Indian agency 'freezes' $351m assets of Anil Ambani Group

Case involves loans taken from India's YES Bank between 2017 and 2019

India’s financial crime watchdog has provisionally frozen assets worth 30.84 billion Indian rupees ($350.87 million) belonging to the Reliance Anil Ambani Group as part of an ongoing money-laundering investigation, a government source said on Monday.

The case involves loans taken by the group, owned by the younger brother of billionaire Mukesh Ambani, from India's YES Bank between 2017 and 2019 in excess of $568.86 million. Investments made with the funds delivered no returns.

The Enforcement Directorate has now blocked any transactions from taking place on residential units and land parcels across Mumbai, Delhi and Chennai, including industrialist Anil Ambani’s family residence in Mumbai, the source added.

Reliance Group did not immediately respond to a request for comment.

Investigators allege the funds raised by Reliance Home Finance Ltd and Reliance Commercial Finance Ltd were part of a "well-planned" scheme to siphon off 30 billion Indian rupees ($350 million) in loans from YES Bank to many shell companies.

The loans were originally invested through mutual funds and routed to group-linked entities in violation of regulations. The Reliance Group entities are also accused of paying bribes to YES Bank officials before loans were disbursed, a government source had said earlier.

The Enforcement Directorate has cited weak borrower profiles, missing documentation and misuse of funds, the source said, in a case that involves the diversion and laundering of public funds.

The agency is also probing Reliance Communications Ltd and affiliates, where over 136 billion Indian rupees ($1.55 billion) were allegedly diverted through loan evergreening and fund rerouting.

-

Poll reveals majority of Americans' views on Bad Bunny

-

Man convicted after DNA links him to 20-year-old rape case

-

California cop accused of using bogus 911 calls to reach ex-partner

-

'Elderly' nanny arrested by ICE outside employer's home, freed after judge's order

-

key details from Germany's multimillion-euro heist revealed

-

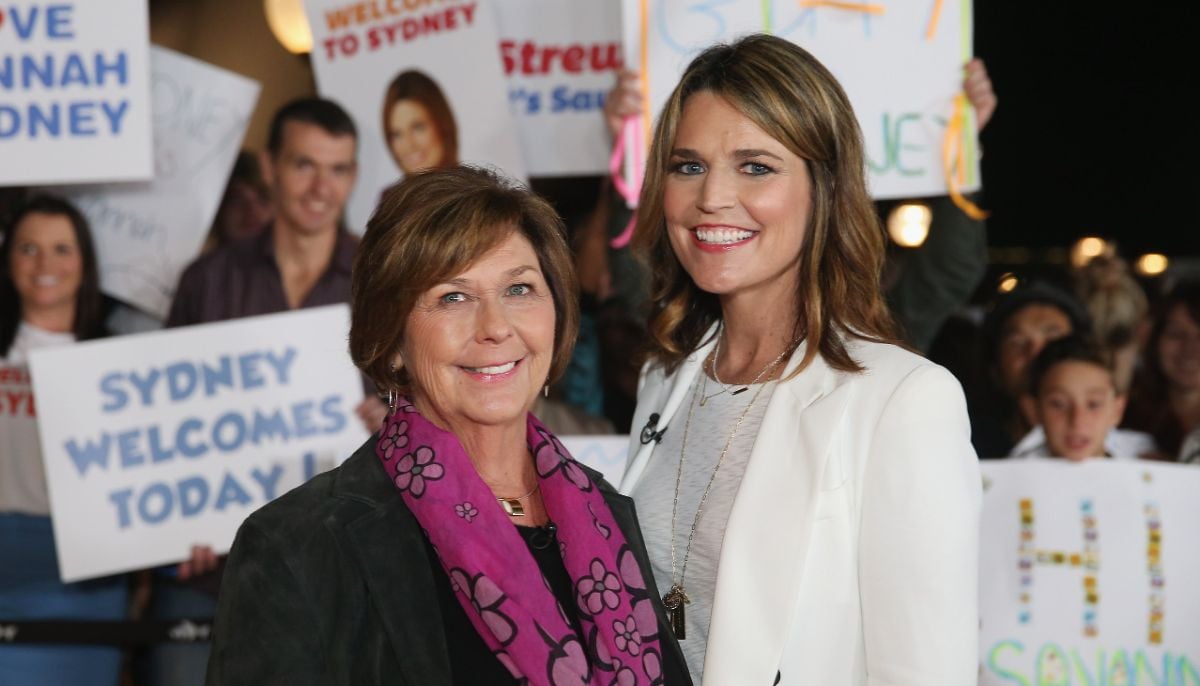

Search for Savannah Guthrie’s abducted mom enters unthinkable phase

-

Barack Obama addresses UFO mystery: Aliens are ‘real’ but debunks Area 51 conspiracy theories

-

Rosie O’Donnell secretly returned to US to test safety