After losing $1.7bn, SBP-held forex reserves register nominal rise

Central bank, without attributing the rise, reveals that SBP-held forex reserves stand at $3,192.9m as of Feb 10

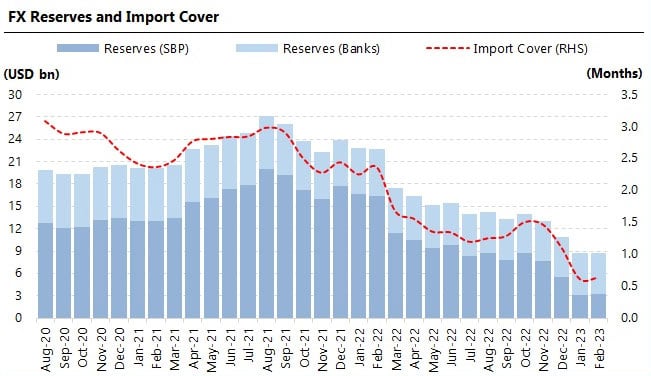

Following a massive plunge of $1,685 million cumulatively during the last three weeks, the State Bank of Pakistan (SBP)-held foreign exchange reserves rose above $3 billion once again after registering a nominal increase.

The central bank, in its weekly bulletin, revealed that the foreign currency reserves held by the SBP clocked in at $3,192.9 million as of February 10, up $276 million compared with $2,916.7 on February 3.

It should be noted that despite a meagre increase the amount is still barely enough to cover one month of imports.

The net forex reserves held by commercial banks stand at $5,509.3 million, $2,316.4 billion more than the SBP, bringing the total liquid foreign reserves of the country to $8,702.2 million, the statement mentioned.

The central bank did not mention any specific reason behind an increase in SBP-held reserves.

Pakistan is eyeing the crucial loan tranche from the International Monetary Fund (IMF) which would unlock other avenues of funding for Pakistan.

Faced with critically low US-dollar reserves, the government had banned all but essential food and medicine imports until a lifeline bailout is agreed upon with the IMF.

Pakistan's economy is in dire straits, stricken by a balance-of-payments crisis as it attempts to service high levels of external debt amid political chaos and deteriorating security.

Inflation has rocketed, the rupee has plummeted and the country can no longer afford imports, causing a severe decline in the industry.

Since January, the world's fifth most populous nation is no longer issuing letters of credit, except for essential food and medicine, causing a backlog of raw material imports the country can no longer afford.

The logjam coupled with the rupee devaluation has sparked a major decline in manufacturing, including textiles and steel, and building projects.

While the IMF cash injection will not be enough to rescue Pakistan on its own, the government hopes it will boost confidence and open the doors for friendly nations such as Saudi Arabia, China and the UAE to offer further loans.

— Additional input from AFP

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold

-

Netflix slams Paramount’s bid: 'Doesn't pass sniff test’ as Warner battle escalates

-

Ubisoft: Shares plunge amid restructuring plan and wave of games cancellations