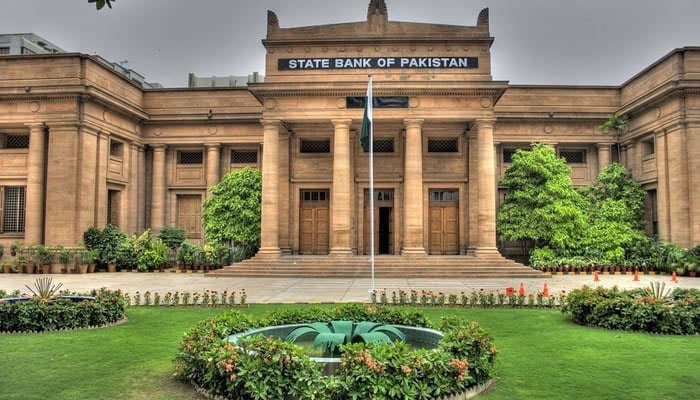

SBP nears interest rate decision as IMF talks loom

KARACHI: The State Bank of Pakistan (SBP) is poised to make a pivotal decision on interest rates next week, with the potential to enact its first cut since June 2020, as inflationary pressures recede and the nation's external accounts improve.

However, the anticipation of a rate cut is tempered by the equally likely prospect of maintaining the current rate, given the commencement of loan review discussions with the International Monetary Fund (IMF).

As the central bank approaches its monetary policy decision on March 18, the financial markets are abuzz with speculation.

The SBP faces a critical choice: to cut interest rates for the first time in nearly four years or to hold steady amidst ongoing loan review and a new bailout talks with the IMF. Analysts are closely watching the central bank, which may initiate a reversal of its interest rate policy by reducing rates by 100 basis points (bps) during its monetary policy meeting next week.

"Anticipation is growing that the central bank may consider initiating the interest rate reversal cycle by slashing interest rates by 100 basis points (bps) when it announces its monetary policy decision on March 18," a report from brokerage Arif Habib Limited (AHL) on Tuesday.

If the benchmark interest rate is lowered by the SBP's Monetary Policy Committee (MPC), it will be the first rate cut since June 2020. The SBP had raised the policy rate from 7 percent in September 2021 to a record 22 percent in June 2023. The rate had risen by 15 percentage points during this time.

However, it’s a difficult call this time. The market is split on this issue, and the MPC may decide to stick with the status quo while newly elected Prime Minister Shehbaz Sharif attempts to negotiate a new longer-term loan programme with the IMF to keep the economy stable in the face of high inflation and the need for external funding. Pakistan has always been advised by the IMF to adopt a tight monetary policy stance.

The SBP committee may wait for a sustained decline in inflation in addition to the outcome of the negotiations between the IMF and the new finance team, according to Mohammed Sohail, CEO of Topline Securities.

This week will probably see the beginning of negotiations between the IMF and Pakistani authorities to carry out the second review of the existing $3 billion loan programme, according to recently sworn-in Minister of Finance Muhammad Aurangzeb. The current stand-by arrangement is set to expire in April.

When the negotiations for a fresh bailout with the IMF to steer the nation's cash-strapped economy under seasoned banker Aurangzeb's leadership will happen remains unclear.

“We expect the SBP to maintain the policy rate at 22 percent as our anticipation stems from the necessity to fortify external reserves and the loosely anchored inflation expectations due to (i) fluctuating energy and petroleum prices, and (ii) potential second-round impacts following the approval of IMF-required taxation measures,” said Awais Ashraf, director of research at Akseer Research.

AHL states that a data-driven approach will play a key role in shaping the SBP's decision-making process. The downward trajectory of headline and core inflation, which is expected to average approximately 17 percent and 15 percent, respectively, (on a 12-month forward basis), would likely be taken into account by this approach, leading to significantly positive real interest rates on a forward-looking basis. Seeing indications of a rate decrease, AHL stated that its forecasts indicate headline inflation will be declining, with this trend becoming more pronounced in the second half of FY24.

In the second half of this fiscal year, the average month-over-month rate is expected to be approximately 1.2 percent, which is less than the 1.6 percent average observed in the first half of FY24. In FY24, headline inflation is expected to hover around 25 percent annually, according to this forecast. Last year, it was 29.2 percent.

“Several contributing factors, including the substantial base effect, stabilization of global commodity prices, support from the stability of the PKR against the USD, and efforts to curtail the current account deficit, underpin these expectations,” it said. The consumer price index (CPI) inflation slowed for a second straight month in February due to a sharp decline in food prices. The consumer prices fell to 23.06 percent in February from 28.34 percent in the previous month.

Moreover, the industrial output showed a 3.4 percent increase in December. The uptick in large-scale manufacturing industries during December marked the second successive month of improvement.

The current account deficit decreased by 71 percent year-on-year to $1.09 billion in the seven months of this fiscal year, a significant improvement from the $3.8 billion deficit recorded in the same period last year.

Additionally, the improvement in the SBP reserves, rising from $4.4 billion at the end of June 2023 to $7.9 billion as of March 1, contributed to a 2.4 percent strengthening of the rupee against the dollar. This, in turn, played a role in controlling imported inflation to a certain extent.

In the primary market, yields across various tenors have decreased. This decline in money market yields suggests a growing sentiment towards a potential rate cut, as reflected by market participants.

-

Princess Eugenie Breaks Cover Amid Explosive Family Scandal

Princess Eugenie Breaks Cover Amid Explosive Family Scandal -

Will Kate And Anthony Have 'Bridgerton' Spin Off? Revealed

Will Kate And Anthony Have 'Bridgerton' Spin Off? Revealed -

Schoolgirl Eaten Alive By Pigs After Brutal Assault By Farmworker

Schoolgirl Eaten Alive By Pigs After Brutal Assault By Farmworker -

King Charles’ Statement About Epstein Carries A Secret Meaning: Here’s Why It Can Be An Invite To Police

King Charles’ Statement About Epstein Carries A Secret Meaning: Here’s Why It Can Be An Invite To Police -

Demi Lovato Delivers Heartbreaking Message To Fans About Her Concerts

Demi Lovato Delivers Heartbreaking Message To Fans About Her Concerts -

Sweden's Princess Sofia Explains Why She Was Named In Epstein Files

Sweden's Princess Sofia Explains Why She Was Named In Epstein Files -

Activist Shocks Fellow Conservatives: 'Bad Bunny Is Winner'

Activist Shocks Fellow Conservatives: 'Bad Bunny Is Winner' -

Noel Gallagher Challenges Critics Of Award Win To Face Him In Person

Noel Gallagher Challenges Critics Of Award Win To Face Him In Person -

Minnesota Man Charged After $350m IRS Tax Scam Exposed

Minnesota Man Charged After $350m IRS Tax Scam Exposed -

Meghan Markle 'terrified' Over Possible UK Return

Meghan Markle 'terrified' Over Possible UK Return -

Did Opiate Restrictions Lead To Blake Garrett's Death?

Did Opiate Restrictions Lead To Blake Garrett's Death? -

Royal Expert Reflects On Princess Eugenie, Beatrice 'priorities' Amid Strained Relationship With Sarah, Andrew

Royal Expert Reflects On Princess Eugenie, Beatrice 'priorities' Amid Strained Relationship With Sarah, Andrew -

Prince William's 'concerning' Statement About Andrew Is Not Enough?

Prince William's 'concerning' Statement About Andrew Is Not Enough? -

50 Cent Gets Called Out Over Using Slur For Cardi B

50 Cent Gets Called Out Over Using Slur For Cardi B -

Scientists Discover Rare Form Of 'magnets' That Might Surprise You

Scientists Discover Rare Form Of 'magnets' That Might Surprise You -

Nancy Guthrie’s Kidnapper Will Be Caught Soon: Here’s Why

Nancy Guthrie’s Kidnapper Will Be Caught Soon: Here’s Why