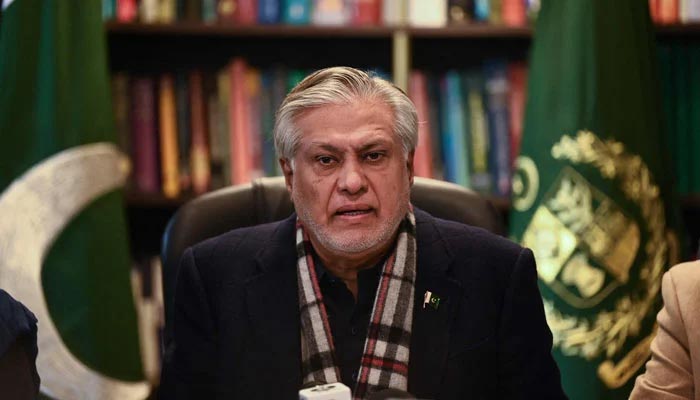

Pakistan to get $300m from China today, Ishaq Dar confirms

"Out of Chinese Bank’s ICBC approved facility of $1.3bn SBP will receive back third and last disbursement today,” says Ishaq Dar

Finance and Revenue Minister Ishaq Dar on Friday announced that Pakistan will receive $300 million from the Industrial and Commercial Bank of China (ICBC) today which will “shore up forex reserves”.

“Out of Chinese Bank’s ICBC approved facility of $1.3 billion (which was earlier repaid by Pakistan), State Bank of Pakistan would receive back third and last disbursement today in its account amounting to $300 million,” Dar wrote on Twitter.

The third critical disbursement from the ICBC will be released after Pakistan completed the necessary documentation.

Last month, the Chinese lender approved a rollover of a $1.3 billion loan for Pakistan. Following the announcement, the Chinese bank deposited $500 million — the first disbursement — on March 4 and then the second tranche of an equivalent amount was released on March 17.

The cash-strapped nation of 220 million people is going through one of its biggest economic crises ever as multiple delays in its loan program created a dollar shortage, and import restrictions and reduced foreign-exchange reserves to less than one month of imports.

The nation’s foreign exchange reserves stand at $4 billion while it needs to pay $2.2 billion in the quarter ending June. It expects to roll over a debt of $2.3 billion, according to State Bank of Pakistan Governor Jameel Ahmad.

More external financing will be coming to Pakistan only after Islamabad signs a deal with the IMF, which the minister said should be done by next week.

The lender has been negotiating the deal with Pakistan since end-January to clear its ninth review, which if approved by its board will issue over $1 billion tranche of the $6.5 billion bailout agreed upon in 2019.

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold

-

Netflix slams Paramount’s bid: 'Doesn't pass sniff test’ as Warner battle escalates