After losing $1.7bn, SBP-held forex reserves register nominal rise

Central bank, without attributing the rise, reveals that SBP-held forex reserves stand at $3,192.9m as of Feb 10

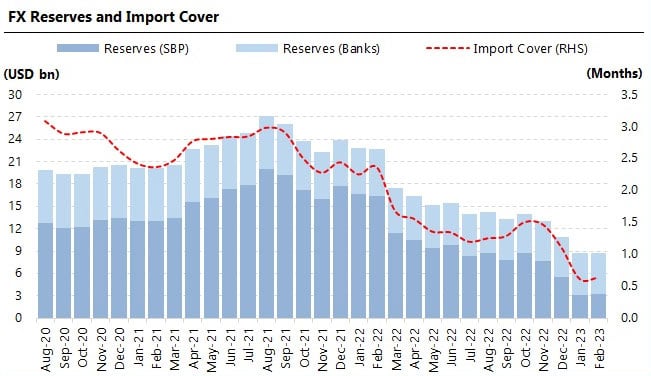

Following a massive plunge of $1,685 million cumulatively during the last three weeks, the State Bank of Pakistan (SBP)-held foreign exchange reserves rose above $3 billion once again after registering a nominal increase.

The central bank, in its weekly bulletin, revealed that the foreign currency reserves held by the SBP clocked in at $3,192.9 million as of February 10, up $276 million compared with $2,916.7 on February 3.

It should be noted that despite a meagre increase the amount is still barely enough to cover one month of imports.

The net forex reserves held by commercial banks stand at $5,509.3 million, $2,316.4 billion more than the SBP, bringing the total liquid foreign reserves of the country to $8,702.2 million, the statement mentioned.

The central bank did not mention any specific reason behind an increase in SBP-held reserves.

Pakistan is eyeing the crucial loan tranche from the International Monetary Fund (IMF) which would unlock other avenues of funding for Pakistan.

Faced with critically low US-dollar reserves, the government had banned all but essential food and medicine imports until a lifeline bailout is agreed upon with the IMF.

Pakistan's economy is in dire straits, stricken by a balance-of-payments crisis as it attempts to service high levels of external debt amid political chaos and deteriorating security.

Inflation has rocketed, the rupee has plummeted and the country can no longer afford imports, causing a severe decline in the industry.

Since January, the world's fifth most populous nation is no longer issuing letters of credit, except for essential food and medicine, causing a backlog of raw material imports the country can no longer afford.

The logjam coupled with the rupee devaluation has sparked a major decline in manufacturing, including textiles and steel, and building projects.

While the IMF cash injection will not be enough to rescue Pakistan on its own, the government hopes it will boost confidence and open the doors for friendly nations such as Saudi Arabia, China and the UAE to offer further loans.

— Additional input from AFP

-

Netflix, Paramount shares surge following resolution of Warner Bros bidding war

-

Paramount wins Warner Bros. bidding war as Netflix abandons deal: Here’s why

-

Singapore's Grab plans AI-driven expansion and new services to boost profit by 2028

-

Bitcoin bounces from $62,000 as on-chain metrics signal prolonged weakness: Here is everything to know

-

BTC price today: Bitcoin sinks below $65K on trade uncertainty

-

Tesla expands Cybertruck lineup with affordable model in US, slashes Cyberbeast price to boost demand

-

Uber enters seven new European markets in major food-delivery expansion

-

Will Warner Bros finalize deal with Paramount or stays loyal with Netflix's offer?