SBP-held forex reserves fall to highly critical level

Reserves barely enough to provide import cover for 18.5 days as nation desperately seeks IMF bailout

The foreign exchange reserves held by the State Bank of Pakistan (SBP) dropped to a highly critical level as the nation faces severe economic distress and strives to unlock the International Monetary Fund (IMF) loan.

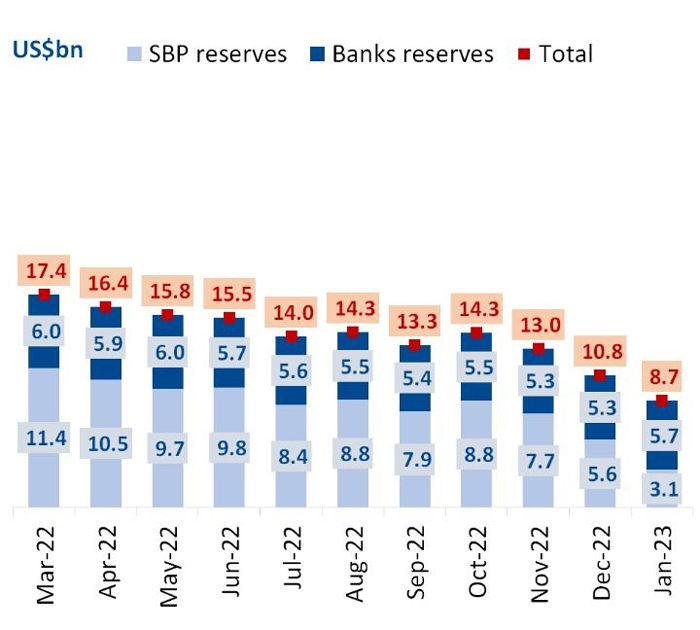

Due to foreign debt payments, the central bank said its reserves fell $592 million to $3,086.2 million during the week ended on January 27, their lowest since February 2014, and are barely enough to provide import cover for 18.5 days (0.61 months).

The reserves held by the commercial banks stand at $5,655.5 million, taking the total reserves of the country to $8,741.7 million, the central bank's statement mentioned.

Despite the falling reserves, the federal government is ensuring it meets international debt obligations to avoid default — a long-standing threat that has now forced the Shehbaz Sharif-led administration to meet the conditions of the IMF.

Amid the liquidity crunch and the government's removal of the cap on the dollar, which was a pre-condition of the IMF, the Pakistani rupee plunged to a historic low of Rs271.35 in the interbank market.

With the reserves hitting new lows every week and the government trying to keep itself afloat by meeting IMF demands, the prices of commodities have also witnessed a spike.

Development economist Maha Rahman told The News that the Washington-based lender's bailout programme had become critical for Islamabad as further inflows were dependent on the IMF's nod.

"Pakistan is in a precarious situation given the limited reserves and our total monthly import bill," the economist said.

"Please bear in mind that the import bill is a conservative amount right now given the payment difficulties and restrictions. So a realistic estimate is worrying," she added.

Consumer prices rose 27.6% compared to 13% in the same month of last year, according to data released by the Pakistan Bureau of Statistics (PBS) on Wednesday. This is the highest year-on-year inflation after May 1975 when the median rate clocked in at 27.77%.

Due to the ongoing situation, the central bank has also restricted the issuance of letters of credit (LCs), leading to the complete or partial shutdown of business — from textile to automobile. This is causing a disruption in the supply chain, which will ultimately lead to an increase in the rates of commodities.

SBP Governor Jamil Ahmed last month said the country owed $33 billion in loans and other foreign payments before the end of the fiscal year in June.

A diplomatic offensive has seen $4 billion rolled over by lending nations, with $8.3 billion still on the negotiating table.

-

Bitcoin crashes below $63K as regulatory pressure and market fears grow

-

Bitwise Crypto Industry innovators ETF: What investors should do in 2026?

-

Nintendo shares slide again as momentum fears grow

-

Gold, silver prices fallen sharply; What’s driving the drop?

-

Gold’s record climb: Experts question if its safety is ‘overstated’

-

Dubai unveils plans to construct street built with real gold

-

Netflix slams Paramount’s bid: 'Doesn't pass sniff test’ as Warner battle escalates

-

Ubisoft: Shares plunge amid restructuring plan and wave of games cancellations