Prince William refuses to release tax details on new whopping income

Prince William’s new change causes concerns over his tax payment

Prince William’s staggering pay cheque for the 2023-2024 financial year was revealed, just a year after he inherited the Duchy of Cornwall estate.

Along with the title and the estate, which was passed to him following King Charles’ ascension, the Prince of Wales received a distributable surplus of £23.6 million ($30.4 million), per the Integrated Annual Report.

The sum covers the official, charitable and private expenses of Prince William, Kate Middleton and their three children, Prince George, 11, Princess Charlotte, 9, and Prince Louis, 6.

William is understood to pay income tax on the full amount, less household costs, which have also not been disclosed.

However, the Prince of Wales has been accused to hiding his tax details, which have been previously mentioned by his father, King Charles, when he owned it.

According to The Telegraph report, when Charles was Prince of Wales, he published a full breakdown of household costs and the amount of tax he paid annually, which for the year ending 2021 was just over £5 million and the year ending 2022, £5.89 million.

Charles also detailed the full breakdown of the Duchy money, plus details of the number of valets, housekeepers, dressers, chefs, butlers and gardeners he employed, as well as his tax bill.

Meanwhile, Kensington Palace insisted that William is paying “appropriate” tax on his income, even more than what his father paid given his higher income.

This is one of many changes implemented by William since he took over the Duchy.

-

Glen Powell reveals wild prank that left sister hunting jail cells

-

'A Knight of the Seven Kingdoms' episode 5: What time it airs and where to stream

-

Gisele Bundchen melts hearts with sweet bike ride glimpse featuring son

-

Camila Mendes reveals how she prepared for her role in 'Idiotka'

-

Jennifer Aniston gives peek into love life with cryptic snap of Jim Curtis

-

'How to Get Away with Murder' star Karla Souza is still friends with THIS costar

-

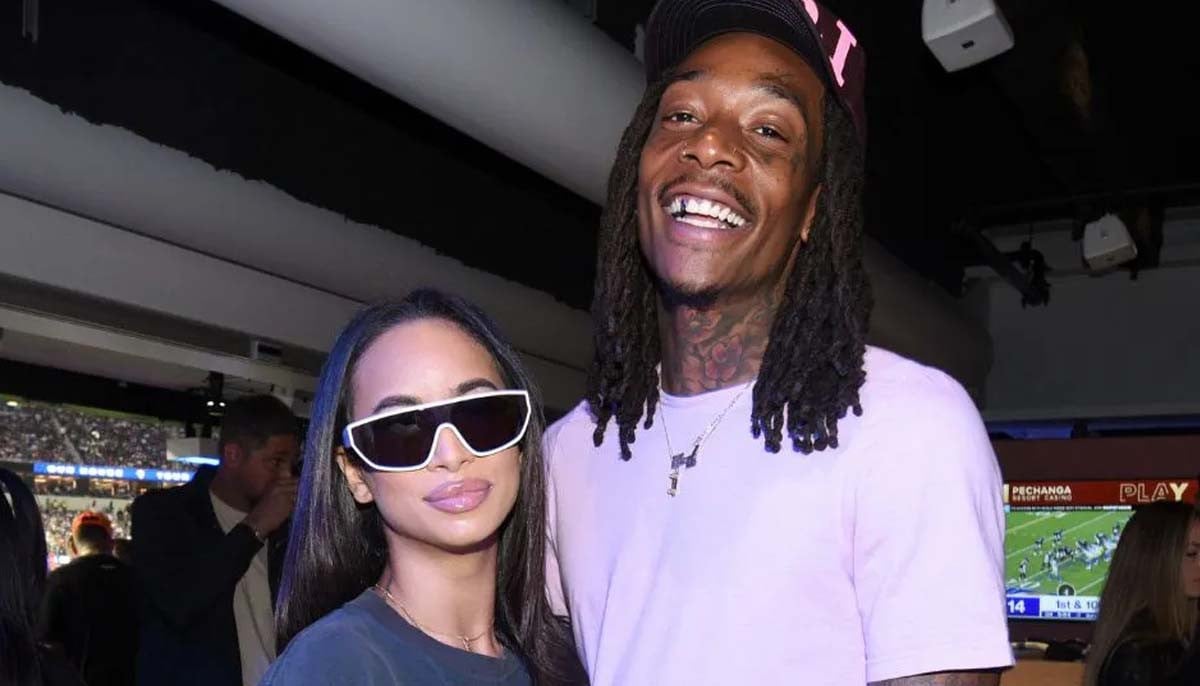

Wiz Khalifa thanks Aimee Aguilar for 'supporting though worst' after dad's death

-

Dua Lipa wishes her 'always and forever' Callum Turner happy birthday