After six emotionally charged episodes filled with tears, triumphs and transformation, Pakistan Idol 2025 has reached a crucial moment.

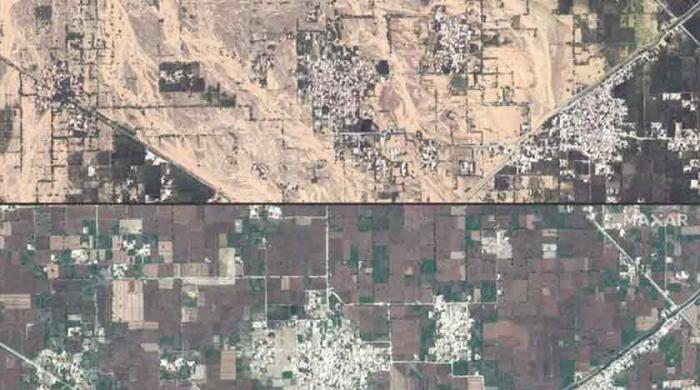

Pakistan stands at the frontlines of the global climate crisis. From scorching heatwaves and prolonged droughts to catastrophic floods that destroy...

This year’s theme of World Children’s Day - ‘My Day, My Rights’ - celebrated on 20th November, highlights the importance of listening to children. You! takes a look…