PSX rallies to new high ahead of federal budget

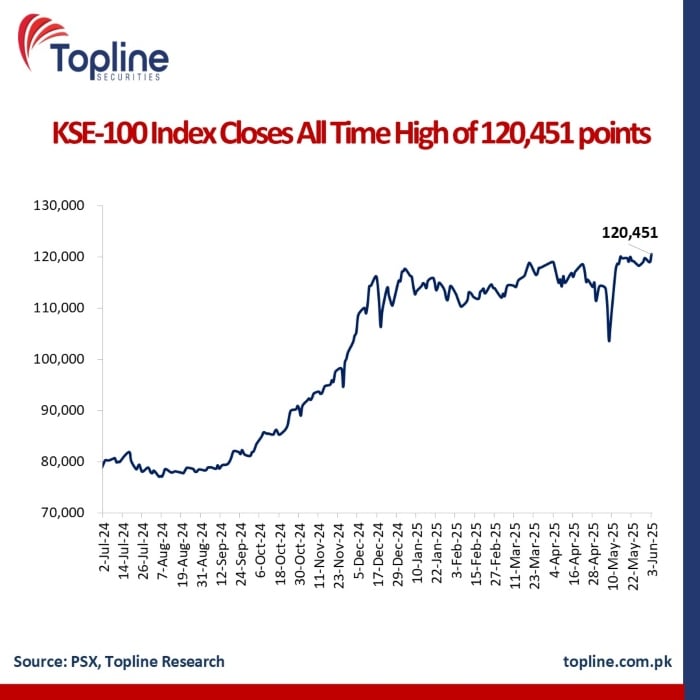

KSE-100 Index settles at all-time high of 120,450.87 points, up 1,573.07 points, or 1.32%

Investor sentiment strengthened on Tuesday as equities rebounded to a record close ahead of next week’s federal budget, as market participants reacted to speculation over tax reforms, International Monetary Fund (IMF) negotiations, and development allocations.

“Market is being driven by sentiments related to budget, rumours related to taxation on different sectors and market,” said Samiullah Tariq, Head of Research at Pak-Kuwait Investment Company, as investors priced in implications of fiscal constraints on growth and development spending.

The Pakistan Stock Exchange’s (PSX) benchmark KSE-100 Index settled at an all-time high of 120,450.87 points, up 1,573.07 points, or 1.32%, from the previous close of 118,877.80.

During the session, the index climbed to an intraday high of 120,693.83, gaining 1,816.03 points, or 1.53%. The index touched a low of 119,129.51, still up by 251.71 points, or 0.21%.

Pakistan and the IMF are edging closer to an agreement on proposed tax relief for the salaried class in the upcoming 2025–26 federal budget, The News reported on Sunday.

IMF officials have given in-principle approval to lower income tax rates across various salary slabs, with estimated relief of Rs56–60 billion. However, to maintain the Rs14.2 trillion revenue target, the Federal Board of Revenue (FBR) is expected to introduce compensatory measures.

A top official confirmed that a reduction to 1% tax on the first slab (Rs0.6m–1.2m annually) has been proposed, down from the current 5%, though the IMF prefers a 1.5% rate. For higher slabs, a 2.5% reduction is under discussion, with the top slab potentially falling from 35% to 32.5%. Full reconciliation between the IMF and FBR is still pending.

Meanwhile, on Monday, the Annual Plan Coordination Committee (APCC) approved a national development outlay of Rs4.083 trillion for FY2025–26.

The federal portion was set at Rs1 trillion, while provinces will contribute Rs2.8 trillion. Despite IMF-related restrictions forcing deletion of 118 projects from the PSDP, Rs50 billion has been allocated under the SDGs Achievement Program for treasury parliamentarians.

The APCC also cleared a macroeconomic framework targeting 4.2% GDP growth and 7.5% inflation next year. A final decision is expected at the June 5 National Economic Council (NEC) meeting, chaired by Prime Minister Shehbaz Sharif.

The previous session on Monday saw the market close lower, with the KSE-100 Index falling by 813.29 points, or 0.68%, to 118,877.81. The index had touched a high of 120,590.77 and a low of 118,672.84 during the session.

-

$44 billion Bitcoin blunder: Bithumb exchange apologizes for accidental payout

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’