No Google payments blocked, clarifies SBP

The SBP has contradicted the media reports that it held payments to Google

The State Bank of Pakistan (SBP) has clarified that no Google payments had been blocked.

The central bank said this in response to reports in some sections of the media that claimed that the Google Play Store services would not be available in Pakistan from December this year owing to the non-payment of $34 million to international service providers.

The report said, "The direct carrier billing (DCB) mechanism was discontinued by the central bank after which a payment of $34 million on an annual basis through mobile companies to international service providers, including Google, Amazon and Meta, got stuck."

The SBP clarified in a recent notification, "The fact is that in order to facilitate the domestic entities, SBP specified certain Information Technology (IT) related services, which such entities can acquire from abroad for their own use and make foreign exchange payments there against up to USD 100,000 per invoice."

"Such services include Satellite Transponder, International Bandwidth/ Internet/ Private Line Services, Software License/Maintenance/Support, and service to use electronic media and databases. Entities desirous of utilizing this option designate a bank, which is approved by SBP one time. Subsequently, after designation, such payments can be processed through the designated bank, without any further regulatory approval," it stated.

The SBP, however, said that during recent off-site reviews, it was observed that in addition to utilizing the aforesaid mechanism to remit funds for IT-related services for their own use, Telcos were remitting bulk of the funds for video gaming, entertainment content, etc. purchased by their customers using airtime, under Direct Carrier Billing (DCB).

DCB is, in general, an online mobile payment method, which allows users to make purchases by charging payments to their mobile phone carrier bill, the central bank explained.

"The Telcos were allowing their customers to purchase above mentioned products through airtime and then remitting funds abroad reflecting such transactions as payments for acquisition of IT related services. Thus, in effect the Telcos were acting as intermediaries/ payment aggregators by facilitating acquisition of services by their subscribers. Therefore, in view of the violation of foreign exchange regulations, SBP revoked the designation of banks of Telcos for such payments. However, to facilitate their legitimate IT-related payments, Telcos have been advised through their banks to resubmit their requests," the SBP statement says.

"If any entity, including a telco, intends to operate as an intermediary/payment aggregator and such arrangement involves outflow of foreign exchange, it has to approach SBP, separately through its bank, for seeking special permission for providing such services under the Foreign Exchange Regulation Act, 1947."

