Workers’ remittances rise in October following crackdown against hawala, hundi

SBP says Pakitan recorded $2.5 billion in workers' remittances during the month of October

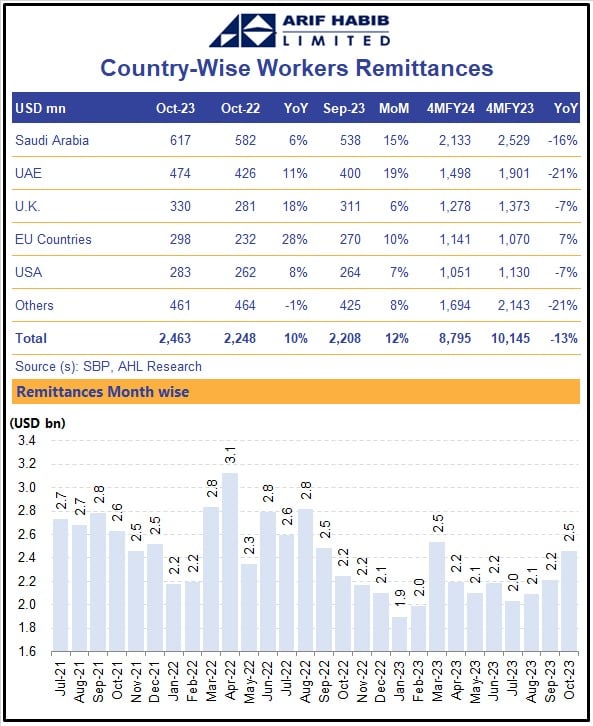

KARACHI: Following the crackdown against the illegal exchange market and closing of the gap between interbank and open markets, the workers' remittances were recorded at $2.5 billion in October making it an increase of 9.6% year-on-year basis, according to the State Bank of Pakistan (SBP) data.

“In terms of growth, during October 2023, remittances increased by 11.5% on month on month and 9.6% on year on year basis,” said the central bank on Friday.

The SBP also shared that in the first four months of the ongoing fiscal year, the inward remittances stood at $8.8 billion.

As per the SBP, out of the $2.5 billion, Pakistani workers in Saudi Arabia sent $616.8 million, United Arab Emirates was second with $473.9 million, remittances from United Kingdom were recorded at $330.2 million and $283.3 million was sent from the United States.

Former economic adviser to the Ministry of Finance Dr Khaqan Najeeb credited the closing of the exchange rate between the open and interbank markets and curbing of illegal exchange for the increase in remittances.

“Closing of the exchange rate between the open market and interbank has helped remittances flow through the formal sector increasing the October remittances by nearly $300 million compared to last month,” said Dr Najeeb.

The economist states that the recent “enforcement measures” undertaken by the government against the illegal exchange market had helped bring down the demand for smuggling for dollarisation and also control hundi/hawala.

“This has all helped channelise remittances through the interbank,” said Dr Najeeb. He added that the increase in remittances from the Middle East was an indicator that hundi/hawala was declining as these countries have a higher percentage of the hundi/hawala business.

“This overall is contributing to the improvement in the remittances in October,” said the economist.

-

Global memory chip crunch puts spotlight on Apple; Will iPhone become more pricey?

-

Bitcoin plummets toward $60,000 as investors dump risky bets

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold