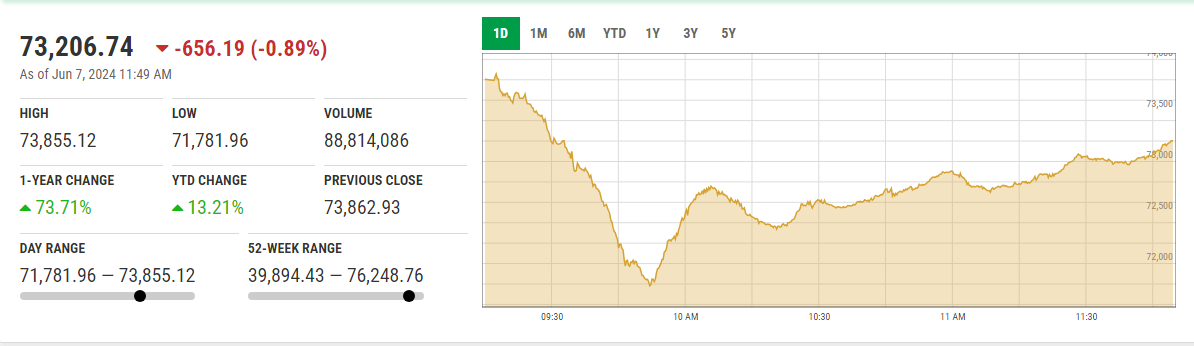

KSE-100 loses over 600 points in intraday trade

During early trading at around 10am, stocks plunged by over 1,900 points and hit 71,961

KARACHI: Bears dominated the Pakistan Stock Exchange (PSX) on Friday as it plummeted by over 600 points during the intraday trading.

The benchmark KSE-100 index declined by 656.19 points or 0.89% to reach at 73,206.74 points as compared to the yesterday's close of 73,862.93 points.

At one point around 10am, the stocks plunged by over 1,900 points and hit 71,961 points.

Speaking to Geo.tv, Arif Habib Limited (AHL) Head of Research Tahir Abbas said that the market sentiment is negative amid news flow suggesting increase in capital gains tax on equities alongside higher taxation on dividend income in the upcoming budget.

"The investors rushed to sell their positions before the budget which caused panic in the market," he added.

A day earlier, the benchmark index decline by 356.51 points or 0.48% due to concerns about higher taxes in the impending FY25 budget and economic uncertainties.

Analyst Ahsan Mehanti at Arif Habib Corp said: “Stocks closed lower on concerns for economic uncertainty. Investor expectations for cautious SBP policy and subdued growth impacted the sentiments.”

Reports of likely harsh conditions in the new International Monetary Fund (IMF) programme for raising power tariffs, tax measures in the Federal Budget FY25 played a catalyst role in the bearish close.

More to follow...

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold