NA body chairman threatens resignation if Hafeez Shaikh remains absent

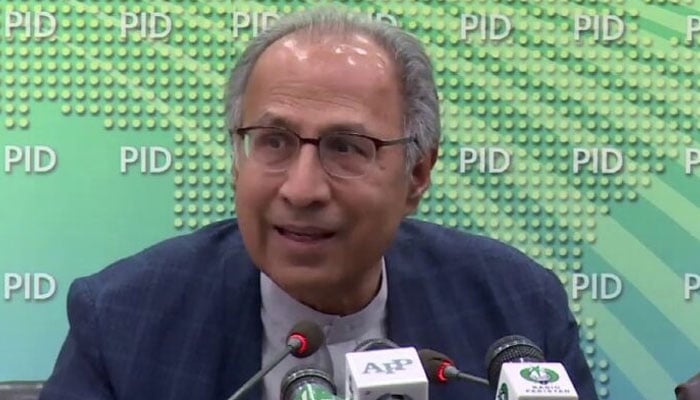

ISLAMABAD: While the ruling party’s chairman of the National Assembly’s Standing Committee on Finance has threatened to tender resignation if Dr Abdul Hafeez Shaikh did not bother to attend the next meeting, the government has failed to get nod on proposed changes into Anti Money Laundering (AML) Act as the committee referred the bill to special legislation committee.

As the Special Committee on Legislation witnessed deadlock among treasury-opposition benches so it was not yet known how the government would proceed further to get approval of Parliament on important bills of legislations including for complying with the FATF requirements. The government might bulldoze the bill before the House without seeking approval of the parliamentary committee, one MNA feared.

The changes in AML Act are part of the FATF requirements to comply with 27 conditions so that Islamabad can graduate from the grey list. The NA Standing Committee on Finance held its meeting under the chairmanship of Faizullah here at the Parliament House.

When Dr Abdul Hafeez Shaikh did not attend the meeting, it infuriated the participants of the NA panel. The chairman of the committee announced that he would tender resignation if the adviser did not bother to attend the next meeting.

It was told by secretary finance that the adviser to PM was attending the cabinet meeting so he could not participate in this meeting. The NA panel decided to refer the proposed changes into AML Act before the special committee on legislation, making it impossible for the government to pass the desired changes from the committee’s within envisaged deadline of FATF.

The PML-N MNA Ayesha Ghous Pasha criticised the government for mishandling of important issues and inquired that why the government was sleeping during last six months. She said that the proposed legislation was handed over Tuesday morning and now the government wanted to use the opposition as rubber stamp to get approval on this important legislation. She said that the government was accepting conditions contrary to UN’s accepted human rights so why they were failing to convince the FATF or other institutions such as IMF for accepting inhuman conditions.

The meeting was informed that Pakistan is required by FATF to implement an action plan to bring its financial systems in compliance with international FATF standards on Anti Money Laundering/Countering the Financing of Terrorism (AML/CFT). Asia Pacific Group, in its Mutual Evaluation Report (MER) on Pakistan has also made recommendations on AML/CFT.

The finance committee after deliberation decided to refer the proposed legislation to comply with the FATF requirements special committee on legislation headed by Foreign Minister Shah Mehmood Qureshi for detailed deliberations.

On the issue of FATF, Secretary Finance Naveed Kamran Baloch said that Hammad Azhar was looking after matters of FATF so he would participate into the meeting to brief the committee on the matter.

The newly appointed Director General Financial Monitoring Unit (FMU) Lubna Farooq informed the committee that amendments to Anti Money Laundering Act would be required to pass till August 2020 to comply with the FATF requirements.

The country would submit report on implementation of action plan by August 6, 2020 and mutual evaluation meeting of the APG would be held in September. The meeting was informed that out of 27 action plan agenda items under the FATF review, Pakistan has so far implemented 14.

The proposed amendments will reflect the government's firm resolve to strengthen its AML regime in the country resolve to try. These amendments prescribed by the FATF are aimed at streamlining the existing AML law in line with international standards. These amendments would identify AML/CFT regulatory authorities in Pakistan including the regulatory authorities for designated non-financial businesses and professions (DNFBPs) and their powers. Functions and powers of AML/CFT regulatory authorities have been clearly defined with powers to issue licenses, regulations and to perform other ancillary functions to comply with the requirements of the provisions of the AML Act. Customers Due Diligence process has been explained in detail in the proposed amendments.

Moreover, money laundering has been proposed to be a cognisable offence. The fine for the offence has been proposed from existing up to Rs5 million to up to Rs25 million rupees and in certain cases the fine may extend up to Rs100 million in place of existing Rs5 million.

-

Camila Mendes Reveals How She Prepared For Her Role In 'Idiotka'

Camila Mendes Reveals How She Prepared For Her Role In 'Idiotka' -

China Confirms Visa-free Travel For UK, Canada Nationals

China Confirms Visa-free Travel For UK, Canada Nationals -

Inside Sarah Ferguson, Andrew Windsor's Emotional Collapse After Epstein Fallout

Inside Sarah Ferguson, Andrew Windsor's Emotional Collapse After Epstein Fallout -

Bad Bunny's Star Power Explodes Tourism Searches For His Hometown

Bad Bunny's Star Power Explodes Tourism Searches For His Hometown -

Jennifer Aniston Gives Peek Into Love Life With Cryptic Snap Of Jim Curtis

Jennifer Aniston Gives Peek Into Love Life With Cryptic Snap Of Jim Curtis -

Prince Harry Turns Diana Into Content: ‘It Would Have Appalled Her To Be Repackaged For Profit’

Prince Harry Turns Diana Into Content: ‘It Would Have Appalled Her To Be Repackaged For Profit’ -

Prince William's Love For His Three Children Revealed During Family Crisis

Prince William's Love For His Three Children Revealed During Family Crisis -

Murder Suspect Kills Himself After Woman Found Dead In Missouri

Murder Suspect Kills Himself After Woman Found Dead In Missouri -

Sarah Ferguson's Plea To Jeffrey Epstein Exposed In New Files

Sarah Ferguson's Plea To Jeffrey Epstein Exposed In New Files -

Prince William Prepares For War Against Prince Harry: Nothing Is Off The Table Not Legal Ways Or His Influence

Prince William Prepares For War Against Prince Harry: Nothing Is Off The Table Not Legal Ways Or His Influence -

'How To Get Away With Murder' Star Karla Souza Is Still Friends With THIS Costar

'How To Get Away With Murder' Star Karla Souza Is Still Friends With THIS Costar -

Pal Reveals Prince William’s ‘disorienting’ Turmoil Over Kate’s Cancer: ‘You Saw In His Eyes & The Way He Held Himself’

Pal Reveals Prince William’s ‘disorienting’ Turmoil Over Kate’s Cancer: ‘You Saw In His Eyes & The Way He Held Himself’ -

Poll Reveals Majority Of Americans' Views On Bad Bunny

Poll Reveals Majority Of Americans' Views On Bad Bunny -

Wiz Khalifa Thanks Aimee Aguilar For 'supporting Though Worst' After Dad's Death

Wiz Khalifa Thanks Aimee Aguilar For 'supporting Though Worst' After Dad's Death -

Man Convicted After DNA Links Him To 20-year-old Rape Case

Man Convicted After DNA Links Him To 20-year-old Rape Case -

Royal Expert Shares Update In Kate Middleton's Relationship With Princess Eugenie, Beatrice

Royal Expert Shares Update In Kate Middleton's Relationship With Princess Eugenie, Beatrice