-

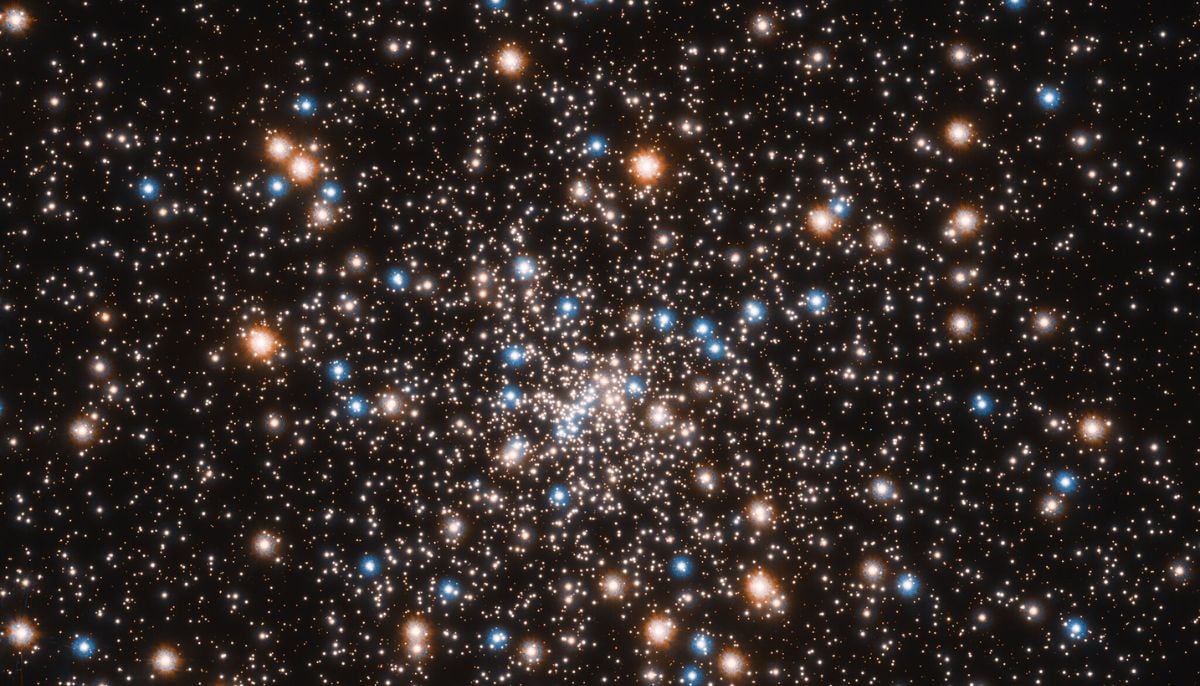

Hidden ‘dark galaxy' traced by ancient star clusters could rewrite the cosmic galaxy count

-

Astronauts face life threatening risk on Boeing Starliner, NASA says

-

Giant tortoise reintroduced to island after almost 200 years

-

Blood Falls in Antarctica? What causes the mysterious red waterfall hidden in ice

-

Scientists uncover surprising link between 2.7 million-year-old climate tipping point & human evolution

-

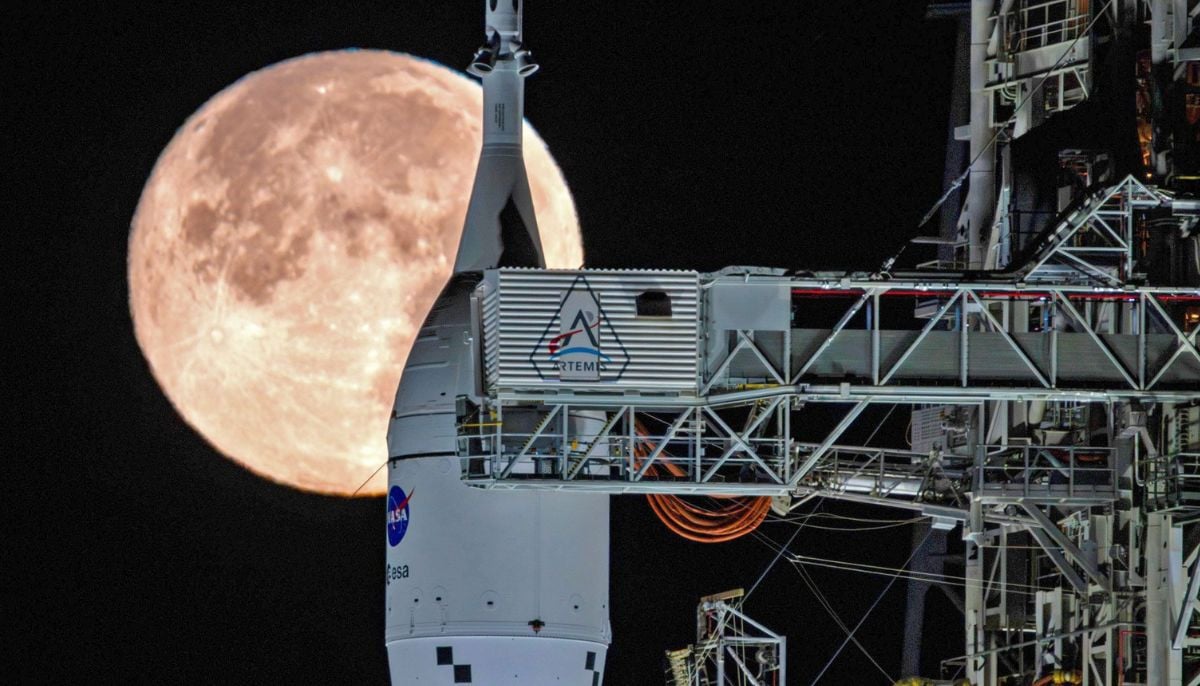

NASA takes next step towards Moon mission as Artemis II moves to launch pad operations following successful fuel test

-

Spinosaurus mirabilis: New species ready to take center stage at Chicago Children’s Museum in surprising discovery

-

Climate change vs Nature: Is world near a potential ecological tipping point?