, boom bust cycles have shattered investor confidence. Some interest has been seen in Tech stocks, but overall, the market has not performed well, he said.

When Tahir Abbas, Arif Habib Securities Analyst was contacted, he said the beginning of 2021 was exceptional for the equity market as the index witnessed a massive jump on the back of reopening of global economies and a V-shaped recovery locally, which translated to an all-time high profitability of listed companies together with slowdown in Covid-19 infection ratio.

Effective vaccine rollout played a key role in reviving sentiments. On the macroeconomic front, the Current Account remained in surplus in early part of the year, tagged with Pak Rupee strengthening (PKR 153 against USD), robust growth in LSM, GDP growth rate climbing up, lower CPI reading amid low international commodity prices, unchanged interest rate at 7%, surge in exports and lower imports all contributed to the positive momentum. However, this celebration remained short lived as political noise coupled with macroeconomic indicators turning red, changed the sentiment, he maintained.

In particular, he said the pressure on the external account, rising inflationary reading, recurring waves of COVID-19, delay in approval of IMF’s sixth review, and transition from Emerging Market to the Frontier Market put pressure on the bourse. Moreover, foreign exchange reserves started depleting, with the Pak Rupee losing significant ground against USD. Whereas the State Bank had a shift in policy, resuming monetary tightening in order to maintain sustainable growth and avoid another boom and bust cycle like those seen before. That said, the index closed on 43,901 points, generating a return of 0.3% (USD based return of –9.9%), he concluded.

-

Prince Harry Urges His Pals Are ‘not Leaky,’ He Is Not ‘Mr Mischief’

Prince Harry Urges His Pals Are ‘not Leaky,’ He Is Not ‘Mr Mischief’ -

What Prince William And Kate Think Of Brooklyn's Attack On Victoria And David Beckham?

What Prince William And Kate Think Of Brooklyn's Attack On Victoria And David Beckham? -

Meghan Trainor Reveals Why Surrogacy Was The 'safest' Choice

Meghan Trainor Reveals Why Surrogacy Was The 'safest' Choice -

Victoria Beckham Supports Youngest Son In First Move Since Brooklyn's Rebellion

Victoria Beckham Supports Youngest Son In First Move Since Brooklyn's Rebellion -

'Percy Jackson' Star Feels Relieved After Season Two Finale

'Percy Jackson' Star Feels Relieved After Season Two Finale -

Jelly Roll Reveals How Weight Loss Changed Him As A Dad: 'Whole Different Human'

Jelly Roll Reveals How Weight Loss Changed Him As A Dad: 'Whole Different Human' -

Prince Harry Gets Emotional During Trial: Here's Why

Prince Harry Gets Emotional During Trial: Here's Why -

Queen Camilla Supports Charity's Work On Cancer With Latest Visit

Queen Camilla Supports Charity's Work On Cancer With Latest Visit -

Dove Cameron Opens Up About Her Latest Gig Alongside Avan Jogia

Dove Cameron Opens Up About Her Latest Gig Alongside Avan Jogia -

Petition Against Blake Lively PGA Letter Gains Traction After Texts With Taylor Swift Revealed

Petition Against Blake Lively PGA Letter Gains Traction After Texts With Taylor Swift Revealed -

Netflix Revises Warner Bros. Deal To $83 Billion: All-cash Offer

Netflix Revises Warner Bros. Deal To $83 Billion: All-cash Offer -

Prince Harry Mentions Ex-girlfriend Chelsy Davy In UK Court

Prince Harry Mentions Ex-girlfriend Chelsy Davy In UK Court -

David, Victoria Beckham 'quietly' Consulting Advisers After Brooklyn Remarks: 'Weighing Every Move'

David, Victoria Beckham 'quietly' Consulting Advisers After Brooklyn Remarks: 'Weighing Every Move' -

Meta's New AI Team Delivered First Key Models

Meta's New AI Team Delivered First Key Models -

Prince Harry Defends Friends In London Court

Prince Harry Defends Friends In London Court -

AI May Replace Researchers Before Engineers Or Sales

AI May Replace Researchers Before Engineers Or Sales