Pakistan's business community disgruntled as SBP keeps interest rate in double digits

If pressure builds up, then SBP may consider another interest rate cut but a week from now seems too dreamy to be true

"Was this a populist move? Was it under the federal government's pressure? Was the MPC convinced that they had made a blunder? I'm confused," says Majyd Aziz Balagamwala, a Karachi-born business tycoon, of the State Bank of Pakistan's (SBP) second policy rate cut in less than 10 days.

Balagamwala's operations are already suffering from the coronavirus pandemic, which has brought global stock markets crashing to 2008-esque levels, wiped out close to $6 trillion last month, and left 20,000 dead.

In Pakistan, however, the number of positive COVID-19 cases have surpassed 1,000, while eight people have passed away. Of the total, most cases are in Sindh — which has the country's business and economic hub, Karachi — and Punjab, which hosts manufacturing plants, especially in Sialkot and Faisalabad.

But around the world, central banks have stepped up to offer major rate cuts to cushion their local industries, bringing, in some cases, the interest rate to even below zero.

The SBP, on the other hand, first put forth a reduction worth a measly 75 basis points mid-March, and then not-so-graciously docked another 150 bps, much to the chagrin of Pakistan's business community. Businesspeople have time and again pushed for cuts of 300-500 bps and met the central bank's boss, former IMF official Reza Baqir, to present their proposals.

The SBP "noted considerable uncertainty about how the coronavirus outbreak would impact the global economy and Pakistan”, it had said in a statement on Twitter. "These developments imply that the outlook for growth and inflation in Pakistan is likely to be revised down further."

It, regardless, still failed to come up to the industrialists' and traders' expectations.

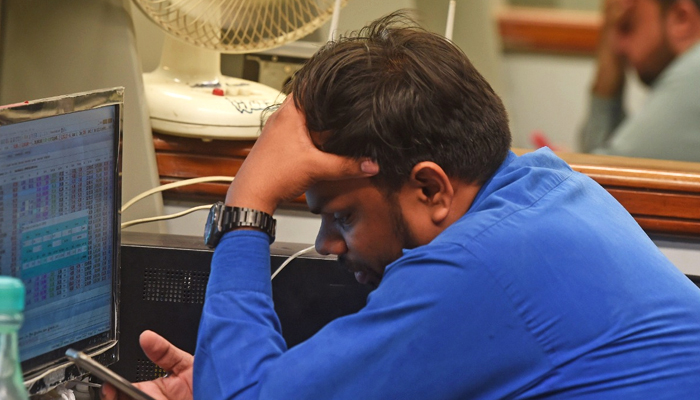

"Had they [SBP] taken a radical decision last week, it would have boosted the morale and today's market would have had at least some confidence," says Balgamwala, the president of the Employers' Federation of Pakistan (EFP). "But there are Herculean costs. You can't stop payments to banks because they can otherwise grab you by the neck according to the government's new rules.

"We've been asking in the first phase to reduce 300 bps and had the MPC — Monetary Policy Committee — taken this same decision last week, then there wouldn't have been so much uproar. In fact, both the SBP and [Prime Minister] Imran Khan would have been lauded [had they reduced the rates significantly]," he said.

The business magnate says Khan noted a few days ago that there should be a large cut in the policy rate. Now, however, he is telling the media that the meagre reduction was after his approval. "So either the SBP is trying to show its autonomy or this was a U-turn" — a signature move of eating one's own words that the PTI leader has been known to make often.

The only relief provided by Khan so far is a package worth around Rs1.2 trillion announced to ward off the negative impact from COVID-19. Although it looks a promising, how effective it is remains to be seen after it is implemented.

Industrialist and former president of the Karachi Chamber of Commerce & Industry (KCCI), Anjum Nisar, echoes the sentiment, though he acknowledges even the smallest of efforts. He says manufacturers and business owners could not lay off their staff but had to pay the bills. "Ask any economist; industry can't be set up like this and neither will they flourish" in such a restrictive environment, he explains.

"Our exports are not rising, Europe is on a lockdown", and unemployment — which is already on the rise — will continue its uptrend in line with the International Monetary Fund's (IMF) forecast of 6.2%, now more than ever, notes Nisar.

"Even at this rate, it will end up at 14-15% given the additional mark-up," he mentions. "We have been telling them for so long to hack the policy rate; late decisions bring late impact. While I appreciate this, the effect won't be as adequate or desired."

Earlier this month, the United States pulled back its interest rate to almost zero, cutting it down from 1.25% to 0.25%, in an effort to lend support to its faltering economy. The United Kingdom followed suit, squeezing it from an existing 0.25% to 0.1%. Both countries' rates came close to the levels seen during the global financial crunch of 2008 and both brought down the rates in two emergency moves.

Various other countries, including Sweden, Denmark, and Canada, have done the same for their economies. Even Saudi Arabia and China — Pakistan's "iron brother" — decreased their discount rates.

