Inside tech giants’ billion-dollar deals powering 2025 AI boom

The burgeoning spending in AI chips and cloud computing has skyrocketed companies’ valuations

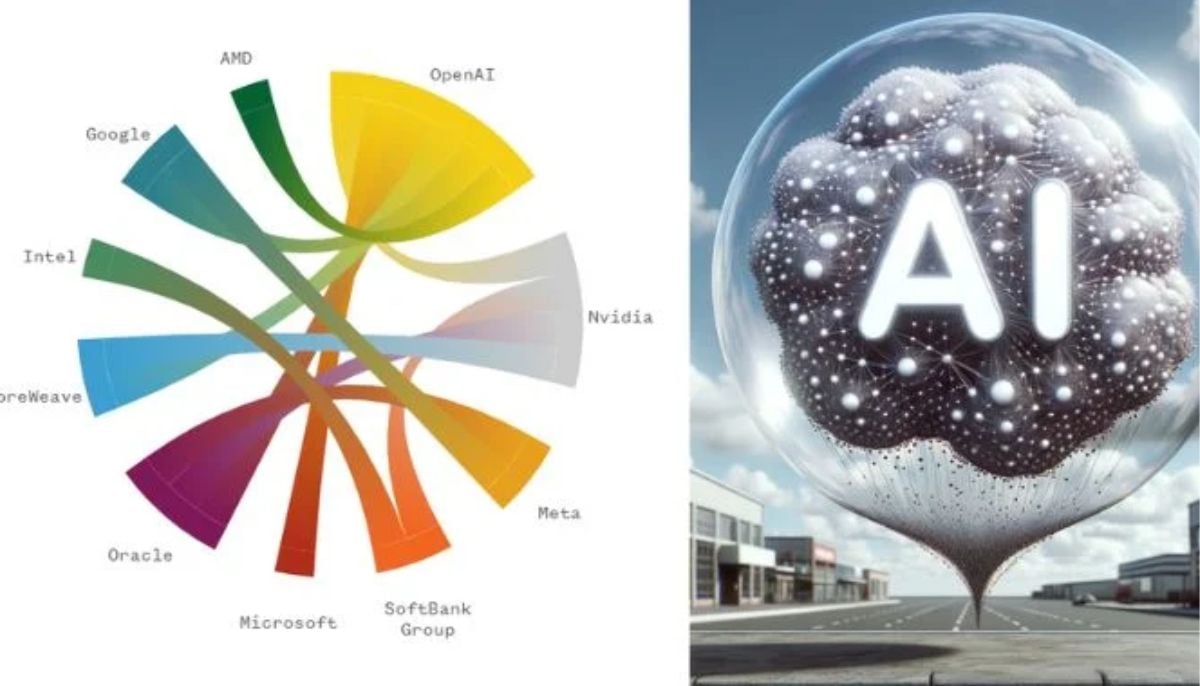

In 2025, the world witnessed an artificial intelligence boom driven by the billion-dollars tech giants’ investment in AI infrastructure.

The burgeoning spending in AI chips and cloud computing has skyrocketed companies’ valuations, thereby taking the US stock indexes to new heights.

However, the massive surge in circular deals has raised the concerns regarding the bursting of the “AI bubble” among tech experts and financial institutions.

Billion-dollar circular deals fueling AI boom in 2025

OpenAI deals with other tech firms

OpenAI has entered into key deals with significant tech firms. Amazon is in talks to invest more than $10 billion inOpenAI, aiming to sell its AI-powered chips and computing power to ChatGPT maker and signalling a major shift in the competitive AI landscape.

Similarly, Disney has announced a $1 billion investment in OpenAI. It will also allow the tech giant to use characters from Pixar, Marvel, and Star Wars franchises in AI video generator Sora.

Under the three-year licensing agreement, Sora and ChatGPT will generate videos featuring Disney characters such as Mickey Mouse, Cinderella, and Mufasa early next year.

OpenAI has made a deal with Broadcom for producing its first in-house AI processors.

Advanced Micro Devices (AMD) and OpenAI joined the partnership with the announcement of a multibillion-dollar deal.

Under this agreement, OpenAI will buy AMD’s chips, in turn the company will be entitled to take a stake of as much as 10 percent in the semiconductor giant.

In addition, Nvidia has invested $100 billion in OpenAI in a bid to establish state-of-the-art 10 gigawatts of AI data centers equipped with millions of Nvidia GPUs.

OpenAI is also collaborating with Oracle over the biggest cloud deal, under which the tech firm will buy $300 billion worth computing power for 5 years. CoreWeave also signed a five-year contract worth $11.9 billion with OpenAI.

The deals are further complicated by the joint venture named Stargate between OpenAI, Oracle, and SoftBank, aiming to build additional data centers.

Meta key deals

Meta has also partnered with the firms who are already the customers of OpenAI. For instance, Meta has signed a $14 billion deal with CoreWeave to acquire the computer power.

As reported by Reuters, the Facebook parent company also partnered with Google for a 6-year cloud computing deal.

Oracle is also in talks for a multi-year cloud computing deal worth about $20 billion.

Google deals with other firms

Google is planning to invest $40 billion in new three data centers in Texas through 2027.

Google also hired the Windsurf’s staff members and will pay $2.4 billion as a part of license fee for using the technology.

Nvidia deals

Recently, Nvidia has agreed to license technology from AI startup Groq for its AI-powered chips for $20 billion in cash. The acquisition of assets marks Nvidia’s largest-ever purchase.

Moreover, Anthropic, Microsoft, and Nvidia have also signed a deal in which Microsoft will invest up to $5 billion and US-based chipmaker up to $10 billion in Anthropic.

In turn, Anthropic will provide up to 1 gigawatt of computing powered by Nvidia’s Blackwell GPUs.

CoreaWeave also signed a $6.3 billion initial order backed by Nvidia. The chipmaker has committed to purchasing any of CoreWeave’s cloud capacity that remains unsold to customers. Nvidia has also invested $5 billion in Intel.

The growing concerns of AI bubble

Given the massive AI-based deals, the concerns related to the AI bubble have been gaining ground since the middle of the year, giving it resemblance to the 2008 financial crisis.

According to an analysis conducted by MacroStrategy Partnership, the current AI bubble is larger than the past crises, 17-times more bigger than the 1990s dot-com bubble and four times the scale of the 2008 financial crisis.

In 2025, the IMF and Bank of England also issued warnings against the bursting of the AI bubble based on the sudden rise in companies’ valuations.

-

YouTube Music tests AI-powered ‘Your Week’ recap to summarise listening habits

-

Is AI heading into dangerous territory? Experts warn of alarming new trends

-

Google updates Search tools to simplify removal of non-consensual explicit images

-

Facebook rolls out AI animated profile pictures and new creative tools

-

Adam Mosseri set to testify in court over social media addiction claims

-

ByteDance suspends viral Seedance 2.0 photo-to-voice feature: Here’s why

-

Siemens Energy profit surges nearly threefold amid AI boom for gas turbines, grids

-

TikTok's ByteDance to develop advance AI chips with Samsung