External debt, liabilities go up to $74.6 billion

Debt Policy Statement 2017

ISLAMABAD: The government has submitted Debt Policy Statement 2017 before the Parliament, stating that the country’s total external debt and liabilities stocks have risen to $74.6 billion till end September in current fiscal as external public debt has jumped up by around $1 billion during the first quarter of 2016- 17.

However, the Debt Policy Statement 2017, a copy of which is available with The News, states that there is a limited pressure from external debt repayments in the medium term. The projected principal repayments to the IMF against Extended Fund Facility (EFF) are stretched over a longer timeframe, starting at $0.2 billion in 2018 and rising to $0.8 billion in 2020, with the final payment due in 2025. An amount of $0.75 billion due in June 2017 is the only Eurobond maturing until 2019. Repayments for Official Development Assistance from the Paris Club began in 2016, but over a 23-year period.

The Debt Policy Statement 2017 prepared by Finance Ministry and submitted into the Parliament, states that the external debt and stocks (EDL) was $73.1 billion as at end June 2016 compared with $60.9 billion as at end June 2013 out of which external public debt was $57.7 billion as at end June 2016 as compared with US$ 48.1 billion as at end June 2013. Apart from net external inflows, public external debt witnessed an increase on account of revaluation loss due to depreciation of US Dollar against other major currencies.

The gross public debt was Rs20,538 billion as at end September 2016, while net public debt was Rs18, 278 billion. Domestic debt recorded an increase of Rs772 billion during the first quarter of 2016-17 while government domestic borrowing for financing of fiscal deficit was Rs369 billion during this period.

This differential is mainly attributed to increase in government credit balance with SBP/commercial banks during the first quarter of 2016-17 which was mostly utilized by the government in October 2016. Hence, the pace of domestic debt increase is expected to be smoothened in second quarter of 2016-17.

The external public debt increased by around $1 billion during first quarter of 2016- 17 and recorded at $58.7 billion. Government mobilised $1.83 billion during first quarter of 2016-17, mainly from commercial banks ($900 million), bilateral sources contributed $423 million (mainly funded by China amounting $405 million and IMF ($102 million) and multilateral development partners ($405 million). Government also repaid $1.08 billion during the first quarter of 2016- 17. Rest of the increase in external public debt was contributed by translational losses on account of depreciation of US Dollar against other foreign currencies.

Going forward, there is limited pressure from external debt repayments in the medium term. Projected principal repayments to the IMF against Extended Fund Facility (EFF) are stretched over a longer timeframe, starting at $0.2 billion in 2018 and rising to $0.8 billion in 2020, with the final payment due in 2025. An amount of $0.75 billion due in June 2017 is the only Eurobond maturing until 2019. Repayments for Official Development Assistance from the Paris Club began in 2016, but over 23 years.

The debt policy statement 2017 also confirmed The News report published few days back by stating that further, the government undertook hedging on limited scale during 2015-16 to minimize the risk of its short term external public debt portfolio emanating from adverse movement of other foreign currencies against US Dollar.

As at end June 2016, the forex reserves of SBP were $18.1 billion and external public debt stood at $ 57.7 billion, thus net external indebtedness was $39.60 billion. Therefore, net external indebtedness of the country improved by $4.50 billion as compared with end June 2013.

Significant reduction was observed in primary and revenue deficits during 2015-16 as the government adhered strictly to its objective of fiscal consolidation. Revenue deficit was reduced to 0.7 percent of GDP during 2015-16 from 1.7 percent during 2014-15 as the growth in total revenue (13 percent) outpaced the growth in current expenditure (6 percent) during 2015-16. Similarly, primary deficit was reduced to 0.2 percent of GDP during 2015-16 from 0.5 percent during 2014- 15 as the growth in total revenue overshadowed the growth in non-interest expenditure during 2015-16.