It was expected that a cricketer-turned-politician — who claims to have spent a major portion of his life in "the West so I know how it operates" — would take a leaf out of foreign countries' books and urge for the significant rate cut that he had said was required.

Nisar, the businessperson, believes that the rate should have been slashed to single digits. "If [the foreign] markets are unable to perform well at zero or 1%, despite having money, better capacity, and low inflation, then Pakistan should have cut the rate to 3% at least," he says.

Interestingly, however, the Bank of England has already announced that there was a need for "a further package of measures".

Pakistan's only partner in the double-digit interest rate club is Turkey, which has so far maintained its rate to 10.75%. But Pakistan has also announced that it is in talks with the International Monetary Fund (IMF) for a yet another package worth $1.4 billion amid the coronavirus crisis.

Abdullah Zaki, the former chairperson of the Pakistan Soap Manufacturers Association (PSMA) and the Pakistan Yarn Merchants Association (PYMA), says the business fraternity — as a delegation of the KCCI — met with officials of the SBP in this regard but "they did not take us seriously either".

"It's the state's responsibility to ensure a smooth flow of business. We met [SBP Governor] Dr Reza Baqir too but it is an all-IMF team there," he explains. "The government is not making proper decisions; they should have reduced the interest at least in the range of 4-7%."

Zaki reminisces about the tenure of former central bank governor, Dr Ishrat Hussain, when the rate was 7-8%. "Industries are dissimilar to trading as there's a lot of planning required. Now that those who obtained loans back then have installed their machinery, the rate they face is KIBOR + 2%," he says.

"Pakistan has one of the highest rates and we cannot compete with regional players such as India, Bangladesh, and Malaysia. On top of that, orders are being cancelled around the world, LCs [letters of credit] have stopped, and the business cycle halted.

"Imran Khan is not taking this seriously, while [Narendra] Modi has locked down for 21 days," he notes, referring to how the Indian prime minister has shut down the country amid the COVID-19 pandemic. Plus, India's discount rate has been hacked from 5.4% to 5.15% as well.

Balagamwala, who has in the past headed the KCCI, seconds Zaki's comment.

"It's not easy in today's world since competitors have a better deal in terms of capital, utilities, and financing costs", he says. He also maintains that this "extremely depressing mode" would continue for the Pakistani economy unless the central bank opts for a more aggressive route to deal with the pandemic panic. However, that may not be the case.

"It has been the SBP's specialty that it becomes very, very conservative when playing with discount rate. Only in [former president Asif Ali] Zardari's time was there a positive response," he underlines. The business tycoon stresses conditions are relaxed around the world during challenging times.

But "if your dependence is on financing from banks, then you're between devil and the deep blue sea" and in this manner, "it's a tough decision to continue; you either have your business stagnate or you leave it altogether".

The EFP president goes on to say that Pakistan has "begged around in the world" and was able to procure $3 billion last year, of which $1 billion has already been withdrawn. The SBP's "indecisive attitude" is not only risky but outright dangerous.

"The FBR [Federal Board of Revenue] is not meeting its revenue targets, we may not be able to go out for asking for more lending, neither Saudi Arabia nor China would be willing to give more money, and this vicious circle would continue," he emphasises, noting the dire circumstances that prevail and that were likely to worsen as the coronavirus fears continue pounding the economy.

Not to forget that a research study has already forecasted 12.3-18.5 million people to be laid off in the aftermath of a partial or complete shutdown. Dr Nasir, Naseem Faraz, and Mahmood Khalid — the economists who prepared the report — maintain that the economy would suffer monthly losses in three stages: Rs22 billion, Rs187 billion, and Rs261 billion.

Add to that the inflation rate, which, after hitting its decade-high of 14.56% in January, has come down to 12.4% but continues to paralyse common people. And it remains to be seen what the recently-announced Emergency Cash Programme would do; its 10 million beneficiaries are yet to be apprised of how the system will work.

With regard to what comes next, Ebrahim Qassim, an importer and owner of distribution empire he set up decades ago, comments that while the COVID-19 has been and would continue to be a major shock to the entire economy, "there's no ground for next week".

If the pressure builds up, then the SBP may consider another cut but a week from now seems too dreamy to be true. "We're not even asking to even go down to 3%. Ideally, it should have been 8-9% ... single digits," he adds.

But not all seems to be lost.

Nisar, the former KCCI president, suggests that the central bank should become more active and not leave decisions for the MPC to decide in two months. Tuesday's decision was "just a cosmetic change" but the SBP should now review it weekly.

"Work aggressively on this and make some substantial changes," he stresses, adding that if the policy rate is cut to single digits, it would bring positivity and motivation for the market as well as the investors.

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold

-

Netflix slams Paramount’s bid: 'Doesn't pass sniff test’ as Warner battle escalates

-

Ubisoft: Shares plunge amid restructuring plan and wave of games cancellations

-

Netflix revises Warner Bros. deal to $83 billion: All-cash offer