Premium prize bonds investment rises 21 percent to Rs20.5bln

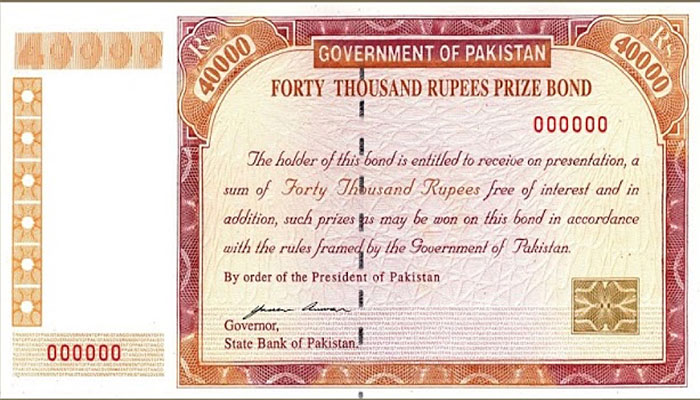

KARACHI: Investment in premium prize bonds of Rs40,000 denomination has registered a growth of 21 percent to Rs20.54 billion by the end of October 2020, compared with Rs16.93 billion in the corresponding period last year, the Central Directorate of National Savings (CDNS) data revealed on Wednesday.

The government launched premium prize bonds about three-and-a-half years ago in April 2017 to document the economy. The premium prize bonds are issued only against CNIC with valid bank accounts.

To make the instrument attractive, the government also announced biannual profit, which transferred directly to the bond holders.

The investment in premium prize bonds remained attractive, as the government announced to withdraw same denomination unregistered prize bonds to eliminate all unregistered debt securities and to ensure verified source of income and to comply with the requirements of the Financial Action Task Force (FATF).

The Ministry of Finance in early January 2020 issued “National Saving Schemes (AML and CFT) Rules, 2019” to curb money used for terror financing and money laundering.

Under these rules, the authority would collect all information of persons investing in saving schemes. The information would include name, address, CNIC, passport, etc.

Further, the investors either existing or new investors would require to provide a source of money related to the invested amount.

The pace of investment in these premium prize bonds witnessed a significant increase in July 2019 after the government’s announcement of discontinuation of the bearer or unregistered bonds of Rs40,000 on June 24, 2019.

The bearer bonds of Rs40,000 was to be completely discontinued for legal tender by March 2020. However, it is extended up to December 30, 2021.

The extended date resulted in a rising stock of unregistered prize bonds of Rs40,000 denomination.

The total stock of bearer bonds of Rs40,000 denomination was reduced to Rs756 million by June 2020, but it again increased to Rs2.1 billion by the end of October 2020.

The unregistered bonds of all denominations remained attractive for investors, as the stock increased 3 percent to Rs739 billion by the end of October 2020, compared with Rs719 billion in the same month of the last year.

-

Hailey Bieber's Subtle Gesture For Eric Dane’s Family Revealed

Hailey Bieber's Subtle Gesture For Eric Dane’s Family Revealed -

Moment Prince William 'broke Down' And 'apologised' To Kate Middleton

Moment Prince William 'broke Down' And 'apologised' To Kate Middleton -

Paul Mescal And Gracie Abrams Stun Fans, Making Their Romance Public At 2026 BAFTA

Paul Mescal And Gracie Abrams Stun Fans, Making Their Romance Public At 2026 BAFTA -

EU Rejects Any Rise In US Tariffs After Court Ruling, Says ‘a Deal Is A Deal’

EU Rejects Any Rise In US Tariffs After Court Ruling, Says ‘a Deal Is A Deal’ -

King Charles Congratulates Team GB Over Winter Olympics Success

King Charles Congratulates Team GB Over Winter Olympics Success -

Meryl Streep Comeback In 'Mamma Mia 3' On The Cards? Studio Head Shares Promising Update

Meryl Streep Comeback In 'Mamma Mia 3' On The Cards? Studio Head Shares Promising Update -

Woman Allegedly Used ChatGPT To Plan Murders Of Two Men, Police Say

Woman Allegedly Used ChatGPT To Plan Murders Of Two Men, Police Say -

UK Seeks ‘best Possible Deal’ With US As Tariff Threat Looms

UK Seeks ‘best Possible Deal’ With US As Tariff Threat Looms -

Andrew Arrest Fallout: Princess Beatrice, Eugenie Face Demands Over Dropping Royal Titles

Andrew Arrest Fallout: Princess Beatrice, Eugenie Face Demands Over Dropping Royal Titles -

Rebecca Gayheart Breaks Silence After Eric Dane's Death

Rebecca Gayheart Breaks Silence After Eric Dane's Death -

Kate Middleton 2026 BAFTA Dress Honours Queen Elizabeth Priceless Diamonds

Kate Middleton 2026 BAFTA Dress Honours Queen Elizabeth Priceless Diamonds -

Sterling K. Brown's Wife Ryan Michelle Bathe Reveals Initial Hesitation Before Taking On New Role

Sterling K. Brown's Wife Ryan Michelle Bathe Reveals Initial Hesitation Before Taking On New Role -

BAFTA Film Awards Winners: Complete List Of Winners

BAFTA Film Awards Winners: Complete List Of Winners -

Millie Bobby Brown On Her Desire To Have A Big Brood With Husband Jake Bongiovi

Millie Bobby Brown On Her Desire To Have A Big Brood With Husband Jake Bongiovi -

Backstreet Boys Admit Aging Changed Everything Before Shows

Backstreet Boys Admit Aging Changed Everything Before Shows -

Biographer Exposes Aftermath Of Meghan Markle’s Emotional Breakdown

Biographer Exposes Aftermath Of Meghan Markle’s Emotional Breakdown