The debt burden is only understood in comparison to its relation with the GDP. The analysis of public debt to GDP ratio during last 15 years reveals that in the period of high inflation, public debt to GDP ratio performed relatively better as the denominator becomes larger and this ratio mostly hovered close to 60 percent even when real GDP growth was merely half a percent. For instance during the tenure of previous government (2009-2013), the average inflation remained around 12 percent while real GDP was 2.8 percent.

Whereas, during the tenure of present government, the average inflation remained around 5 percent while real GDP was over 4 percent. The higher inflation could help reducing the public debt to-GDP ratio yet it has other adverse repercussions for the economy. Therefore, It may be noted that net public debt to GDP ratio (60.2 percent as at end June, 2016) remained at the same level of end June 2013 despite reduction in fiscal deficits during last three years. The non-fiscal deficits factors like revaluation losses on account of cross currency movements and loans from IMF contributed to this increase.

The IMF loans are only applied towards Pakistan’s balance of payments, add to foreign currency reserves and do not come as an extra resource in the budget.

To be continued

-

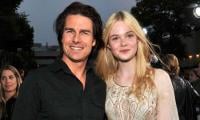

Tom Cruise's Reunion With Elle Fanning Thrilled Him At Saturn Awards

Tom Cruise's Reunion With Elle Fanning Thrilled Him At Saturn Awards -

Jennifer Runyon's 'Charles In Charge' Co-star Pays Tribute After She Loses Battle To Cancer

Jennifer Runyon's 'Charles In Charge' Co-star Pays Tribute After She Loses Battle To Cancer -

Paul Bettany Gets Honest About Voldemort Casting Rumours In 'Harry Potter' Series

Paul Bettany Gets Honest About Voldemort Casting Rumours In 'Harry Potter' Series -

Kim Kardashian, Kylie Jenner Show Support As Brody Jenner Reveals Big News

Kim Kardashian, Kylie Jenner Show Support As Brody Jenner Reveals Big News -

King Charles Plans Emotional Reunion With Lilibet, Archie

King Charles Plans Emotional Reunion With Lilibet, Archie -

Royal Expert Shares Exciting Update For Princess Eugenie, Beatrice

Royal Expert Shares Exciting Update For Princess Eugenie, Beatrice -

Epstein Files: New Photos Of Former Prince Andrew With Woman On His Lap Emerge

Epstein Files: New Photos Of Former Prince Andrew With Woman On His Lap Emerge -

WhatsApp Hacked: Russia-backed Group Breaches Accounts Of Journalists, Officials, Military Personnel

WhatsApp Hacked: Russia-backed Group Breaches Accounts Of Journalists, Officials, Military Personnel -

Selena Gomez Pays Sweet Tribute To Benny Blanco On His Birthday: 'I Love You'

Selena Gomez Pays Sweet Tribute To Benny Blanco On His Birthday: 'I Love You' -

Doja Cat Calls Out Timothée Chalamet For Making Insensitive Comment About Opera

Doja Cat Calls Out Timothée Chalamet For Making Insensitive Comment About Opera -

Stephanie Buttermore's Final Heartbreaking Remarks About Fiance Jeff Nippard

Stephanie Buttermore's Final Heartbreaking Remarks About Fiance Jeff Nippard -

From Signals To Surveillance: How WiFi Tracks Human Activity Through Walls

From Signals To Surveillance: How WiFi Tracks Human Activity Through Walls -

Find Out If Your Personal Information Is Being Sold Online

Find Out If Your Personal Information Is Being Sold Online -

TCS Unveils Physical AI Innovation At 7th Gemini Experience Center In Michigan

TCS Unveils Physical AI Innovation At 7th Gemini Experience Center In Michigan -

How Well Can AI Build Android Apps? Google Aims To Find Out

How Well Can AI Build Android Apps? Google Aims To Find Out -

Tim Cook Opens Up About Apple’s Secret Formula

Tim Cook Opens Up About Apple’s Secret Formula