trade

As the world is moving towards reduced import duties and removal of unjustified nontariff barriers, there are regimes acting otherwise and adding to the cost of doing business due to their policies. This is the apprehension of the business community of Punjab with respect to the cess the government of Punjab has imposed on the goods imported and cleared in the province. Imposed under the pretext of generating resources to take care of the province's infrastructure, this cess is being criticised by the business community for being oppressive and discriminatory.

Two years back, Punjab Infrastructural Development Cess (PIDC) was levied through the Punjab Infrastructure Development Cess Act, 2015 at the rate of 0.90 percent of the total value of goods as assessed for customs value. Using the Web-based One Custom (WeBOC) system available to Customs Collectorates, the Punjab Revenue Authority (PRA) –the body set up to collect provincial revenues–started collecting PIDC with effect from May 25, 2015.

Two years back, Punjab Infrastructural Development Cess (PIDC) was levied through the Punjab Infrastructure Development Cess Act, 2015 at the rate of 0.90 percent of the total value of goods as assessed for customs value. Using the Web-based One Custom (WeBOC) system available to Customs Collectorates, the Punjab Revenue Authority (PRA) –the body set up to collect provincial revenues–started collecting PIDC with effect from May 25, 2015.

Since then this levy has been resisted by the importers, manufacturers and trade bodies at all levels on grounds of being discriminatory in nature and leading to dual taxation. It was also pointed out that the levy would result in additional cost of the imported raw material and subsequently disturb the pricing mechanism of the traders and industry. Responding to such opposition, Punjab government rolled back imposition of infrastructure development cess on petroleum products ab initio on June 7, 2016, however it remained levied at all other goods imported into or exported out of Punjab. Another exemption is on the import of fresh vegetables and food products.

The Punjab Infrastructure Development Cess Act, 2015, states "there shall be levied and collected a cess on the goods manufactured, produced or consumed in the Punjab, goods imported into or goods exported out of the Punjab at a fixed rate of 0.90 percent of total value of goods as assessed for customs purposes." It adds, "this cess shall be deposited in the Provincial Consolidated Fund to be utilised by the government for maintenance and development of infrastructure and other activity ancillary to the infrastructure in such manner as may be deemed proper by the government." Fortunately, the law has not been implemented fully and this like exports is still exempted.

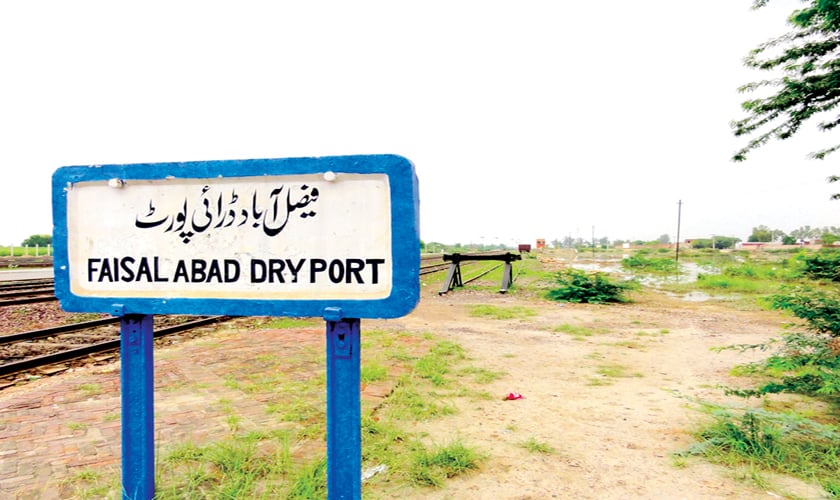

There is a visible negative impact of PID cess on the cargo received at dry ports in the province. A noticeable number of importers and industrial concerns affecting their import clearances through dry ports here have shifted to dry ports outside Punjab to avoid this additional cost. The dry ports falling under the jurisdiction of Model Customs Collectorate (MCC), Lahore have also faced a fall in the volume of cargo cleared there.

Due to the extra costs involved now, leading business and manufacturing concerns and importers like PEL, Newage Cables, Mughal Steel, Pepsi, Roshan Packages, Bin Rasheed, Ghani Glass, Tetra Pak, United Auto and Abu Yousaf who used to get their imports cleared here have shifted to Karachi for this purpose.

Muhammad Kashif, a customs clearing and forwarding agent based in Lahore, shares that the importers opting for clearance in Karachi have to go through extra hassle because it takes far longer time to get their imports cleared there than in Lahore. Besides, he says, transporting these goods to their facilities all the way from Karachi is also a tedious task. "Earlier, they could get their goods cleared right at their doorstep, at Lahore dry port."

The imposition of this tax has not only affected the importers; it has also impacted the federal revenue collection authority as well. In a situation where importers and major manufacturing concerns were shifting their imports to Karachi to avoid the levy of PID cess, it was a major challenge for the Collectorate of Appraisement, Lahore to meet the revenue targets assigned by the Federal Board of Revenue (FBR). Reportedly, Collectorate of Customs Appraisement, Lahore, chalked out a strategy to meet this challenge and woo the importers by cutting the over-all costs involved, plugging all possible avenues of revenue leakage and reducing dwell time if they got their imports cleared here.

Kashif who offers services to importers at Mughalpura Dry port Lahore confirms there have been encouraging developments in this respect and thinks it is the right time PIDC is removed so that the importers can benefit from the Collectorate working on a corporate and business–friendly model.

A major improvement that would facilitate importers is the streamlining of the processes at the WeBOC registration section. This section was established in 2013 for registration of all Lahore-based users of WeBOC System including importers, clearing agents, warehouse licencees, shipping lines, terminal operators etc. A fresh standard operating procedure (SOP) system has been issued through which proper queue system has been introduced for receipt of applications and mechanism for premises verification and processing of applications. Besides, newly recruited appraising officers (AOs) have been posted in appraising hall and secondly, a new ‘document receipt counter’ has been established outside the appraisement hall. All the necessary documents called by the AOs are to be routed through this counter instead of any direct interaction between the clearing agents and the AOs that eliminates chances of corruption. Similarly, the composition of examination staff has been changed by posting all the newly recruited examination officers.

Anis ul Haq, secretary, All Pakistan Textile Mills Association (Aptma), Punjab, urges removal of PIDC saying it is anti–business and a move that further burdens the sectors already in the tax net. No doubt the governments need to raise funds to meet their expenses, but this should better be done by expanding the tax base, he adds. He says the Sindh government has also imposed provincial tax on imports but some parties have obtained stay orders against it.

Anis ul Haq, secretary, All Pakistan Textile Mills Association (Aptma), Punjab, urges removal of PIDC saying it is anti–business and a move that further burdens the sectors already in the tax net. No doubt the governments need to raise funds to meet their expenses, but this should better be done by expanding the tax base, he adds. He says the Sindh government has also imposed provincial tax on imports but some parties have obtained stay orders against it.

Jamil Nasir, collector, Customs Appraisement, Lahore told Money Matters that there is no doubt the financial burden due to PIDC has compelled importers to move out of the province, however, there are many who are still using dry ports in Lahore. This, he says, is due to the highly improved services and a streamlined system free of conventional red-tape, involvement of informal money or unnecessary delays in the clearance of imported goods.

He says with the very aim to offset the impacts of this cess, the collectorate has taken certain measures to retain clientele and at the same time meet the revenue targets given to them by the FBR. For example, he says, they have introduced a transparent transfer/posting policy, performance based rewards, feedback mechanism and an open door policy of all supervisory officers. Suggestion boxes have been placed at prominent places at all dry ports, and independent feedback is also sought through phone and email.

Installation of CCTV cameras in appraisement and examination halls, SMS alert system for feedback of importers and other stakeholders like chambers, associations, terminal operators etc, Facebook page of the collectorate for information and feedback and development of collectorate’s mobile applications are other steps taken for the facilitation of the importers, he adds. He shares the importers have fully benefitted from these steps, a proof of which is that the collectorate has successfully met its revenue targets during the last seven months. This is despite the fact that many importers are getting customs clearance done outside the province.

Muhammad Arif, import manager at a manufacturing concern on Raiwind Road, Lahore, shares that despite the PIDC they are getting their goods cleared in Lahore and the main reason for this is that they neither have time nor energy to go through the hassles of getting this done in Karachi. He says the load of work at Karachi is already too high and shifting of clearance businesses there from Punjab has added to it. The quality of service and speedy clearance in Lahore has led them to settle for this option, he adds.

Arif points out that Prem Nagar Dry port was established near Raiwind Road, Lahore to facilitate the industry in and around this area, but this cess has created problems for the targeted beneficiaries. The Punjab government must rethink this decision in the interest of the industry and the people of the province who have to ultimately bear the brunt of the additional costs of doing business, he concludes.

The writer is a staff member